Stock market today: S&P 500 slips on tech woes, but Nvidia’s rise limits downside

- The Fed is expected to hike rates more aggressively to control inflation.

- As such, many have started to worry about a possible recession.

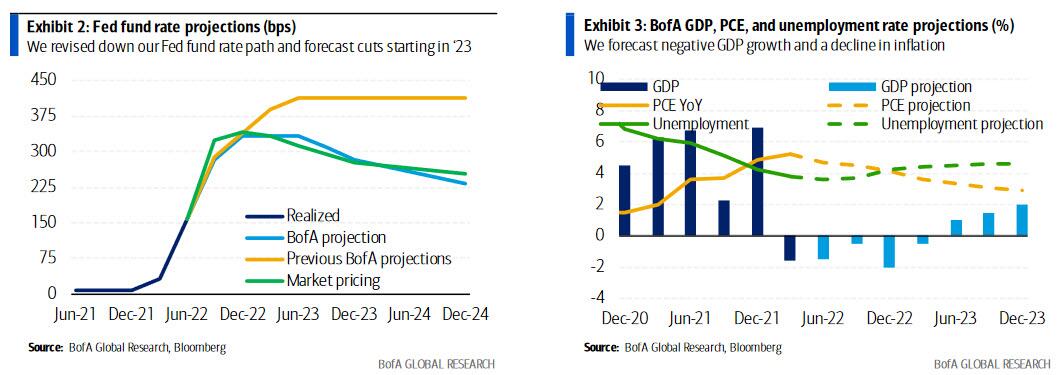

- In light of that, the consensus is growing that the U.S. central bank will pivot to rate cuts in early 2023.

Market participants have dramatically raised their bets that the Federal Reserve will have to hike interest rates even more aggressively than anticipated in its ongoing effort to tame the highest inflation in decades.

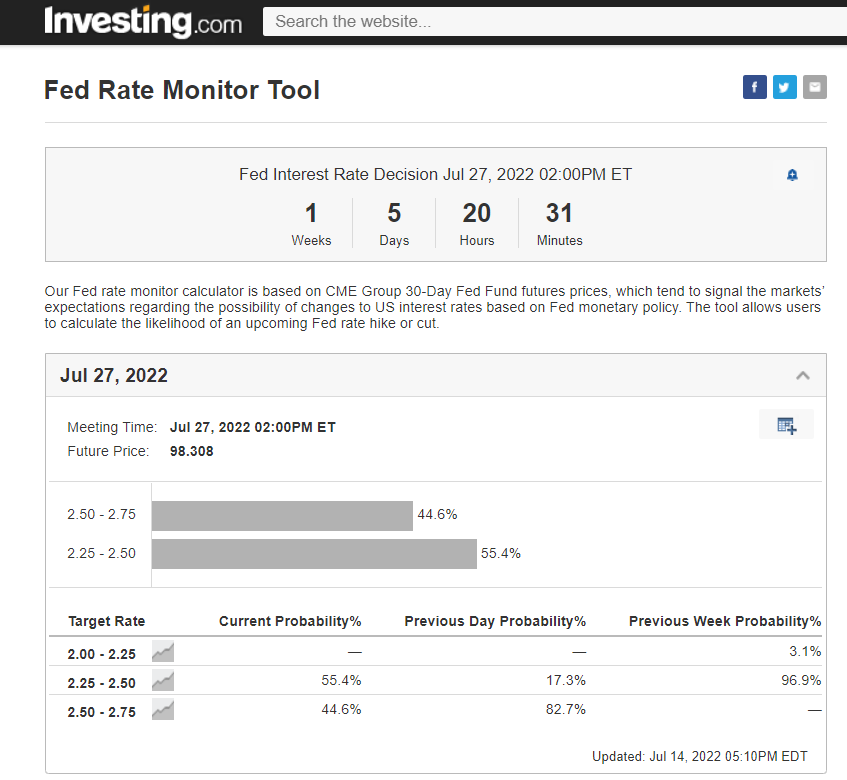

The Investing.com Fed Rate Monitor Tool briefly showed a more than 80% chance of a supersized 100 basis point (bps) rate hike at the end of the July 26-27 meeting on Wednesday, up from 8% the day before.

It was last showing a 44% probability of a 100bps move as of the end of trade on Thursday.

Markets had broadly priced in a 75bps move before Tuesday’s scorching-hot consumer price inflation report, which showed that headline CPI jumped to a fresh 40-year high of 9.1% in June.

However, they now see a good chance of 175bps in rate hikes over the next four meetings through the rest of the year, bringing the Fed Funds rate to a range of 3.50%-3.75% by the end of 2022.

The U.S. central bank has already raised its benchmark interest rate by 150 bps this year.

Nonetheless, looking further ahead, there is less certainty surrounding the Fed’s rate hike path, with the possibility of a potential rate cut coming into play as early as Q1 2023.

Indeed, mounting signs of slowing economic growth combined with easing inflationary pressures could prompt the Fed to make a U-turn and pivot to rate cuts.

Mounting Recession Signals

With the Fed expected to tighten monetary policy aggressively to fight inflation, many have started to worry about a recession.

Judging by the latest data releases, U.S. economic growth has slowed considerably in recent weeks, with worsening forward-looking indicators setting the scene for an ugly contraction in the third quarter.

Not surprisingly, the Atlanta Fed’s GDPNow tracker now points to a 1.2% contraction for the second quarter.

With the U.S. economy shrinking 1.6% in Q1, that would meet the technical definition of a recession, generally defined by a decline in GDP for two straight quarters.

The reaction in the bond market exemplifies the increasing jitters that the Fed will trigger a recession with aggressive rate hikes.

The U.S. 10-year Treasury yield, which approached 3.50% on June 14, tumbled rapidly to as low as 2.75% on July 6 amid a rethink of the monetary outlook.

At this point, it’s not about if or when the economy will tip into recession; it’s about how severe the downturn will be.

Peak Inflation

Signs that the pace of price increases has peaked and will moderate further in the months ahead are piling up.

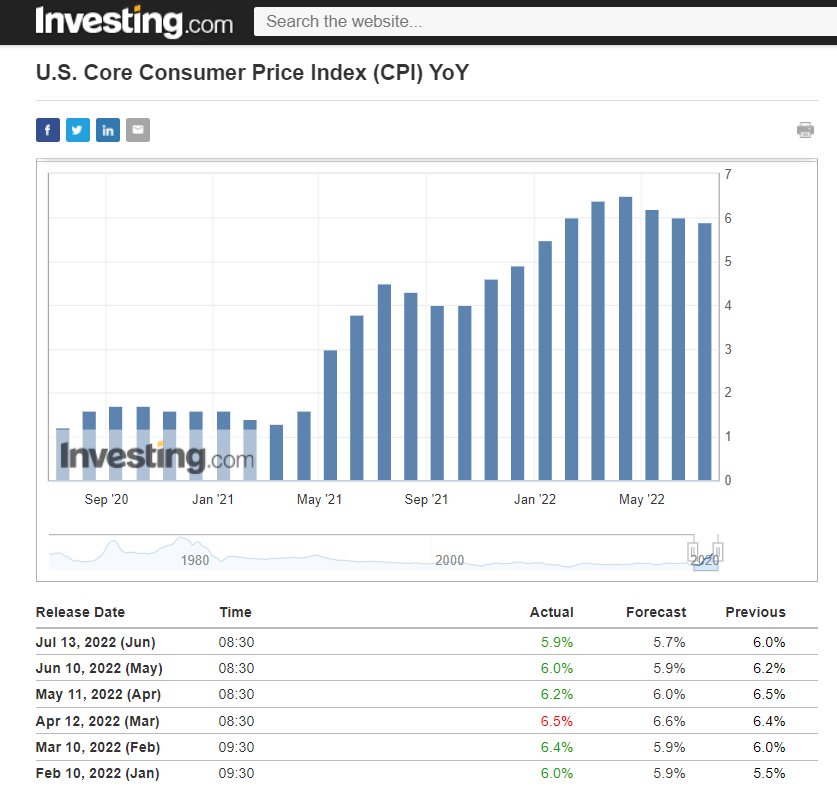

The core consumer price inflation index, which strips out volatile food and energy prices, cooled to an annual rate of 5.9% in June, marking a slowdown from the 6.0% rate seen through May.

As seen in the graphic above, the core CPI index has slowed for three straight months after peaking at a 6.5% annualized rate in March.

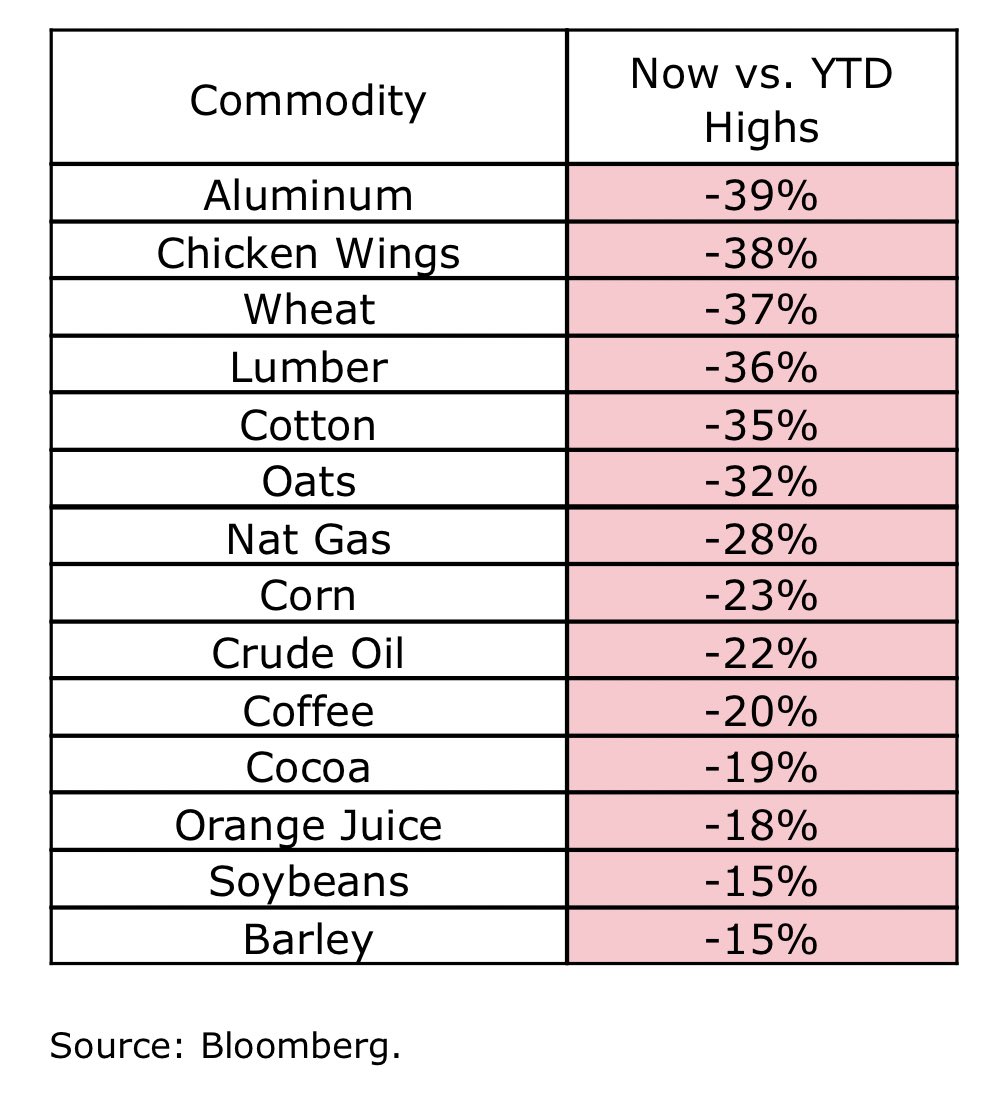

With crude oil and gasoline prices falling sharply from mid-June, headline CPI inflation is forecast to decelerate in July.

And it’s not just the energy-related commodities that are well off their peaks; prices of wheat, corn, soybeans, barley, oats, coffee, orange juice, and even chicken wings are all down at least 20% from their recent highs, adding to evidence that food inflation is moderating.

As such, the reduced rate of CPI could provide the Fed with another catalyst to start cutting rates again early next year.

Market Prices In Full Rate-Cut In Q1 2023

Given our view for inflation to continue slowing through the rest of the year—combined with growing expectations for a recession—markets are increasingly leaning towards the possibility that a sharp change in Fed policy could come in the months ahead.

In fact, the market is now pricing in one full rate cut in the first quarter of next year as the Fed fights off the recession it created.

Consensus is also growing amongst most Wall Street banks that the Fed will end its current rate hike cycle at its December meeting in response to lower inflation and recessionary conditions.

Bank of America’s top Rates strategist and former N.Y. Fed analyst Marc Cabana published a note on Thursday warning:

“[Bank of America] is making substantial downward revisions to our rate forecasts following our U.S. economics team’s new call for a mild 2022 recession and lower Fed funds rate path.”

Disclaimer: The author currently does not own any of the securities mentioned in this article.