- Market awaits Apple, Alphabet and Microsoft results

- Bitcoin recovers but remains volatile

- Oil still under pressure

- Federal Reserve policy meeting concludes on Wednesday.

- On Wednesday, crude oil inventories are announced.

- US GDP data is due on Thursday.

- The STOXX 600 fell 0.8%

- Futures on the S&P 500 fell 0.5%

- Futures on the NASDAQ 100 fell 0.4%

- Futures on the Dow Jones Industrial Average fell 0.6%

- The MSCI Asia Pacific Index fell 1.4%

- The MSCI Emerging Markets Index fell 2.3%

- The Dollar Index rose 0.2%

- The euro fell 0.2% to $1.1779

- The Japanese yen rose 0.3% to 110.11 per dollar

- The offshore yuan fell 0.6% to 6.5202 per dollar

- The British pound fell 0.2% to $1.3786

- The yield on 10-year Treasuries declined five basis points to 1.24%

- Germany’s 10-year yield declined two basis points to -0.44%

- Britain’s 10-year yield declined two basis points to 0.55%

- Brent crude fell 0.3% to $74.31 a barrel

- Spot gold was little changed

Key Events

A selloff in European shares dragged US futures on the Dow, S&P, NASDAQ and Russell 2000 lower on Tuesday after the underliying indices of the Dow, S&P and NASDAQ recorded new all time highs a day earlier during the New York session.

The dollar was stronger for a second day while gold tumbled.

Global Financial Affairs

A look at today's US contracts reveals that growth stocks continue to outperform while stocks that represent a re-opening economy remain out of favor. All four US futures are in the red, but those on the NASDAQ have fallen the least.

At the other end of the reflation-spectrum, Russell futures have slumped the most. This may be because the imminent return to a pre-COVID economy is looking less likely, as the Delta variant continues to spread across the globe—or it may simply be higher demand for growth shares ahead of mega tech earnings this week.

Either way, it’s ironic that the technology sector is ahead of all other US sectors as it was only at the start of Tuesday's European session that US futures moved into the red as European markets were driven lower by the reverberations of the Chinese crackdown on the education technology sector.

What's incongruous to us: during the Asian session, when markets there were selling off because of the clampdown in China, US futures were higher. This is just one example of the great mysteries of the market.

In Europe, the STOXX 600 Index dropped as much as 1.1% but settled at 0.6% at the time of writing.

The pan-European index appeared to have completed an Evening Star, but that would require the star to gap up, which did not happen. Therefore, it didn’t pull in unsuspecting bulls, who would selloff when the price the next day not only erases those gains but also most of those from the preceding day. Although the European benchmark didn’t complete a bearish pattern, it found resistance at the top of a broadening formation, a potentially bearish pattern.

Note the volume. After rising with the first struggling rally (green channels), the volume also rose with the plunge that wiped out the preceding slow gains. Finally, even when the price jumped back as quickly as it dropped, it did so on diminishing volume—reinforcing the broadening pattern.

The pan-European index sold off with the consumer goods sector, which fell after Reckitt Benckiser (LON:RKT) provided soft guidance.

The maker of Lysol plummeted as much as 10%, but the price hammered out support, forming a powerful hammer, with the price settling at a 7.1% decline. After falling to its lowest level since March 2020, buyers and sellers are fighting it out at the February 2021 level, which may provide support. However, for now, the impetus is on the downside in the medium-term, as the stock posted a second, lower trough.

Hong Kong led the losses in Asia, with a second consecutive slide of over 4%. Japan's Nikkei 225 rose for the third consecutive day, bucking the downward trend. However, investors focused on the fact that the price failed to surpass the 28,000 level on both days. As far as we’re concerned, however, the trajectory is up for the Japanese benchmark.

The index has been developing a massive falling wedge since Feb. 16, the highest since 1990, after adding a third to its value in the preceding three-and-a-half months. Notice the diminishing volume.

Australia’s ASX 200 index climbed 0.5% to a new record high, as Bluescope Steel (ASX:BSL) surged 6.7% to its highest level since October 2018, after it provided an outlook of more than three times full-year earnings, boosting the all-important Australian mining sector.

American stocks extended all-time highs on Monday, with megacaps driving the rally ahead of the quarterly results of some of the most popular technology companies. Tesla (NASDAQ:TSLA) topped analyst expectations, buoying the broader market.

Shares of Apple (NASDAQ:AAPL), Amazon (NASDAQ:AMZN), Alphabet (NASDAQ:GOOGL) (NASDAQ:GOOG) and Facebook (NASDAQ:FB) are all higher ahead of their results. Unfortunately, the strong performance from these megacap, technology players suggests that traders are not overly optimistic that an economic recovery is on the cards, as their performances will continue to benefit from the ongoing restrictions imposed during coronavirus lockdowns.

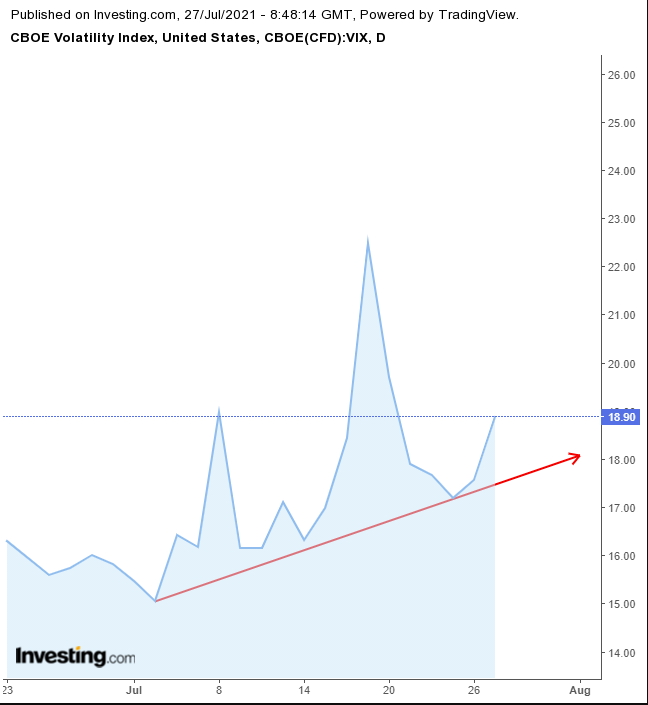

This may seem counterintuitive considering stocks have enjoyed their best five-day streak of gains since March. However, at the same time, volatility has returned to markets

Recent economic data indictors have reminded investors that inflation is high and the number of COVID cases is increasing again which could pose a risk to market valuations.

Yields on the 10-year Treasury note continue to slide, as investors continue to buy haven Treasuries.

They will have to break the downtrend to show a market that is in-line with the economic outlook.

The dollar rebounded from yesterday’s selloff.

The greenback is inching back towards 93 and the neckline above it that marks a massive double bottom.

Dollar strength meant gold slid for the third day, for the first time since June 18, when the it began developing a bearish pattern.

The yellow metal extended the penetration after a downside breakdown of a bearish wedge.

Bitcoin whipsawed but managed to retain yesterday’s exceptional gains.

The cryptocurrency surged 14.3% on Monday, but settled with a 5.3% advance. That was the sixth straight daily rally, the first since the seven day advance from Jan. 3. Demand for the digital coin came after Amazon (NASDAQ:AMZN) listed a position for a digital currency and blockchain product manager. The rally broke out of a falling wedge, bullish after the preceding 45% decline in the short time between May 8 and May 23. We tried interpreting the pattern in different ways, including a descending triangle (the bottom of which is the dotted line), which was apparently wrong. It is worth noting that the cryptocurrency found a powerful resistance by the extended deadline of the previous H&S top.

Oil edged down for the second day

The price is sitting on top of the neckline of a potential small, H&S top.