- Warren Buffett's cash pile has reached its lowest level since 2019

- The Oracle of Omaha has bought a total of 16 stocks this year

- Like him, I believe it is a good time to buy—if you have the correct strategy

- Occidental Petroleum (NYSE:OXY)

- Chevron (NYSE:CVX)

- HP (NYSE:HPQ)

- Paramount Global (NASDAQ:PARA)

- Citigroup (NYSE:C)

- Activision Blizzard (NASDAQ:ATVI)

- Ally Financial (NYSE:ALLY)

- Celanese (NYSE:CE)

- Apple (NASDAQ:AAPL)

- Formula One Group (NASDAQ:FWONA)

- Floor & Decor (NYSE:FND)

- McKesson (NYSE:MCK)

- Markel (NYSE:MKL)

- RH (NYSE:RH)

- General Motors (NYSE:GM)

- Berkshire Hathaway (buybacks)

Last night, I spent about ten minutes reviewing the 2005 annual Berkshire Hathaway (NYSE:BRKa) (NYSE:BRKb) meeting, in which Warren Buffett and his partner Charlie Munger shared their views on the U.S. economy ahead of the Global Financial Crisis.

It wasn't until more than two years later that the markets collapsed. Yet, several investors were already asking about inflation, recession, the possible collapse of markets, yield curve inversion, and a thousand possible scenarios.

Now, I think Buffett's answer, which lasted only 30 seconds, is worth more than any investment textbook or supposed expert we may have to deal with; here is a very concise excerpt of what he said:

"We are not good at predicting the market, but we generally knew that there were several very good deals in the 1970s and that the markets went crazy in the late 1990s. But we never waste time thinking or talking about how the stock market will go from here on out because we don't know."

As Munger added:

"I've seen many people miss opportunities because they focus on a single economic variable or a single problem the country faces and forget about the good things. But if you buy a great business at an attractive price, it's crazy to say: 'I'll buy it tomorrow because maybe it will be cheaper if the world goes to hell.' We have never operated that way; we have never decided not to buy a business we liked because of the market view."

There will always be reasons to sell, but more generally, if you are an investor—and therefore a buyer with a medium- to long-term horizon—, you should buy when prices fall.

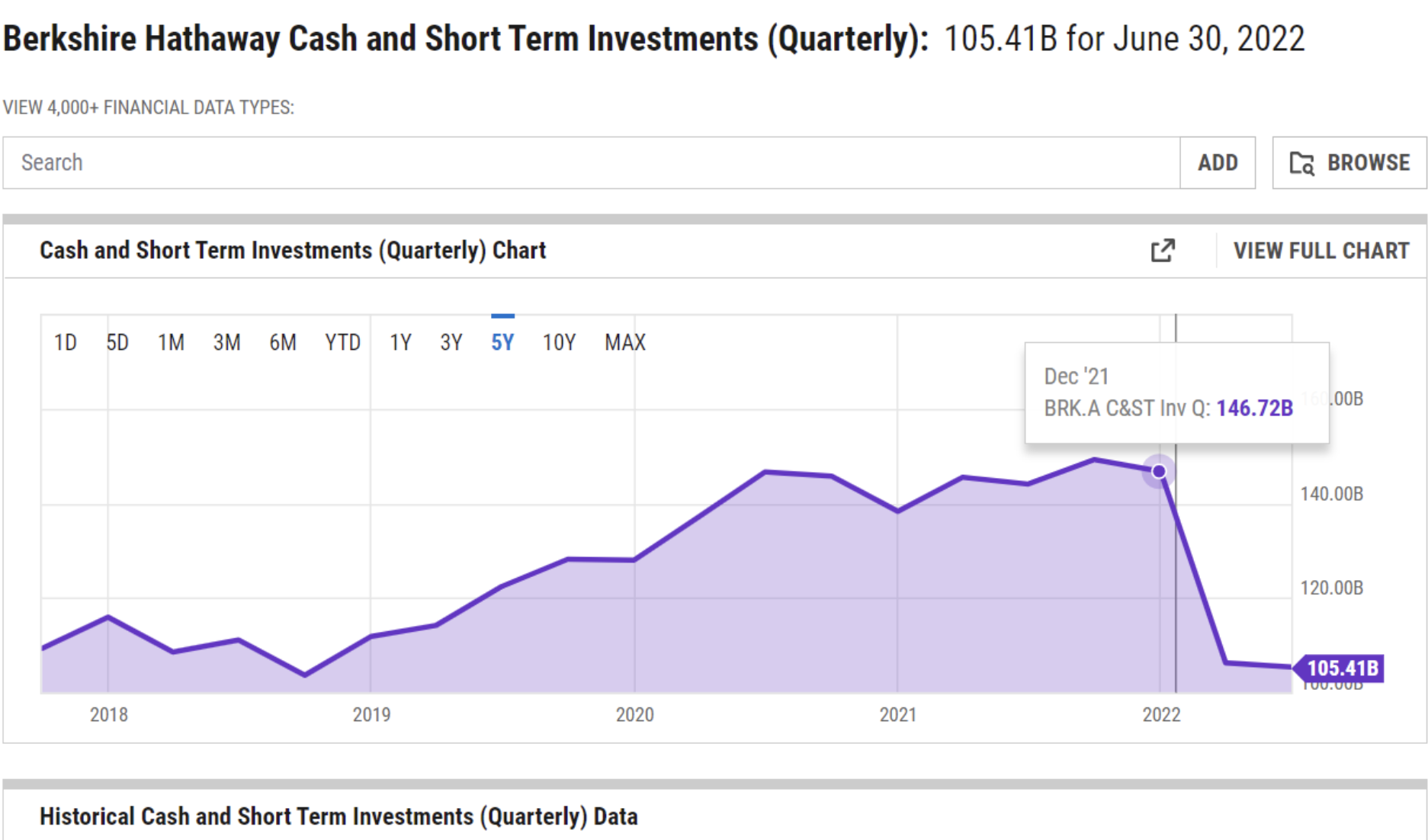

That is exactly what Buffett is doing right now. The chart below shows the sharp drop in Berkshire Hathaway's cash holdings and short-term investments since the beginning of the year. It was mainly used for the purchase of 16 stocks:

Source: Ycharts

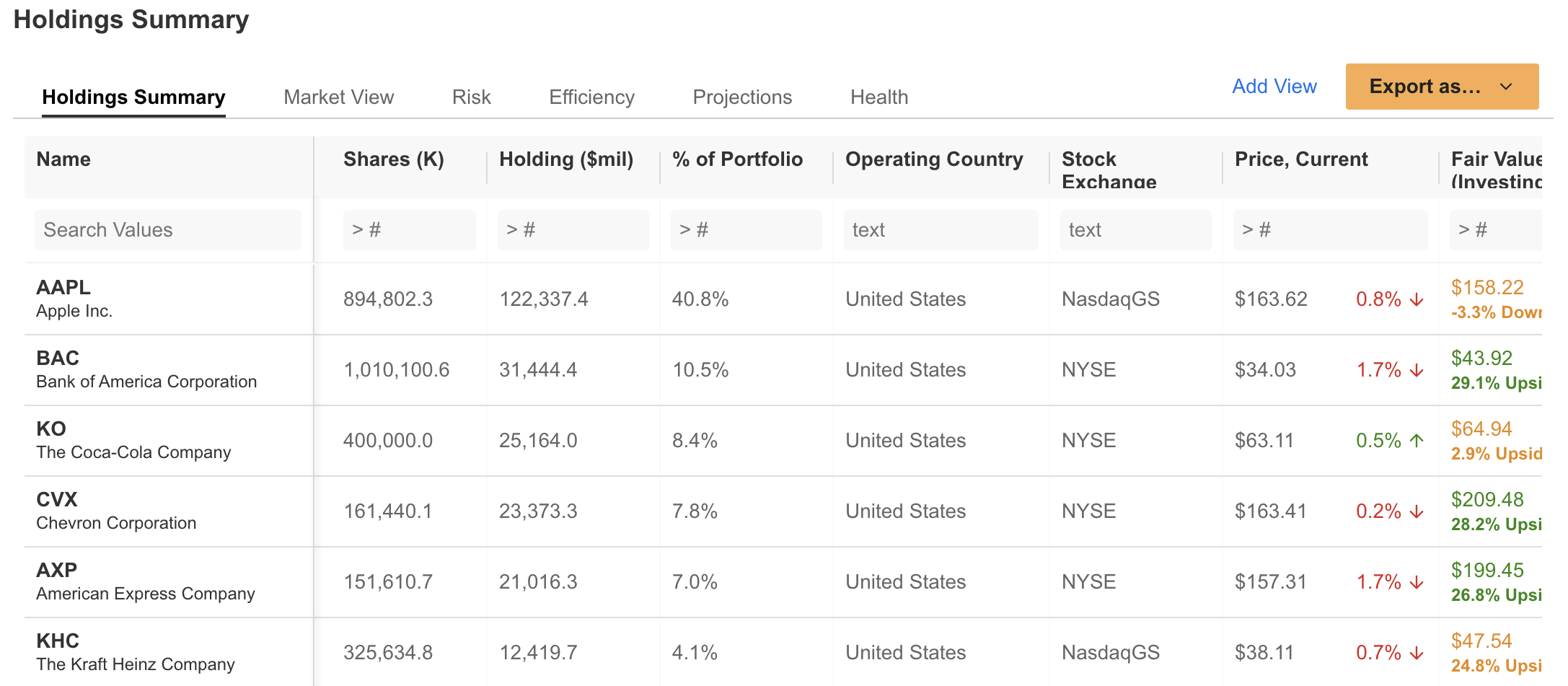

InvestingPro provides a more detailed view of Warren Buffett's holdings, sector concentration, SEC filings, and performance.

Source: InvestingPro

I have often repeated in my analyses the objection that liquidity is not infinite and that you cannot keep buying unless you are a millionaire.

However, once you have set up a well-planned and intelligent strategy, the thing is straightforward. I will tell you mine to help avoid doubt: at the end of 2021, I had about 30% in cash—primarily due to sky-high valuations.

My holding period is at least until 2030; I plan to continue to buy at every 10/15% drop, and even if the markets drop up to 50-60%, I still would have entered at reasonable levels on a long-term horizon.

Do you know who is worried about declines? Those who don't know what they are doing in the markets, those who don't know them, those who can't handle volatility, those who don't plan. And do you know why?

Because their focus and attention are on something that is simply impossible to know, which is how the markets will do one week, one month, or a year from now.

Disclosure: the author doesn't own any of the securities mentioned in this article.