- Berkshire Hathaway's recent 13F filing showed the status of Warren Buffett's latest holdings

- Apple remains the top holding in the Oracle (NYSE:ORCL) of Omaha's portfolio

- On the other hand, the company's cash reserves are increasing rapidly raising the question: Is Buffett bracing for a market downturn?

- Secure your Black Friday gains with InvestingPro's up to 55% discount!

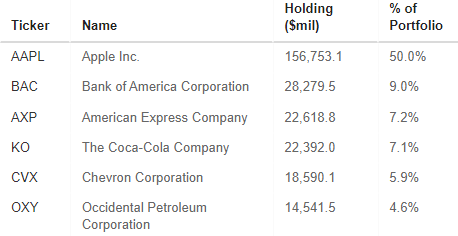

On November 14, the Berkshire Hathaway (NYSE:BRKb) fund submitted its obligatory 13F report to the U.S. Securities Exchange Commission, outlining portfolio details for units trading in stocks valued at over $100 million. The pivotal observation from the presented data underscores unwavering confidence in Apple (NASDAQ:AAPL), maintaining its position as the undisputed leader, constituting 50% of the portfolio.

Additionally, a new cash holding record was set at around $157.2 billion, a notable increase from the previous quarter's $147.4 billion. This substantial cash reserve suggests that the Oracle) of Omaha, Warren Buffet, is gearing up for potential market opportunities amid projections of a U.S. economic slowdown or even recession.

So, What Strategic Moves Have Warren Buffet and His Company Made?

The record cash holdings stem from capital gains, primarily dividends, and the reduction of some positions. In the last quarter alone, $5 billion worth of securities were divested, contributing to a total of $44 billion over the last twelve months. Stocks no longer considered promising include General Motors Company (NYSE:GM), Procter & Gamble Company (NYSE:PG), Johnson & Johnson (NYSE:JNJ), HP (NYSE:HPQ), and Amazon (NASDAQ:AMZN).

The most significant moves were observed in Chevron Corp (NYSE:CVX) with a -10.45% adjustment and complete sell-offs in Activision Blizzard (NASDAQ:ATVI) and General Motors. On the revenue side, noteworthy symbolic purchases include Liberty Media Formula One Corp A (NASDAQ:FWONA), Atlanta Braves Holdings Inc (NASDAQ:BATRA), and Sirius XM Holding Inc (NASDAQ:SIRI).

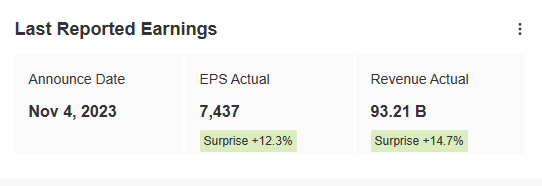

Earlier this month, the company released its quarterly results, with a positive surprise in both earnings per share and revenue.

Source: InvestingPro

From the point of view of stock prices, the results supported the demand side, which is confidently heading for an attack on this year's maximums, which are also historical peaks.

The closest support where to look for a place to join the train is within the $373 level for B shares.

Apple Continues to Dominate Berkshire Hathaway’s Portfolio

Warren Buffet's fascination with Apple continues in earnest, as evidenced by the dominance of the US tech giant in the portfolio of the billionaire-led investment vehicle with a score of 50%. This is followed by equally recognized brands such as Bank of America, American Express (NYSE:AXP) and Coca-Cola (NYSE:KO).

Source: InvestingPro

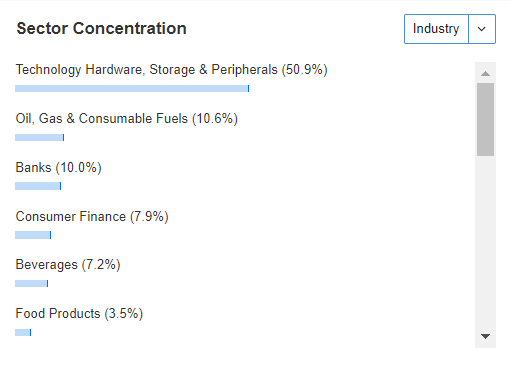

The structure of the portfolio shows that the strategy based primarily on mature value-oriented companies is continuing with very good results.

Source: InvestingPro

What will be the next steps of the "Oracle of Omaha"? It's hard to find an answer to this question at the moment, but it's very possible that the next major moves will be made on the occasion of a possible discount sale in the broad market.

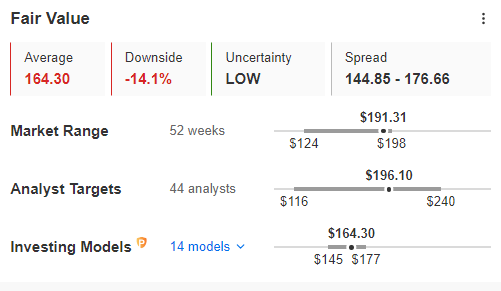

Watch Out for a Correction in Apple’s Stock Price

For more than three weeks, Apple's stock price has been moving within a dynamic upward impulse, for which the next target area is the historical maxima located in the price region just below $200. However, the fair value index suggests the possibility of a correction of up to 14%, which would correspond to a rebound near the local support area falling in the vicinity of $164 per share.

Source: InvestingPro

From the point of view of connecting to the uptrend, this would be a favorable situation, which would allow buying at a much better price from the perspective of a continuation of the northward movement.

***

Buy or Sell? Get the answer with InvestingPro for Half of the Price This Black Friday!

Timely insights and informed decisions are the keys to maximizing profit potential. This Black Friday, make the smartest investment decision in the market and save up to 55% on InvestingPro subscription plans.

Whether you're a seasoned trader or just starting your investment journey, this offer is designed to equip you with the wisdom needed for more intelligent and profitable trading.

Disclaimer: The author does not own any of these shares. This content, which is prepared for purely educational purposes, cannot be considered as investment advice.