Market Brief

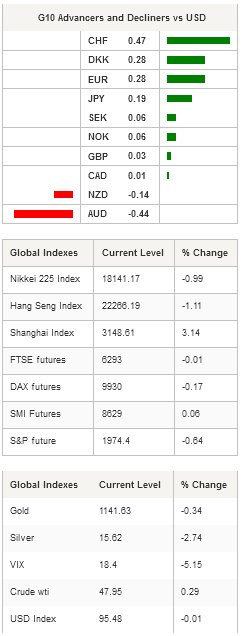

Japan’s current account surplus narrowed less-than-expected in August from ¥1,808.6bn to ¥1,653.1bn (versus ¥1,226bn expected). Machinery orders (considered as proxy for capital expenditure) fell 5.7%m/m in August, well below market expectations for an increase of 2.3%m/m and the previous month’s contraction of 3.6%m/m. Recent data continues to suggest that the Japanese economy is decelerating and today’s data adds to the mounting possibility of more stimulus from the BoJ on the 30th of October. Data triggered a mini sell-off in Japanese equities, with the Nikkei 225 and the Topix index falling 0.99% and 0.79% respectively. USD/JPY continues to move sideways.

In mainland China, stock exchanges reopened after the Golden Week holiday and tried to play catch-up. However, the mixed performances of other Asian regional markets undermined Chinese investors’ optimism. The Shanghai Composite climbed “only“ 3.14%, while its tech-heavy counterpart, the Shenzhen Composite, rose 4.15%. Elsewhere, Hong Kong’s Hang Seng fell 1.11%, South Korea’s Kospi rose 0.68%, and in Taiwan the Taiex fell 0.58%, while in Singapore shares edge down 0.52%.

AUD/USD is taking a breather around $0.72 after a 1-week rally during which the Aussie appreciated as much as 4.30% against the greenback on improving risk sentiment. However, AUD/USD fell 0.80% overnight as investors took their profits home. In our opinion, there is still room for further Aussie appreciation in the short-term, but we remain cautious as the rally may be short-lived. Indeed, the prevailing optimism is disconnect from the region’s fundamentals. In New Zealand, the same story applies: the kiwi rose as much as 5.70% against the US dollar over the same period and fell 0.77% since then. The closest resistance can be found at $0.6709 (high from August 21st).

In Switzerland, unemployment rate rose to 3.4% (s.a.), matching market’s expectations, from 3.3% a month earlier. Usually, September is a good month for the Swiss economy, as companies start to hire again after the summer break. However, it seems that the global uncertainty together with the strong Swiss franc are crippling the Swiss economic machine. EUR/CHF is holding ground slightly below the 1.10 threshold, as it continues to move sideways around 1.0950.

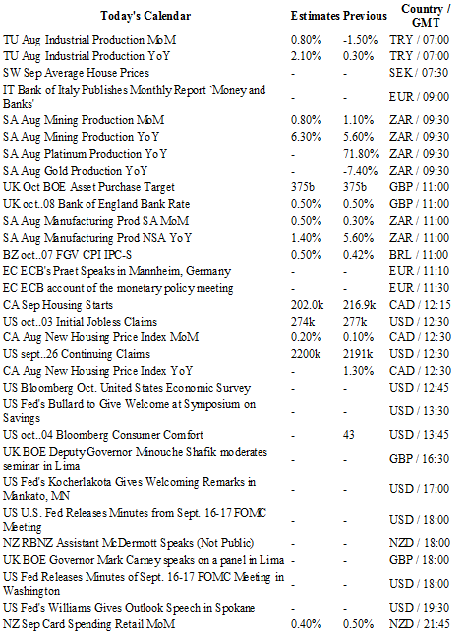

In Europe and the US, we are heading into a busy day! The Fed will release the minutes of its September 16-17th FOMC meeting. The minutes are expected to deliver more insight on why the Fed decided to put its credibility at stake by leaving interest rates unchanged. EUR/USD is trading in low volatility environment and is holding ground around 1.1250.

In UK, the BoE minutes will be a non-event, as the majority of MPC’s members will likely vote to maintain rate at 0.50% (8-1 in favour of no-change at the previous meeting). GBP/USD is currently testing the resistance level implied by its 200dma at around 1.5321. On the downside, the cable will find support at 1.5108 (low from October 1st).

Currency Tech

EUR/USD

R 2: 1.1561

R 1: 1.1330

CURRENT: 1.1281

S 1: 1.1017

S 2: 1.0809

GBP/USD

R 2: 1.5659

R 1: 1.5383

CURRENT: 1.5323

S 1: 1.5089

S 2: 1.4960

USD/JPY

R 2: 125.86

R 1: 121.75

CURRENT: 119.70

S 1: 118.61

S 2: 116.18

USD/CHF

R 2: 1.0240

R 1: 0.9903

CURRENT: 0.9675

S 1: 0.9513

S 2: 0.9259