While VIX was scheduled for a Master Cycle low last Friday at 15.33, today it declined to 15.21, extending the Master Cycle low for a week. The rebound in retail sales and industrial production today with a quick revision in GDP by the Fed may have just set the stage for a runaway VIX next week as the expected rate cuts may be delayed.

(Bloomberg) The VIX with a 15-handle might be less benign than it seems.

Wall Street’s “fear gauge,” as the Cboe Volatility Index is sometimes known, has a lifetime average around 19. Given that, Thursday’s close of 15.8 should not ring alarm bells. But Peter Cecchini, the global chief market strategist at Cantor Fitzgerald LP, sees reason for caution.

SPX rally runs out of juice

SPX peaked on Tuesday morning at the open, then proceeded to make a Bearish Engulfing Candle that is still standing at the end of the week. The showdown at Broad & Wall is now playing with the Bulls getting sucker punched. However, Short-term support at 2877.73 has not been taken out. A new sell signal may be had at a decline beneath Intermediate-term support at 2851.01.“Point 6” remains beneath the December 26 low.

(Reuters) - U.S. stocks dropped on Friday, as shares of chipmakers sank on a warning from sector major Broadcom (NASDAQ:AVGO) of a broad weakening in global demand and Chinese data pointed to the worst slowdown in industrial growth in 17 years.

Shares of Broadcom Inc fell 6.53% after it cut its full-year revenue forecast by $2 billion, blaming the U.S.-China trade conflict and export curbs on Huawei Technologies Co Ltd .

Shares of Apple Inc (NASDAQ:AAPL) also slipped 0.85% and weighed the most on the S&P 500 and the Nasdaq. Broadcom is a major supplier to the iPhone maker.

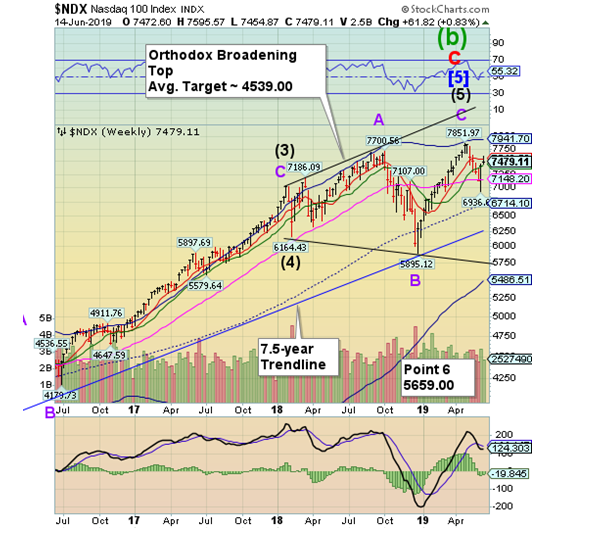

NDX caught between support and resistance

NDX broke above Intermediate-term resistance at 7426.73, remaining above it. However, it could not stay above Short-term resistance at 7540.58 after its own Bearish Engulfing Pattern on Tuesday. The NDX may not be safe, as many of the dominating tech companies have suffered heavy losses last month. The Cycles Model suggests the decline may resume through mid-July.

(ZeroHedge) Heading into today's session, the mood had already soured on chip names after Broadcom's dismal guidance cut, which slammed tech names in Asia and Europe, and which pressured the Semiconductor sector lower all day, and also prevented the Nasdaq from turning green all day.

The latest econ data from China did not help, with Industrial Production missing the lowest estimate, and printing at a 17 year low in the latest confirmation that Beijing's attempt to reflate the local economy is failing, even as retail sales staged a modest rebound from last month's disastrous print.

High Yield Bond Index stalls

The High Yield Bond Index made a new retracement high at the open on Tuesday, then promptly executed a Bearish Engulfing Candle of its own.It appears that the elevator may be stuck. The Cycles Model warns the next step down may be a large one.

(S&PGlobal) Outflows from mutual funds and ETFs that invest in U.S. leveraged loans totaled $686 million for the week ended June 12, according to Lipper weekly reporters. That's less severe than the $1.47 billion withdrawal a week ago, but marks the 30th straight net outflow from the investor segment, for a total of slightly more than $30 billion over that span.

Retail investors have beat a steady retreat from the floating rate asset class as prospects of a Fed rate hike have evaporated, and as expectations of rate hikes solidify.

The record for consecutive withdrawals from U.S. loan funds is 32 weeks, for a streak that ended March 2, 2016, though outflows during that time totaled only $17.6 billion, according to Lipper.

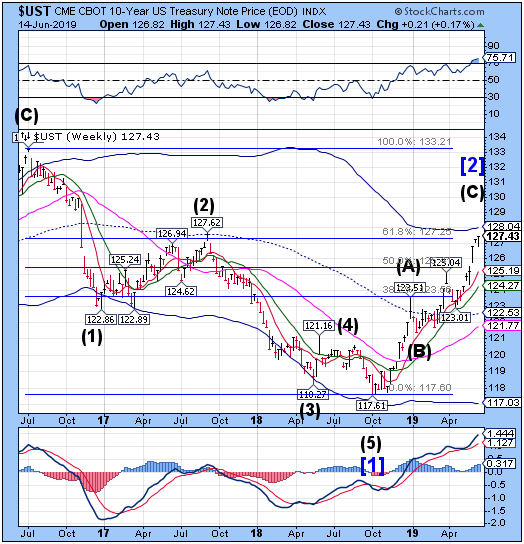

Treasuries make a 20-month high

The 10-year Treasury Note Index continued to rally after a brief setback early this week. It remains on a buy signal with a potential target at the Cycle Top resistance at 128.04. The Cycles Model suggests the rally may be ready for a reversal in the next week. It’s time to find an exit for treasuries.

(CNBC) U.S. government debt yields were little changed on Friday as investors wait for a key policy decision from the Federal Reserve next week.

At 3:41 p.m. ET, the yield on the benchmark 10-year Treasury note, which moves inversely to price, held around flatline at 2.08%, while the yield on the 30-year Treasury bond was a tick lower at 2.58%.

The Fed is set to hold a two-day policy meeting next week. Investors will look for clues for an easing of monetary policy later this year. Traders are now pricing in a more than 80% chance of a rate cut in July and 70% probability of another reduction in September, according to the CME Group’s FedWatch tool.

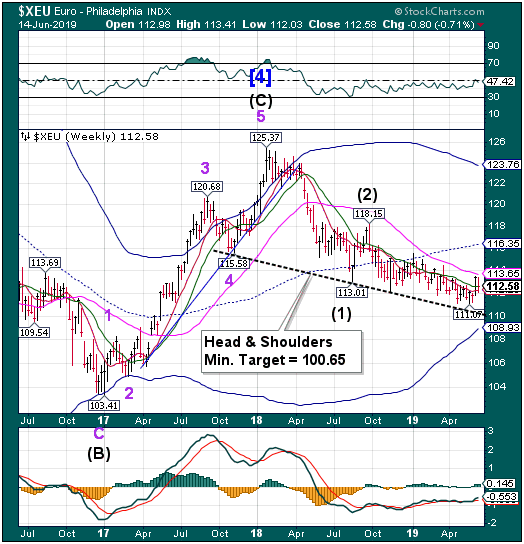

The euro pulls back but remains above Intermediate-term resistance

The euro broke away from Long-term resistance at 113.65, but closed above Intermediate-term support at 112.53. The close above Intermediate-term support may extend the rally another week. However, should a reversal occur the neckline may be tested.

(Bloomberg) As Italy toys with the idea of a parallel payments system, known as mini-BOTs, a cautionary tale from the euro area’s recent history shows how a similar system was due to work as an exit ticket for Greece from the currency bloc. There is a blueprint with four chapters on how to leave a union which is supposed to be irreversible. The 157-page plan on how to manage Grexit, not seen until today — even by most government leaders, senior officials and mandarins — is revealed in a new book by our very own ViktoriaDendrinou and esteemed friend and competitor Eleni Varvitsioti. Here’s a taste of the EU’s top-secret plan B, including its cryptic code name.

Eurozone Budget | EU finance ministers reached a deal at 4:40 a.m. this morning on most elements of the design of a miniature budget for the euro area. However, key details about the funding have been left open, and the can will be kicked down the road to leaders meeting next week in Brussels.

Euro Stoxx makes an Island Reversal

Note: StockCharts.com is not displaying the Euro Stoxx 50 Index at this time.

The SPDR Euro Stoxx 50 (NYSE:FEZ) made an Island Reversal (seen on the daily chart) today, closing beneath weekly short-term support at 37.66. The sell signal is reinstatedat today’s close. The Cycles Model suggests up to 4weeks of decline may lie ahead.

(CNBC) European stocks closed in the negative territory on Friday as tensions heightened between the U.S. and Iran, following attacks on two oil tankers in the Gulf of Oman on Thursday.

The pan-European Stoxx 600 came off its session lows and closed 0.37% lower. Tech stocks underperformed with the sector down 1.75%, while the majority of other sectors were trading in the red. Utilities and energy, however, posted minor gains.

On the last trading day of the week, the worldwide focus remained on the Middle East, after Norwegian and Japanese-owned oil tankers suffered explosions near the Strait of Hormuz on Thursday.

The yen eases down

The yen eased down this week and may go lower in the next week for an anticipated Cycle low. The Cycles Model calls for a pullback at this point that may last another week. Instead of going to the Cycle Top, it may retest Short-term support at 91.02, or lower.

(YahooFinance) The yen gained ground on Thursday as renewed risk aversion in the broader market underpinned safe haven demand, while the U.S. dollar held steady against a basket of the other major currencies after rebounding from two-month lows.

Market sentiment deteriorated overnight amid uncertainty over whether the U.S. and China can reach a deal on the sidelines of the upcoming G-20 summit meeting in Japan.

The dollar was down 0.2% to 108.28 per yen by 03:21 AM ET (07:21 GMT).

The yen, which tends to attract bids in times of market turmoil and political tensions, rallied 0.5% against the Australian dollar and advanced 0.15% versus the euro.

The risk aversion and falling stock markets are supporting the yen as usual,” said Bart Wakabayashi, Tokyo branch manager for State Street (NYSE:STT) Bank and Trust.

Nikkei stalls under triple resistance

The Nikkei Index stalled under triple resistance at 21393.57. There may be a few days left of Cyclical strength. However, weakness may prevail for up to a month after the rally is finished.

(Reuters) - Japan’s Nikkei edged up on Friday, with oil shares rallying after attacks on two oil tankers in the Gulf of Oman stoked concerns of reduced crude flows through one of the world’s key shipping routes.

Sony Corp (T:6758) was in the spotlight, with the stock rallying as much as 4% after Daniel Loeb’s activist hedge fund Third Point LLC called on the company on Thursday to spin off its semiconductor business and sell off stakes in Sony Financial and other units.

The Nikkei share average tacked on 0.2% to 21,066.26 in midmorning trade, after slipping into negative territory earlier. For the week, the index is up 0.9%.

U.S. dollar makes a Cycle low.

USD extended its Master Cycle low until Thursday at 96.35.US Dollar may bounce another week or two but overhead resistance at 97.31 may be stiff.

(Xinhua) - The U.S. dollar rose on Friday after strong retail sales data lifted the sentiment.

U.S. retail sales increased in May and sales for the prior month were revised higher, easing investors' concerns over a sharp economic slowdown.

Advance estimates of U.S. retail and food services sales for May, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were 519 billion U.S. dollars, an increase of 0.5 percent from the previous month, and 3.2 percent above May 2018, the Commerce Department said on Friday.

The dollar index, which measures the greenback against six major peers, was up 0.58 percent at 97.5702 in late trading.

Gold makes a new 2019 high

Gold made a strong reversal on Friday, testing the Cycle Top resistance at 1364.04. The Cycles Model suggests the topping process may be over, or nearly so. The indications are that Gold may join the SPX in its next decline.

(Investing.com) - Gold prices pared earlier gains after economic data on Friday gave a solid reading on the economy, dampening hopes for a looser monetary policy from the Federal Reserve.

Gold futures for August delivery on the Comex division of the New York Mercantile Exchange, gained $10.90, or 0.8%, to $1,354.60 a troy ounce by 9:47 AM ET (13:47 GMT), compared to intraday highs of $1,361.95 - their highest level in over a year.

U.S. retail sales increased in May and sales for the prior month were also revised higher, providing a more upbeat reading of consumer spending that could lighten concerns over an economic slowdown.

Crude bounces off the Broadening trendline

Crude bounced off the Broadening Wedge trendline but wasn’t able to maintain the elevation it achieved on Monday. The bounce may last a couple more days, giving the current Master Cycle an inversion (high). From there, a decline may emerge, lasting up to two months.

(Investing.com) Oil prices rallied, thanks to attacks on two oil tankers near the Strait of Hormuz, raising concerns about a supply disruption. Oil security in the region is now a pressing concern. About a month ago, two tankers from Saudi Arabia, one vessel from Norway, and one from United Arab Emirates were damaged by sabotage attacks between the Persian Gulf and Gulf of Oman.

With oil supplies along the world’s most important checkpoints coming under threat, the West Texas Intermediate (WTI) crude went up $1.14, or 2.2%, to $52.28 a barrel on Jun 13 after hitting an intraday high of $53.45. This is in sharp contrast to a 4% drop to $51.14 on Jun 12, the lowest since Jan 14, per Dow Jones Market Data.

And when it comes to the Brent crude, the global oil benchmark jumped $1.34, or 2.2%, to $61.3 after touching a session high of $62.64 a barrel. Similarly, the Brent crude fell 3.7% to $59.97 a barrel in the previous trading session, its lowest since Jan 28.

Agriculture Prices break out of consolidation

The Bloomberg Agricultural Subindexbroke out of its three-week consolidation. The rally may extend another week. The most likely outcome may be a high just short of mid-Cycle resistance a 45.98. A close above it may extend the rally another 2-3 weeks, but may not be likely at this time.

(OhioCountryJournal) The DTN National Corn Index settled at $4.20 on Thursday, the highest level in five years.

The index, which DTN assembles from more than 3,000 cash corn bids from across the country, has increased 89 cents from the low it hit in mid-May. While the market has seen declines of that size in recent years, it outpaces the rallies from harvest lows seen last year and in 2016-17.

“The main thing about this rally is that there is still serious reason to possibly expect higher prices because the situation is for real,” DTN Lead Analyst Todd Hultman said.

U.S. farmers are likely to claim a record number of prevented planting corn acres as the soggiest spring in decades kept them from the fields. Much of what did get planted was planted late, which will likely also reduce yields.

Shanghai Index bounces a third time

The Shanghai Index bounced before filling the February gap, although staying within the 6-week consolidation range. The Cycles Model identifies another week of strength dead ahead, so we may see the bounce continue as high as Intermediate resistance at 3008.15. Once filled, the decline may resume through early July.

(Bloomberg) China’s beaten down stocks posted their best gains in weeks on news local governments will have more room to spend on infrastructure, offsetting U.S. President Donald Trump’s latest threat of more tariffs.

The Shanghai Composite Index climbed 2.6%, the most since May 10, though volume was only a little over half the three-month daily average and the benchmark is still down about 10% in the past two months. Construction-related stocks rallied after the finance ministry said Monday it would ease restrictions on the spending of proceeds from special bond sales and encourage banks to offer loans to projects funded by such debt. The yuan rose after the central bank set the daily reference rate stronger than expected.

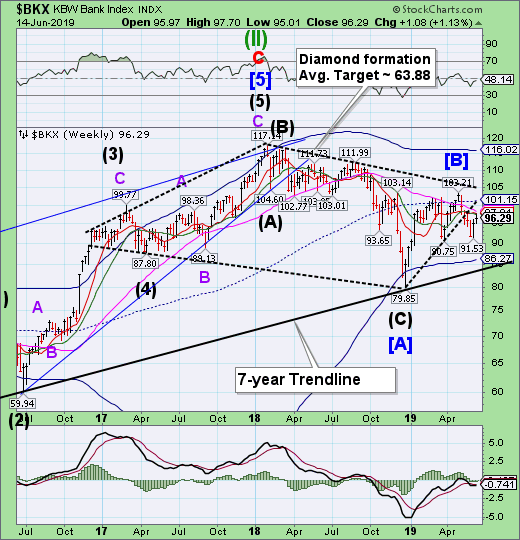

The Banking Index probes higher

-- BKX probed higher on Tuesday, challenging Intermediate-term resistance at 96.59. However, resistance held and BKX eased back down for the weekly close. There may be additional Cyclical strength early next week, but may disappear in the second half of the week.

(YahooFinance) U.S. banks are hitting the ceiling on how much cash they can hand back to shareholders.

After two years of surging payouts as regulators relaxed the reins on the biggest lenders, those firms are likely to boost dividends and buybacks by just 3% following this year’s stress test, according to analysts’ estimates compiled by Bloomberg. The Federal Reserve will release results of the first part of its annual review next week.

Payouts to shareholders started to ramp up in 2016 after the Fed was satisfied that the largest lenders had adequately beefed up loss buffers and improved risk management. Firms including Goldman Sachs Group Inc (NYSE:GS). and Morgan Stanley (NYSE:MS) had their payouts limited in last year’s test because of a one-time hit to capital from a corporate-tax overhaul, and analysts expect those shackles to be removed this year.

(NBCNews) ITTA BENA, Miss. — Shawn Robinson, 50, has a view from his front stoop that he often finds more interesting than what's on TV. From the doorway of his building on the edge of Itta Bena’s town square, Robinson can see people come and go from this struggling Mississippi Delta town's only no-fee or low-fee ATM.

Robinson has seen women stand in front of it and start to cry. On a few occasions he’s heard church folks use blue language or seen people smack the brick wall around the ATM. (The machine itself is too precious to ding.) The most frequent reaction: variations on a sigh.

In Itta Bena, population 1,828 and likely declining, the four other ATMs sit inside gas stations and charge $5.25 to $7.50 per transaction. So, the demand for the most basic financial services at an affordable rate is such that on one or sometimes two days a week, Hope’s ATM runs out of money.

(CaixinGlobal) China’s central bank will hand out 300 billion yuan ($43.4 billion) in rediscount and standing lending facility (SLF) quotas to support lending by smaller banks, the bank said Friday. It was part of a series of moves to ease liquidity concerns on the interbank market and calm market jitters.

The People’s Bank of China (PBOC) will increase the rediscount quota by 200 billion yuan and the SLF quota by 100 billion yuan, it said. The central bank will also accept interbank certificates of deposit (CDs) and bank bills as collateral from small and medium-sized banks for liquidity support, it said in a statement on its website.

Disclaimer: Nothing in this email should be construed as a personal recommendation to buy, hold or sell short any security. The Practical Investor, LLC (TPI) may provide a status report of certain indexes or their proxies using a proprietary model. At no time shall a reader be justified in inferring that personal investment advice is intended. Investing carries certain risks of losses and leveraged products and futures may be especially volatile. Information provided by TPI is expressed in good faith, but is not guaranteed. A perfect market service does not exist. Long-term success in the market demands recognition that error and uncertainty are a part of any effort to assess the probable outcome of any given investment. Please consult your financial advisor to explain all risks before making any investment decision. It is not possible to invest in any index.