No one thought at the end of 2020 that the pandemic, the unprecedented shutdowns of entire economies, and the massive quantitative easing were only the beginning of a long period of instability. Now, at the end of 2022, market trends are still topsy-turvy. For traders, 2022 has brought enormous opportunities - some predictable, others not so easy to have seen coming. This article by FBS analysts discusses the macro trends and biggest challenges of 2022, and provides some prognoses for next year.

Main trends of 2022

Forex

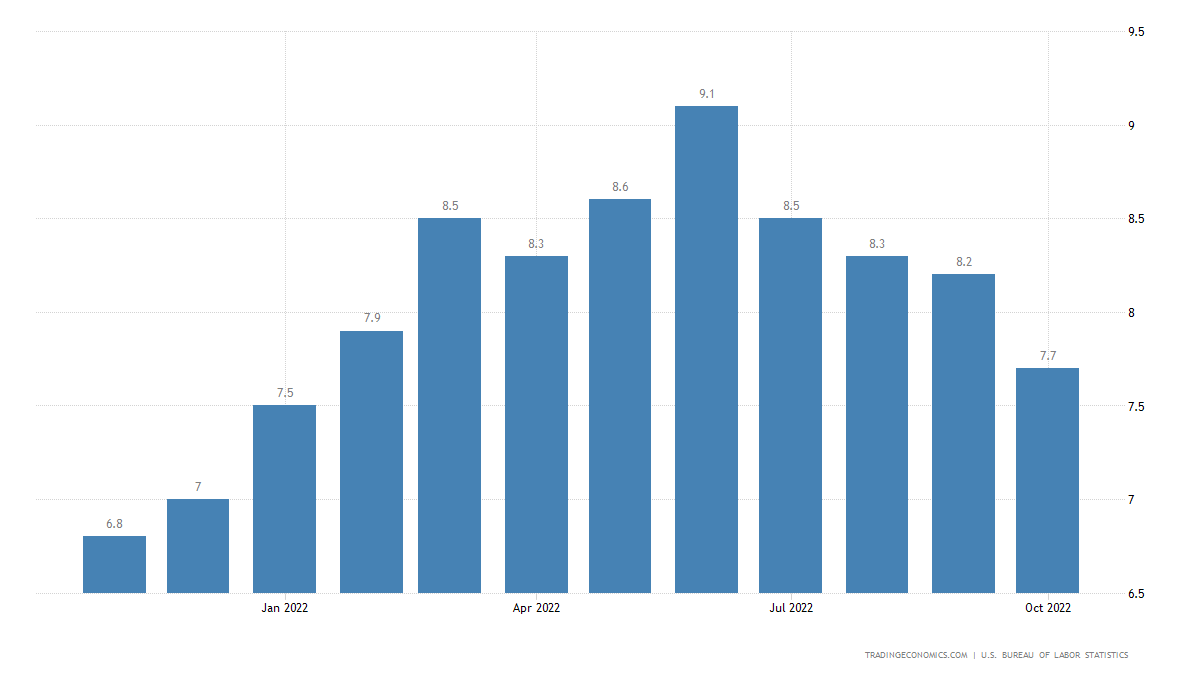

2022 was a year of surging worldwide inflation and aggressive monetary policy by the world’s central banks. Of particular interest to traders was inflation in the United States, which reached 7.5% in January and spiked to 9.1% in May.

The US economy has taken hits from supply disruptions, considerable pandemic bailouts, and the Russia-Ukraine war. The Fed was slow to react to the drastically surging prices, believing at the start of the year that the high inflation was transitory. Interest rate hikes finally followed several months into the uptrend. All of this drove the American Consumer Price Index (CPI) up 18% between January and October.

Major currency pairs

The strong USD has resulted in significant volatility.

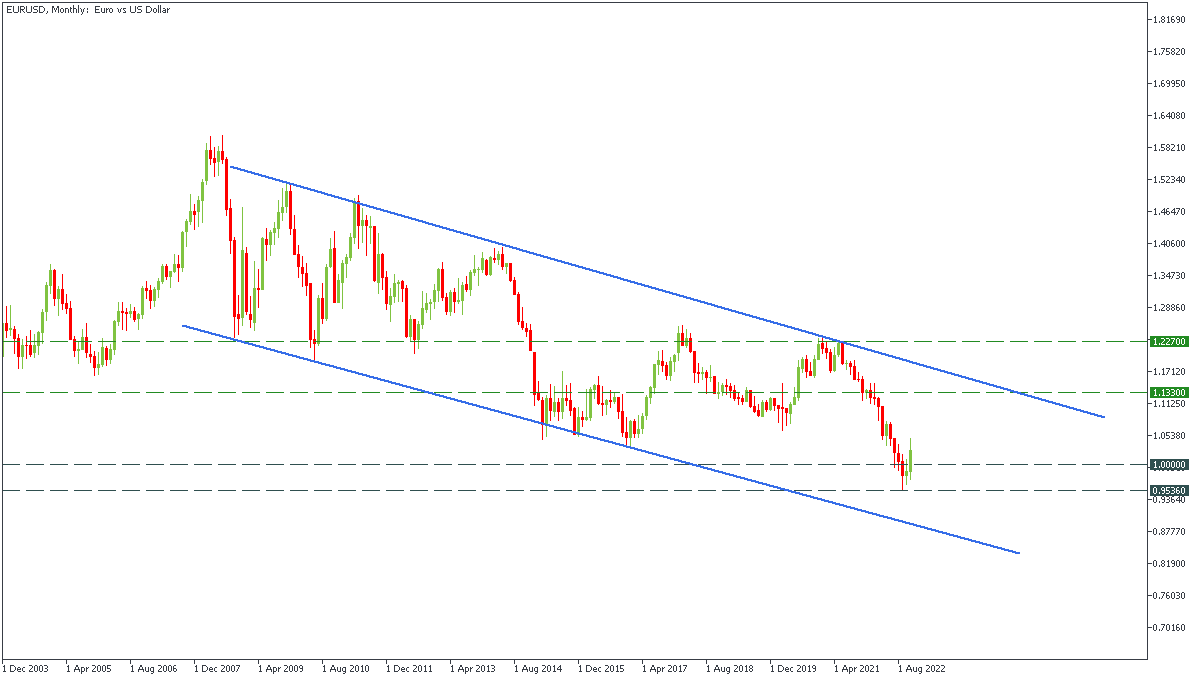

EURUSD

After Russia invaded Ukraine in February, fears that Russia would cut off gas supplies in retaliation for sanctions pushed European gas prices up to over $1.07/MMBtu. The consumer inflation that resulted is the highest in history, with the currency pair crossing the parity line for the first time in 20 years. Despite the euro regaining some strength this month, the global trend is still within a descending channel.

USDJPY

The Bank of Japan prefers to keep the yen on the weaker side, so the USD’s strength pushed the pair to its 1990 peak of 152. The country’s government intervened aggressively, but was unable to reverse the uptrend in October.

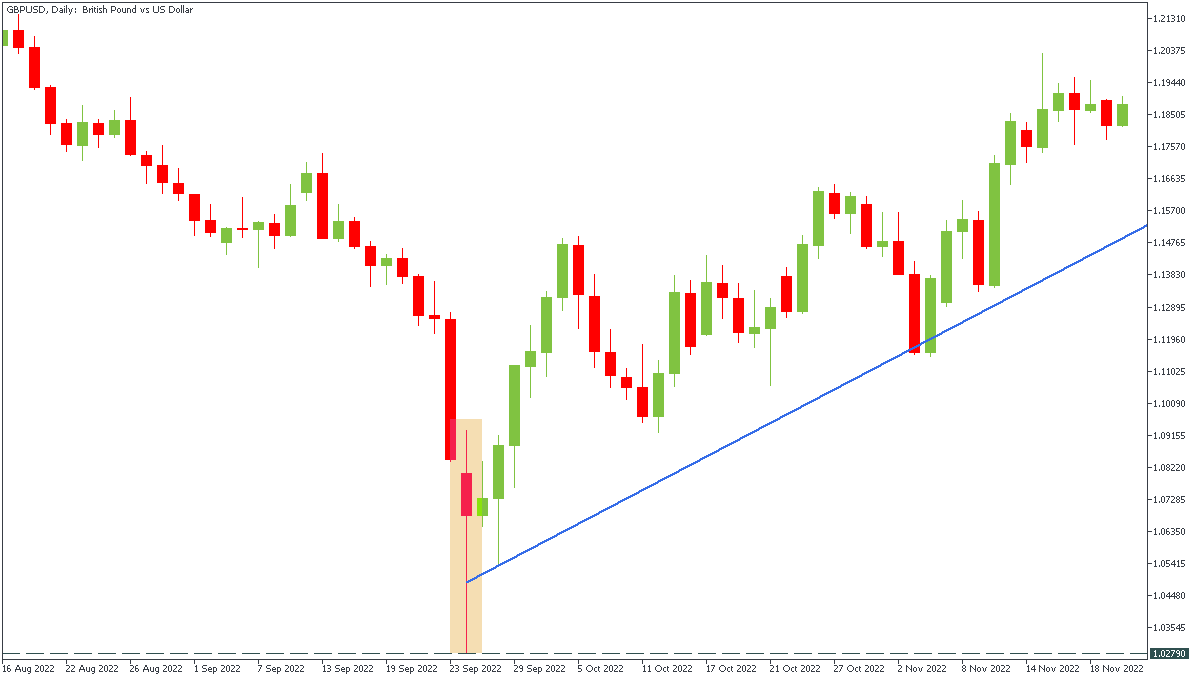

GBPUSD

The plan proposed by Liz Truss in late September to cut taxes for the UK’s top earners sent a shockwave through the British stock market. On September 27, the GBP/USD fell 5% against the dollar, ending up at 1.0279 - its lowest level in years. Shortly after, Liz Truss resigned as Prime Minister to be succeeded by the market-friendly Rishi Sunak, which drove a recovery against the USD in October-November.

Other currency pairs

- This year, USD/TRY has experienced an ongoing uptrend, with inflation hitting 85.5%.

- Following the prolonged weakness of the Chinese yuan, USD/CNH broke above its May, 2020 high, and continued to grow.

Indices

2022 has seen an overwhelmingly bearish stock market.

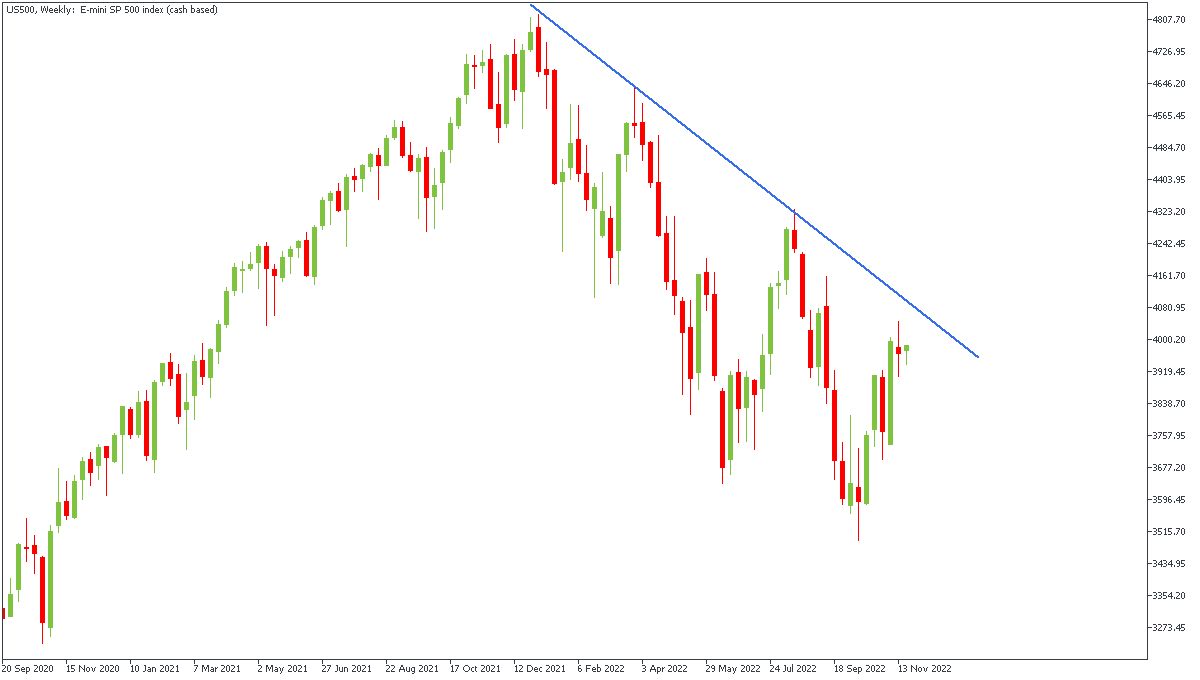

S&P500

The S&P 500 lost over 25% under pressure from the US Fed’s hawkish monetary policy, the negative economic outlook, and the bad earnings by big tech.

There have been three correction waves spurred by a lower-than-expected CPI report and hints by Fed members that monetary policy may loosen soon. Inflation was 0.4% on November 10, as opposed to the expected 0.6%, which pushed the USD down and supported stocks.

After the three upward spikes, however, the S&P500 still remains in a downtrend in November, and is not likely to reverse this year.

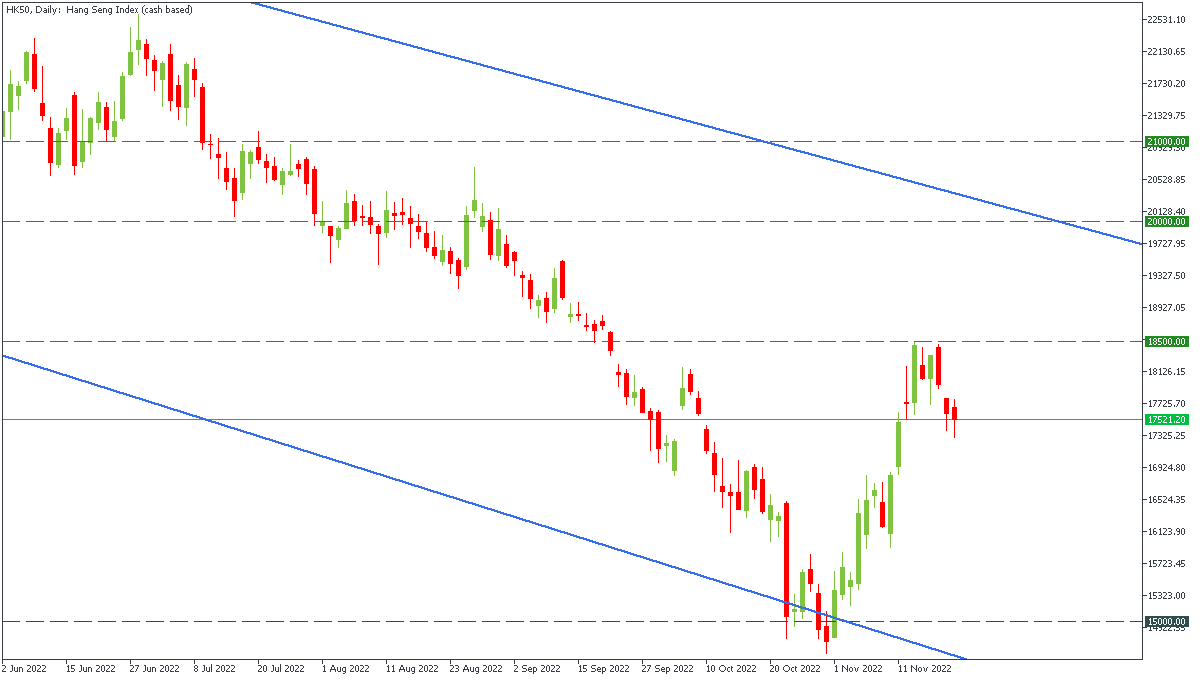

Hang Seng 50

China’s stock market is facing its own enormous pressures: the Covid-zero policy, the property crisis, US restrictions against Chinese tech companies, and the political program of the Chinese Communist Party all contributed to the Hang Seng bottoming out below 15,000 in October. The index made a recovery attempt on positive changes in Covid policy, but it could not rise above 18,500 as the country continues to battle the virus.

Commodities

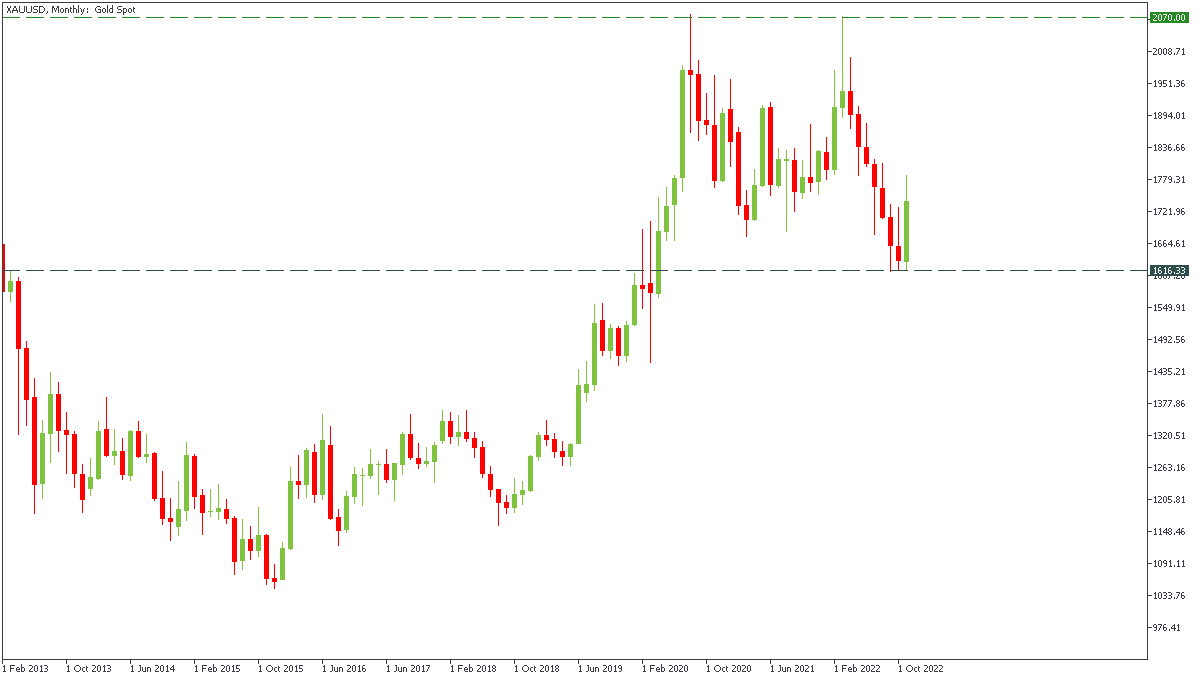

Gold

Despite all the uncertainties of the year, XAU/USD did not perform as well as the Forex pairs. Recession fears, the war in Ukraine, and the resulting energy crisis all contributed to gold testing the August, 2020 high at 2070, but the precious metal then lost 15% of that worth against the dollar.

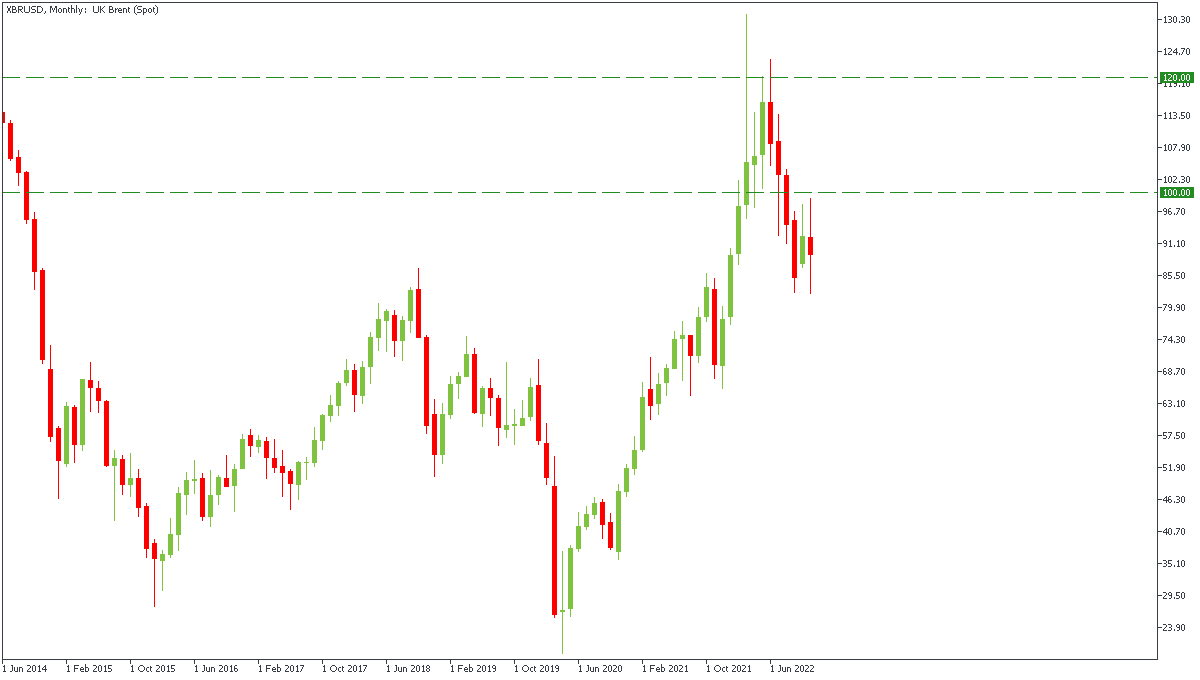

Oil

In March, as Russia’s invasion of Ukraine unfolded and resulted in a tidal wave of sanctions against Russia, fears of supply shortages, and expectations of a ban on oil from Russia in Western countries, XBR/USD tested highs above $130/barrel. Brent’s price uptrend was also affected by OPEC+ decisions. In August, Brent fell back below $100, and at the end of November it was below $80.

Crypto

2022 saw a loss of investor trust in crypto. The crash of UST and LUNA/USD, and the bankruptcy of one of the biggest crypto exchanges, FTX, all contributed to Bitcoin losing more than 60% of its worth since the start of the year.

Crypto is traditionally seen as a high-risk asset, so traders will stay away from it in times of uncertainty.

FBS Surveys

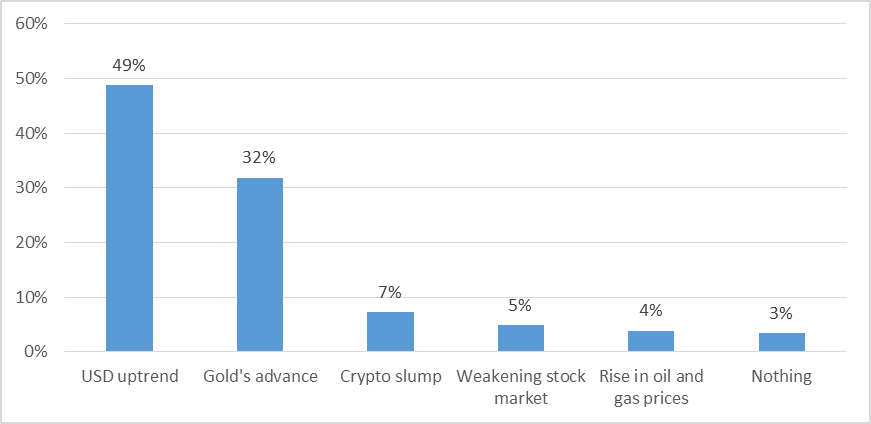

How FBS clients profited in 2022

For traders, volatility means opportunity. FBS asked 728 traders to name the market trends that brought them good results this year.

- 49% of traders were able to take advantage of the USD uptrend.

- 32% profited from the rise of gold at the start of the year.

- 7% of respondents made money on the crypto slump.

- Only 3% came away with nothing.

What’s in store for 2023?

The Fed is expected to stop hiking interest rates. According to 554 traders polled by FBS, next year may bring big reversals for the USD, stocks, and gold.

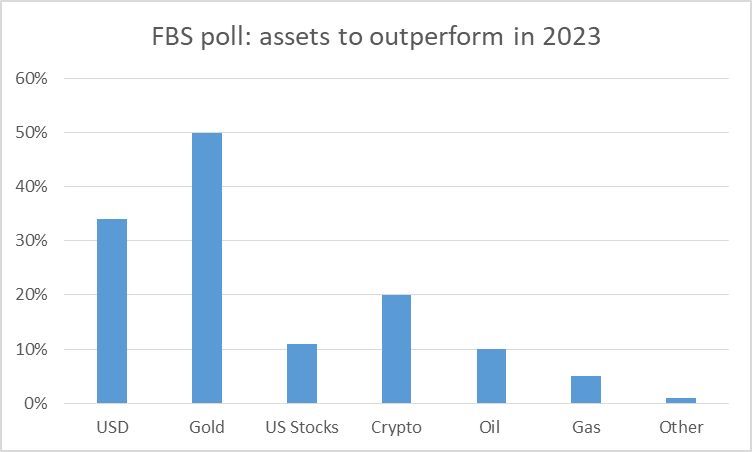

Assets to outperform in 2023

- 50% believe gold will take revenge on the USD.

- 34% expect the USD uptrend to continue.

- 20% see crypto bulls returning to the market.

- Only 5% of respondents said gas would outperform in 2023.

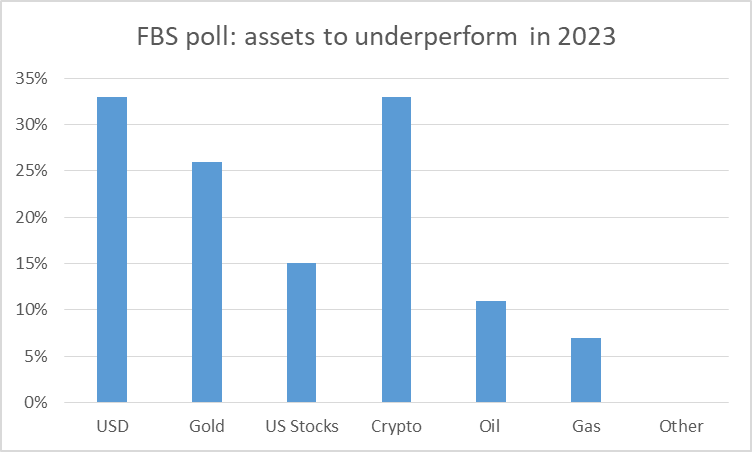

Assets to underperform in 2023

- 33% expect cryptocurrencies and USD to fall next year.

- 26% predict a downtrend in gold.

Takeaway

After the roller-coaster of 2022, the next year will bring unprecedented new opportunities for traders.