Market Brief

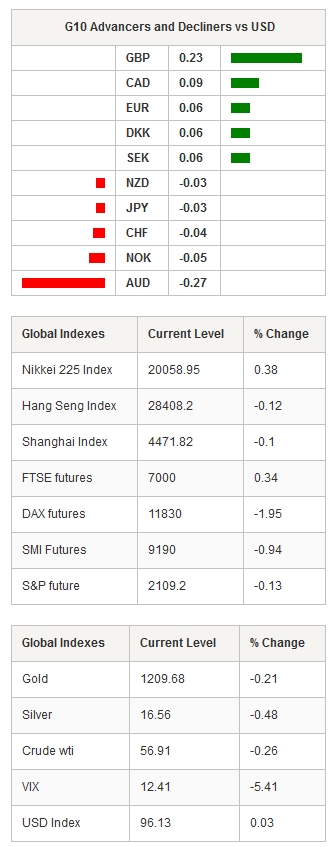

Yesterday, the dollar was heavily sold-off as traders await today’s US GDP figures and FOMC rate decision; the dollar index lost 0.80% at 96.12 and validated the break of the 50dma (97.36). Asian equities are broadly lower this morning with Australian shares down 1.70% while the Hang Seng lost -0.35%, Shanghai Composite is flat and Sensex is down -0.73%. The S&P/ASX 200 is down more than 2% since the beginning of the week and will close in red for the third consecutive day.

AUD/USD appreciated sharply in London and tested a 3-month high before consolidating slightly lower during the Asian session. The Aussie reached 0.8028 and is now trading around 0.7990. The closest resistance stands at 0.8067 (low from May 10th) while a support area could be found between 0.7884/0.7938 (previous highs).

USD/JPY didn’t move much as Tokyo was closed due to Shōwa Day, the first holiday of the Golden Week. Volumes are expected to be thinner than usual until May 8th. The dollar is consolidating around 118.80 and should find some support around 118.33/72 (multi lows). Despite the Golden Week, a lot of economic indicators are due during the following days, as well as the BoJ meeting on April 30th. We therefore expect erratic moves over the following days.

European stocks had a really tough day, DAX lost -1.89%, Euro Stoxx -1.48%, CAC 40 -1.81%, Footsie 100 -1.03% and SMI -0.95%. EUR/USD appreciated sharply to 1.0981 – 3-week high - and stabilized slightly below 1.0971 (high from March 23rd). The euro should find some buying interest above 1.1052 (multi high). However we do not expect much movement during the day as traders await the FOMC rate decision (GMT 6pm).

The sterling didn’t react much to the release of UK Q1 GDP, which came in weaker-than-expected at 2.4%y/y verse 2.6%, and moved higher on USD weakness. GBP/USD finally broke the 1.5266 key resistance (consolidation area from early March) and is now heading to the psychological level of 1.54. On the downside, the cable will find some support at 1.5256 (previous resistance).

EUR/CHF found fresh boost over the last 24h as trend gains momentum. The euro is currently trading above 1.05, a level last seen on April 6th. The depreciation of the Swiss franc against the euro didn’t allow the USD/CHF to move lower. The greenback is moving sideways since last Thursday and is currently trading at 0.9560^, at the bottom of its hourly range.

USD/BRL dropped amid release of higher-than-expected unemployment rate (62.2% verse 6.1% exp), increasing the probability of a rate hike from the BoB, before bouncing back to 2.9373. Brazil’s central bank is expected to raise the Selic rate by 50bps from 12.75% to 13.25% as inflation is running out of control, reaching 8.13% in March. We expect the BRL to appreciate further as traders will rush into the currency to play the carry.

Swissquote Sqore Trade Ideas: http://en.swissquote.com/fx/news/sqore

Currency Tech

EUR/USD

R 2: 1.1114

R 1: 1.1052

CURRENT: 1.0981

S 1: 1.0685

S 2: 1.0504

GBP/USD

R 2: 1.5560

R 1: 1.5400

CURRENT: 1.5376

S 1: 1.4943

S 2: 1.4750

USD/JPY

R 2: 121.52

R 1: 120.18

CURRENT: 118.96

S 1: 118.33

S 2: 117.95

USD/CHF

R 2: 0.9948

R 1: 0.9754

CURRENT: 0.9560

S 1: 0.9481

S 2: 0.9450