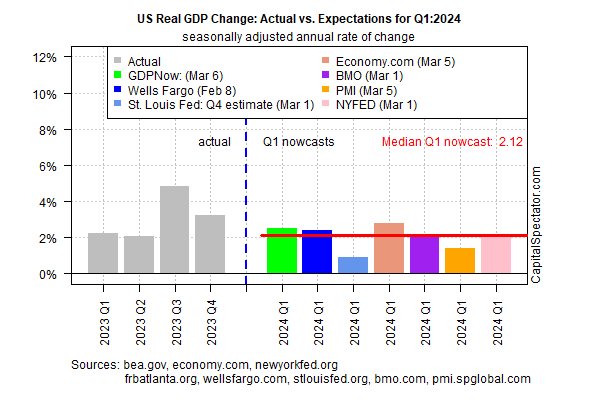

Economic activity remains on a path to slow in the next month’s release of first-quarter GDP data, according to the median nowcast via a set of estimates compiled by CapitalSpectator.com.

The Bureau of Economic Analysis is projected to report in late April that output increased 2.1% (real seasonally adjusted annual rate) during the January-March period, based on today’s revised median GDP nowcast.

The estimate continues to reflect a substantially softer rise vs. Q4’s strong 3.2% advance, which in turn marks a downshift from Q3’s red-hot 4.9% increase, according to government data.

Today’s revised Q1 estimate ticked down slightly, again, from the previous estimate (published on Feb. 28), highlighting that as more data for the current quarter is published, the odds increase that we’ll see a materially softer pace of growth in the upcoming GDP report.

Despite the recent downgrades for Q1 output, the nowcasts still suggest that recession risk is low for Q1. A 2%-plus GDP increase is moderate, but it’s still well above a level that would ring alarm bells.

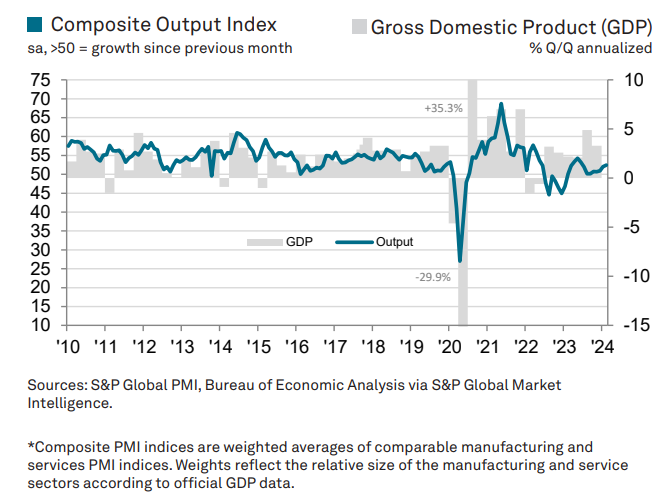

Using survey data for February paints a brighter profile as private sector output increased at fastest pace in eight months, according to the US Composite PMI Output Index, a GDP proxy.

“The latest data signaled a thirteenth successive monthly expansion in business activity at private sector firms, supported by a renewed upturn in manufacturing production and further rise in service sector activity,”

Reports S&P Global, which publishes the PMI numbers.

Meanwhile, executives at US firms are “strikingly more confident about the economy, with expectations of stronger sales and capital investments,” according to another source for business sentiment, reports Axios:

“For the first time in two years, the Business Roundtable’s quarterly gauge of CEO sentiment is above its historical average, signaling that business leaders’ economic uneasiness may finally be fading.”

Gregory Daco, chief economist at EY, also sees an upbeat trend unfolding, telling FT:

“The US economy remains very robust and the main engine of global growth. There are headwinds, but overall there are no indications of an imminent retrenchment in the private sector.”

The next key reality check for Q1 economic activity arrives tomorrow (Fri., Mar. 8) with the release of nonfarm payrolls data for February.

The Labor Department is expected to report that hiring slowed to a still-healthy monthly gain of 190,000 last month, according to Econoday.com’s consensus point forecast.

That’s substantially below the previous two months, but the increases in December and January were unusually strong.