Investing.com - European markets were steady on Wednesday, as investors were on the cautious side ahead of the Federal Reserve's monthly policy decision due later in the day.

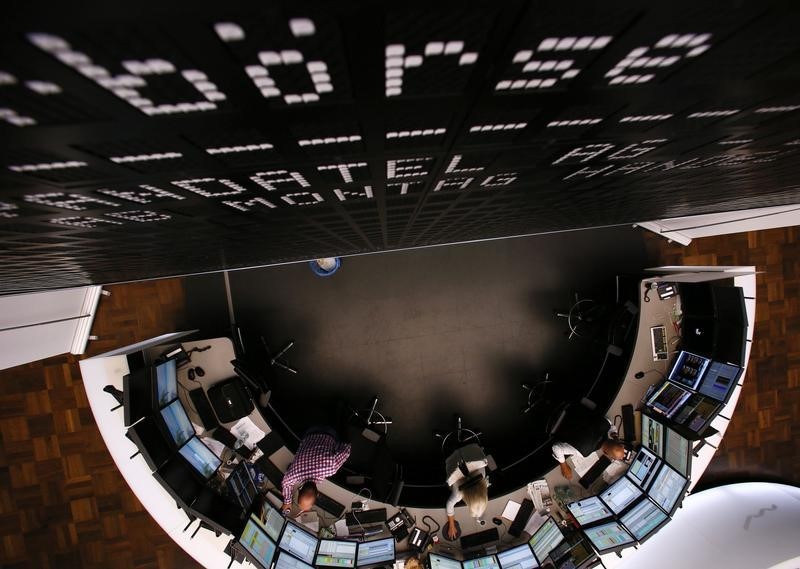

The EURO STOXX 50 was flat, France’s CAC 40 eased up 0.08%, while Germany’s DAX 30 inched 0.02% higher by 03:40 a.m. ET (07:40 GMT).

Later Wednesday, the U.S. central bank was widely expected to leave interest rates on hold, but it was also likely to announce plans to trim its $4.2 trillion in bond holdings.

Traders were also cautious amid potentially higher tensions between the U.S. and North Korea following hawkish statements from U.S. President Donald Trump.

In his first speech before the United Nations General Assembly on Tuesday, Trump said "the United States has great strength and patience, but if it is forced to defend itself and its allies, we will have no choice but to totally destroy North Korea."

Financial stocks were mixed, as French lenders BNP Paribas (PA:BNPP) and Societe Generale (PA:SOGN) gained 0.27% and 0.30%, while Deutsche Bank (DE:DBKGn) tumbled 1.03% and Commerzbank (DE:CBKG) inched up 0.05% in Germany.

Among peripheral lenders, Intesa Sanpaolo (MI:ISP) rose 0.36% and Unicredit (MI:CRDI) slid 0.37% in Italy, while Spanish banks BBVA (MC:BBVA) and Banco Santander (MC:SAN) added 0.07% and 0.25% respectively.

Elsewhere, Thyssenkrupp (DE:TKAG) shares surged 3.92% after Tat Steel said it signed a memorandum of understanding with the German company to create a "leading European steel enterprise."

The joint venture is set to be headquartered in Amsterdam and will be created by both companies combining their flat steel businesses in Europe and the steel mill services of Thyssenkrupp.

Deutsche Telekom (DE:DTEGn) added to gains, with shares up 1.24% following reports the German group's T-Mobile US Inc. unit in the U.S. is in merger talks with rival Sprint Corp.

In London, FTSE 100 added 0.11%, boosted by Kingfisher (LON:KGF) Plc, whose shares soared 6.51% after the group said half-year profits declined 5.9% to £402 million amid what the company describes as "disruption".

Sage Group (LON:SGE) was also one of the top performers on the index, as shares rallied 1.92% after analysts at Numis maintained their “add” rating on the stock.

Meanwhile, mining stocks moved broadly lower. Shares in Glencore (LON:GLEN) slipped 0.27% and Anglo American (LON:AAL) dropped 0.58%, while rival company Rio Tinto (LON:RIO) declined 0.82%.

In the financial sector, stocks were also mostly on the downside as HSBC Holdings (LON:HSBA) and the Royal Bank of Scotland (LON:RBS) slid 0.28% and 0.31% respectively, while Barclays (LON:BARC) retreated 0.64% and Lloyds Banking (LON:LLOY) slumped 0.86%.

Down 1.58%, Diageo (LON:DGE) Plc was one of the worst performers on the index, after the alcoholic beverages company said it expects its organic first-half sales growth to be impacted by the timing of Chinese New Year and a ban on selling alcohol along highways in India.

In the U.S., equity markets pointed to a steady open. The Dow Jones Industrial Average futures pointed to a 0.02% uptick, S&P 500 futures signaled a 0.01% dip, while the Nasdaq 100 futures indicated a 0.07% slip.