Here are the latest developments in global markets:

- FOREX: The US dollar index – which tracks the greenback’s performance against a basket of six major currencies – is down by 0.27% on Thursday, extending the notable losses it posted in the previous session as trade tensions faded. The euro is little changed as traders await the main event of the day; the ECB policy meeting. The yen, meanwhile, is up across the board today amid continued speculation for a hawkish tilt by the BoJ next week.

- STOCKS: US markets closed firmly in the green yesterday, buoyed by signs of de-escalation on the trade front, as the US and EU reached a preliminary deal aimed at avoiding new tariffs. The Nasdaq Composite (+1.17%) reached a new record high, while the S&P 500 (+0.91%) and Dow Jones (+0.68%) also touched multi-month peaks, with the S&P flirting with its own all-time high. However, futures suggest the S&P, Dow, and Nasdaq 100 are likely to open lower today, something likely owed to disappointing results from titans like Facebook (NASDAQ:FB), whose stock collapsed by more than 20% in after-hours trading. Asia was mixed today, with Japan’s Nikkei 225 declining 0.12% but the Topix advancing by 0.70%. In Hong Kong, the Hang Seng was down by 0.76%. Meanwhile, all major European indices were set to open significantly higher today, futures suggest.

- COMMODITIES: Oil prices advanced on Wednesday, aided by a correction lower in the dollar and a much-larger-than-expected drawdown in the weekly EIA crude inventories. News that Saudi Arabia suspended some oil shipments due to tensions in the Gulf may have added fuel to the move. Crude Oil WTI and Brent are mixed today, with WTI being down marginally (-0.08%), but Brent trading higher (+0.52%). Gold rebounded yesterday as well, fueled by a correction lower in the greenback, which renders the dollar-denominated metal more attractive for investors using foreign currencies. That said, the yellow metal is down by 0.17% again today at $1,228 per troy ounce, still hovering just above its lows for the year

.

Major movers: Stocks rally after Juncker-Trump accord; Loonie and peso soar on NAFTA hopes

The President of the European Commission and the US President reached a preliminary accord on trade issues yesterday during their meeting in Washington. The two sides agreed that the EU will increase its imports of US soybeans and liquified natural gas, while the US will hold off from imposing any new tariffs, for instance on imported cars. Moreover, both agreed to enter negotiations with an aim to lower industrial tariffs and align regulatory standards to allow for fewer barriers to trade.

Overall, although nothing particularly concrete was agreed other than to continue negotiating, the spirit of the accord was rather conciliatory, allowing investors to breathe a sigh of relief that the situation at least won’t escalate for now. Major US stock indices raced higher, with the benchmark S&P 500 closing at its highest level since late January, and not far below its all-time highs. Meanwhile, the dollar – which had enjoyed heightened demand amid trade concerns in recent months – corrected lower.

Meanwhile, price action in the euro, the yen, and the pound was less exciting. While all of them gained against the dollar, there was little movement between them. That said, yen bulls seem to have returned on Thursday, as the currency is trading higher across the board. Its gains appear to be owed mainly to speculation around some hawkish BoJ message next week, as opposed to safe-haven demand.

Elsewhere, NAFTA came back in focus, as Canadian Foreign Minister Freeland met with Mexican Economy Minister Guajardo. Both struck an upbeat tone regarding a deal being reached soon, with Guajardo saying two thirds of the points are already agreed. The Loonie and the peso soared, reaching a 6-week and an 11-week high against the dollar respectively, with the loonie’s advance also aided by rising oil prices. There appears to be some optimism that a deal may be achievable prior to the US midterm elections in November. Any signs adding credence to that could lead to an outsized rally in the Loonie, as investors price out trade concerns and price in expectations for faster rate increases by the BoC.

Day ahead: ECB firmly in focus; US durable goods data also of interest

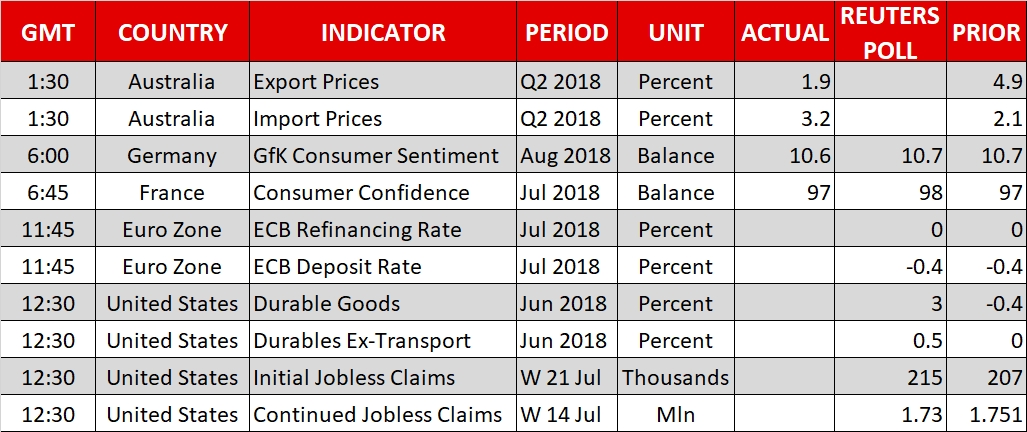

All eyes will be on the European Central Bank on Thursday, as it will be concluding its meeting on monetary policy. On the data-front, US durable goods are perhaps the day’s most important release.

Krona pairs will be generating attention as Sweden’s unemployment rate for June is made public at 0730 GMT.

But the lion’s share of attention is expected to fall on the ECB. The central bank’s policy decision is due at 1145 GMT, with the bank widely anticipated to keep policy on hold. This, combined with no new quarterly projections on the agenda, will shift investor focus to the press conference by ECB chief Mario Draghi which is scheduled to start at 1230 GMT. There is uncertainty as regards when the central bank will start normalizing rates and any comments by Draghi on this front are expected to prove market sensitive. In the meantime, remarks on trade will be of interest, especially after what appeared to be a constructive meeting between Juncker and Trump on Wednesday.

A notable 3.0% m/m rise in US durable goods orders is forecast by analysts during June, after a fall by 0.4% in May. It should also be kept in mind though, that the measures of durable goods that exclude volatile items, are not projected to report such sharp gains, the implication being that the increase is driven by a surge in orders of volatile capital goods. For example, the core measure of durable goods that excludes transportation is anticipated to rise by only 0.5% m/m, after exhibiting zero growth in May. The figures will be hitting the markets at 1230 GMT. Weekly data on initial and continued jobless claims are also due out of the US at the same time.

Of interest will be a visit in Washington by Mexican Economy Minister Ildefonso Guajardo to touch on NAFTA renegotiation efforts; he will be meeting US Trade Representative Robert Lighthizer.

Meanwhile, the BRICS summit taking place in South Africa remains underway and is set to conclude on Friday.

In equities, Amazon (NASDAQ:AMZN), Comcast (NASDAQ:CMCSA), Intel (NASDAQ:INTC), McDonald’s, Starbucks (NASDAQ:SBUX), Under Armour and Xerox (NYSE:XRX) are some of the companies releasing quarterly results on Thursday.

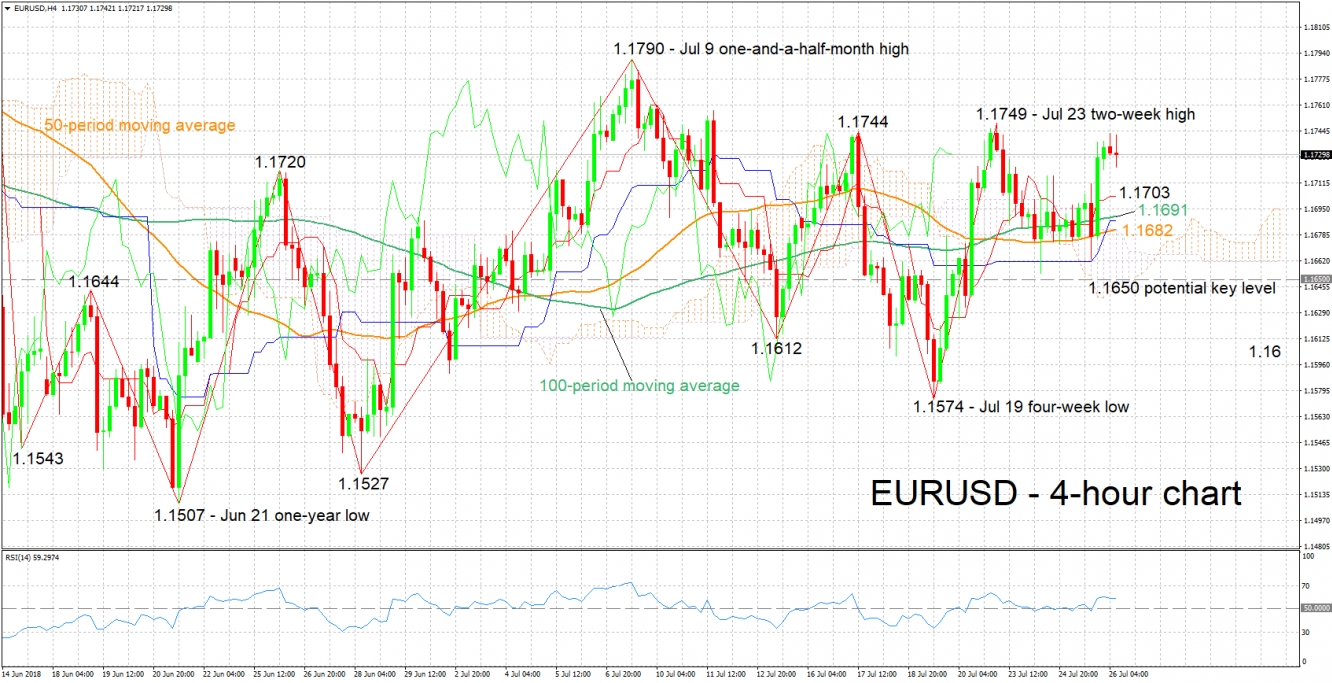

Technical Analysis: EUR/USD bullish bias appears to ease

EUR/USD has retreated a bit after edging closer to the two-week high of 1.1749 recorded on July 23. The Tenkan- and Kijun-sen lines remain positively aligned in support of a positive bias, though the two have eased, pointing to a weakening bullish sentiment. The RSI, which has halted its advance, is projecting a similar picture.

A more hawkish stance by the ECB than expected by markets later today can boost the pair. Immediate resistance may take place around Monday’s two-week high of 1.1749, before the attention turns to the one-and-a-half-month high of 1.1790 from July 9 in the event of steeper gains.

Conversely, a relatively dovish ECB is likely to push EUR/USD lower. The region between 1.1703 and 1.1682 captures the Tenkan-sen, 100-period moving average, Kijun-sen, Ichimoku cloud top, and the 50-period MA and thus may be of importance, providing support to declines. Further below, the area around 1.650 was congested in the past and may also provide support in case of sharper losses.

US durable goods data may also move the pair.