The AUD is testing an important support zone today as one by one; its foundations get eroded.

Last nights U.S ADP Employment Change was a monster number, adding 298,000 jobs against an expected number of 185,000. Such a huge overshoot has seen economists and analysts scrambling to revise tomorrow’s Nonfarm Payrolls (NFP) up from 190,000 consensus. For those that have been on Mars the last couple of weeks, the NFP is the last stone in the wall needed to all but confirm the Federal Reserve hikes at next week’s FOMC.

The street had not priced this in at all as of even seven days ago and had been scrambling to play catch-up ever since. This has manifested itself as a stronger USD, lower precious metals and as of last night some meaningful rises in U.S. bond yields. With the unemployment rate also expected to come in at 4.7% tomorrow night as well, I would suggest that the Federal Reserve is well and truly on their path to three rates hikes this year as reported, perhaps even four. Something we feel is still not priced in by the market.

Apart from gold and silver, down -0.70% and -1.50% respectively, platinum and copper also fell heavily as did corn and wheat, the latter by -2.0%. Like its little Kiwi brother, it looks like the Australian Dollar is finally feeling the effects. As yields rise in the U.S. so does the appeal of AUD yields fade. Australia is a major exporter of most of the commodities above, especially copper and wheat. This further sapped the lucky country. A neutral RBA earlier in the week, a lower growth China are the final pieces of the puzzle.

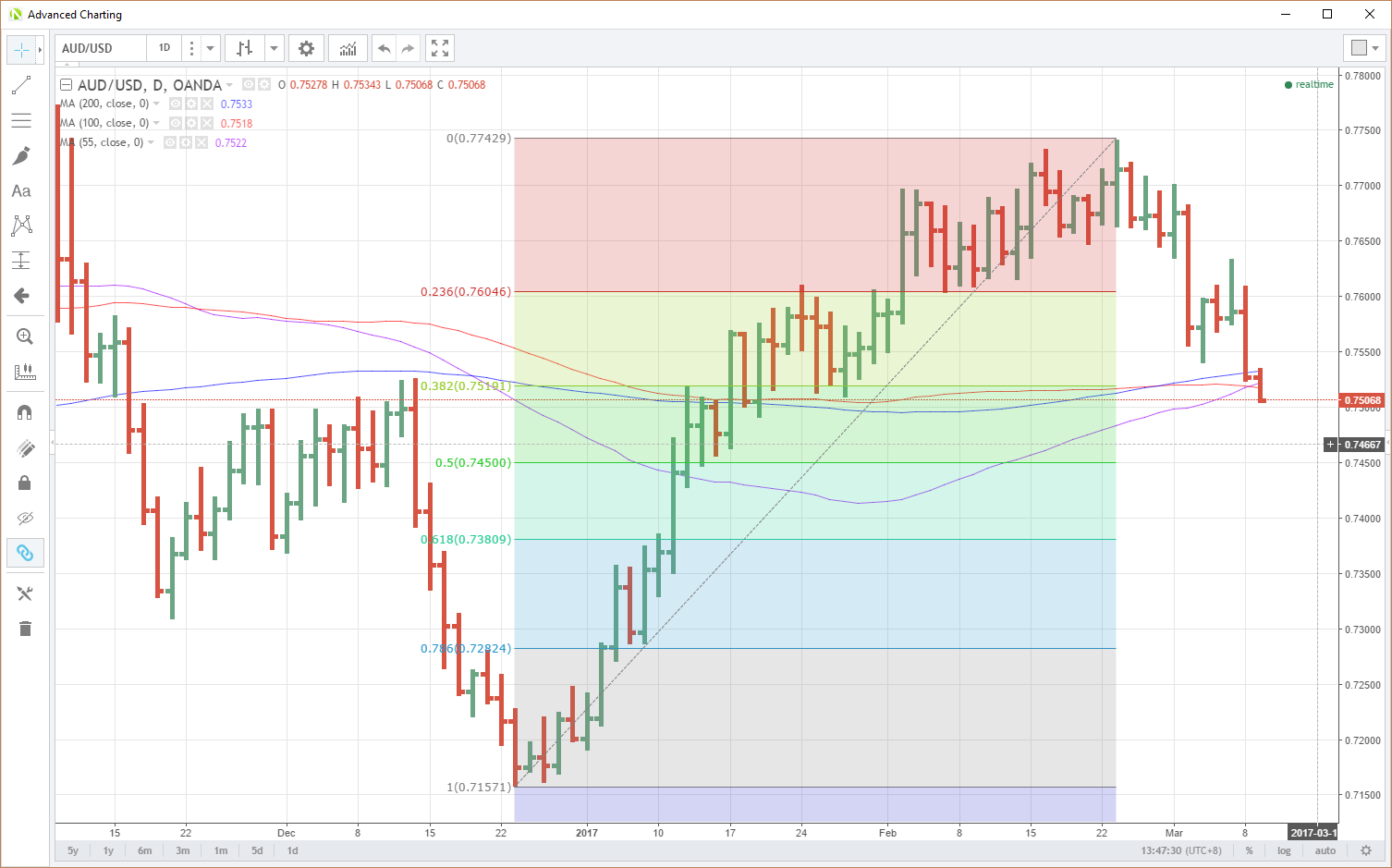

AUD fell from 7610 in New York trading to around 7525 and in Asia has continued lower to 7510. Looking at the chart below, we can see that the 7515/35 region is an important support level, containing the 55, 100 and 200-day moving averages (DMA) ahead of support at 7490. From a technical perspective, a close below the moving averages is bearish.

However, some caution could be warranted as the 7490 level has not broken yet. A look at the chart below shows that AUD has been down to the 7520 area a number of times since early January, only to break bears hearts by rallying after that. A break of 7490 could open further losses from a technical point of view, with very little support until 7450 and 7380, the 50% and 61.8% Fibonacci retracements of the December low to the February high.

It is also important to note that AUD only closed below the 200-dma, not the 55 and 100 on a day basis, although intra-day in Asia, we are trading lower.

Resistance is at the aforementioned 7515/35 area, and then 7605.

Overall, although the technical picture looks potentially quite bearish, AUD’s ability to rally from this level previously, means traders may wish to see a confirmed break on a daily basis if they are bearish.

AUD/USD Daily

Summary

Tomorrow evening’s Non-Farm Payroll is the key. A big undershoot could see USD positioning scaled back benefiting commodities, yield differentials and the AUD. A number above or near to forecast will be seen as a 100% chance the Fed hikes next week and could see more Usd strength.