- Possible US oil reserve release pressures commodity's price

- Russia-Ukraine peace talks may resume

- Inflation concerns ease, boosting stocks

- Eurozone CPI figures are published on Friday.

- On Friday US nonfarm payroll figures are released.

- US ISM manufacturing PMI data is printed on Friday.

- The STOXX 600 rose 0.2%

- Futures on the S&P 500 rose 0.3%

- Futures on the NASADAQ 100 rose 0.7%

- Futures on the Dow Jones Industrial Average rose 0.2%

- The MSCI Asia Pacific Index rose 0.7%

- The MSCI Emerging Markets Index rose 1.1%

- The Dollar Index was little changed

- The euro was up 0.4% at $1.1114

- The Japanese yen rose 0.1% to 121.92 per dollar

- The offshore yuan fell 0.1% to 6.3481 per dollar

- The British pound was little changed at $1.3137

- The yield on 10-year Treasuries declined three basis points to 2.31%

- Germany's 10-year yield fell to 0.57%

- Britain's 10-year yield fell four basis points to 1.64%

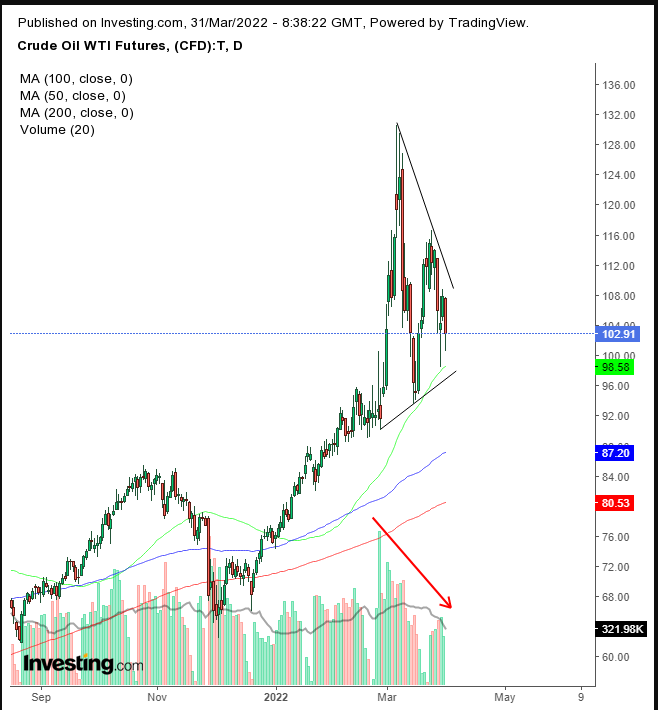

- WTI crude plunged 5% to $102.38

- Brent crude fell 5.84%% to $105.59 a barrel

- Spot gold fell 0.4% to $1,925.51 an ounce

Key Events

On Thursday, US futures for the Dow Jones, S&P 500, NASDAQ 100 and Russell 2000 wavered despite the news that the Russia-Ukraine talks may restart on Friday. Reports that President Joseph Biden is considering a significant release of US oil from the country's strategic reserves in an attempt to reduce oil prices eased the price.

The US dollar recovered while gold slipped.

Global Financial Affairs

The STOXX 600 Index rose in early morning trading with travel shares but then slipped into negative territory.

News that Washington may release one million barrels of oil reserves a day as well as the prospect that the world's second-largest oil exporter, Russia, may return to the negotiating table with Ukraine boosted hopes that there would not be any supply disruptions denting demand for oil.

From a technical perspective, we believe the price is likely to return to its previous highs around $130, subject to an upside breakout of a Symmetrical Triangle.

Earlier Thursday, Asian stocks slid after China reported weaker manufacturer data. Hong Kong's Hang Seng underperformed, dropping 0.76%, followed closely by Tokyo's Nikkei 225, which recorded a 0.73% loss.

US futures have been fluctuating ahead of the US open with the NASDAQ consistently trading in green territory. Ongoing concerns about the conflict in Ukraine causing supply chain disruptions sent commodity prices higher and equities lower in US trading yesterday. The Russell 2000 index was the worst performer, sliding 2% while the NASDAQ fell 1.2%. The Dow and S&P fell a more modest 0.2% and 0.6% respectively.

After a brief Treasury yield curve reversal flashed a possible recession warning earlier this week, long-date maturity Treasuries climbed, extending the rally in the 10-year Treasury note for the fifth day.

The dollar rebounded from a two-day selloff.

The greenback found support at the bottom of a possible falling flag, bullish after the H&S continuation pattern.

Gold fell on dollar strength.

The yellow metal continues to trade along a small H&S top.

Bitcoin climbed.

The digital currency had been stuck at the same level for the fourth day after possibly completing an H&S bottom that's facing off a much larger H&S top.