Here are the latest developments in global markets:

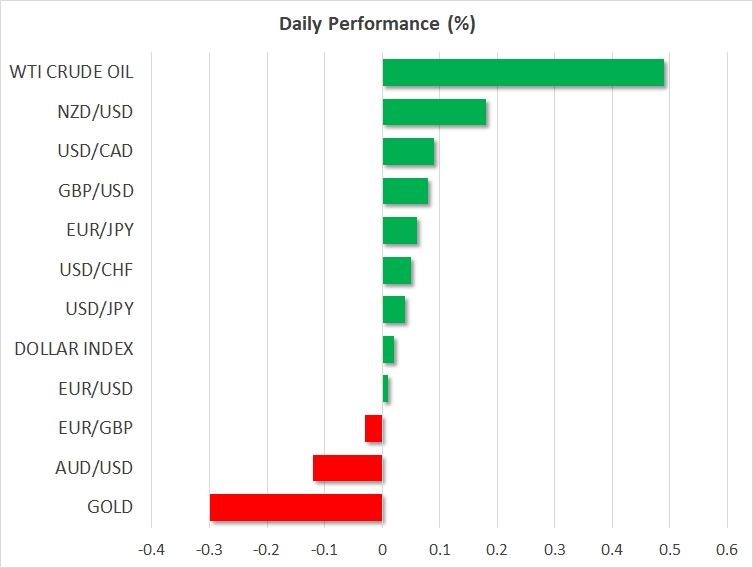

- FOREX: The US dollar index is practically flat on Monday after posting some modest losses in the previous session, failing to capitalize on a strong US GDP print for Q2. Meanwhile, the yen advanced on Friday, as markets positioned for the BoJ’s policy decision, scheduled for the Asian trading session on Tuesday.

- STOCKS: Wall Street posted considerable losses on Friday, as soft earnings releases took the wind out of the sails of major indices. The tech-heavy Nasdaq Composite fell by 1.46%, while the S&P 500 and the Dow Jones dipped by 0.66% and 0.30% respectively. Twitter Inc (NYSE:TWTR) (-20.54%) and Intel Corp (NASDAQ:INTC) (-8.59%) were among the biggest underperformers. Futures suggest another negative open for the major US indices today (S&P, Dow, and Nasdaq 100). Asia was mostly in the red on Monday, with Japan’s Nikkei 225 and Topix declining by 0.74% and 0.43% correspondingly. In Hong Kong, the Hang Seng dropped 0.70%. In Europe, all the major benchmarks were expected to open notably lower today, according to futures.

- COMMODITIES: Oil prices dropped on Friday, weighed on by a deterioration in broader risk sentiment – which typically harms risk-sensitive commodities like oil – as well as an increase in the US oil rig count for the first time in three weeks. Both WTI crude and Brent are a little higher on Monday, though, rising by 0.49% and 0.22% respectively. In precious metals, gold is down by 0.30% at $1,220 per troy ounce on Monday. The outlook for the yellow metal remains bleak, evident by prices trading just off their lows for the year, at $1,211.

Major movers: Yen holds firm as markets gear for BoJ decision; dollar eases

The yen posted another day of advances against the dollar, euro, and pound on Friday, as investors positioned for the Bank of Japan’s (BoJ) policy decision, due during the Asian trading session Tuesday. Following recent media reports that the Bank may adjust its ultra-loose policy framework in a more hawkish direction, yields on longer-dated Japanese government bonds surged to multi-month highs, lifting the yen.

While markets seem to have positioned for a hawkish tilt, one has to sound a note of caution, as it still appears somewhat early for the BoJ to take such steps. Inflation remains muted, consumer spending is in a soft patch, the economy contracted in Q1, and the outlook for exports is clouded amid trade tensions. On top, any hawkish bites could trigger an outsized rally in the yen, which the Bank will probably be keen to avoid as that could weigh down on inflation. All in all, policymakers seem to have little reason to act at this meeting, and should they disappoint those looking for hawkish changes, the yen may be vulnerable to a sharp downside correction as Japanese bond yields come back down.

Meanwhile, the dollar index dipped somewhat on Friday following the US GDP data for Q2. While the headline GDP number was in line with projections at a robust 4.1% annualized pace, investors seemingly expected something better, evident by the modest tumble in the US currency on the news. It’s going to be a long week for the dollar, with a Fed decision on Wednesday and a US employment report on Friday likely to keep traders busy.

In the UK, the pound slipped as well, unable to draw support from growing expectations that the Bank of England (BoE) will raise its benchmark interest rate at its upcoming policy meeting on Thursday. Looking at market pricing, investors have nearly fully factored in a 25bps rate increase. The probability for such action currently rests at 86% according to UK OIS, so the broader direction in sterling will probably be decided by what signals the Bank sends regarding the pace of future hikes, and not by the rate increase itself.

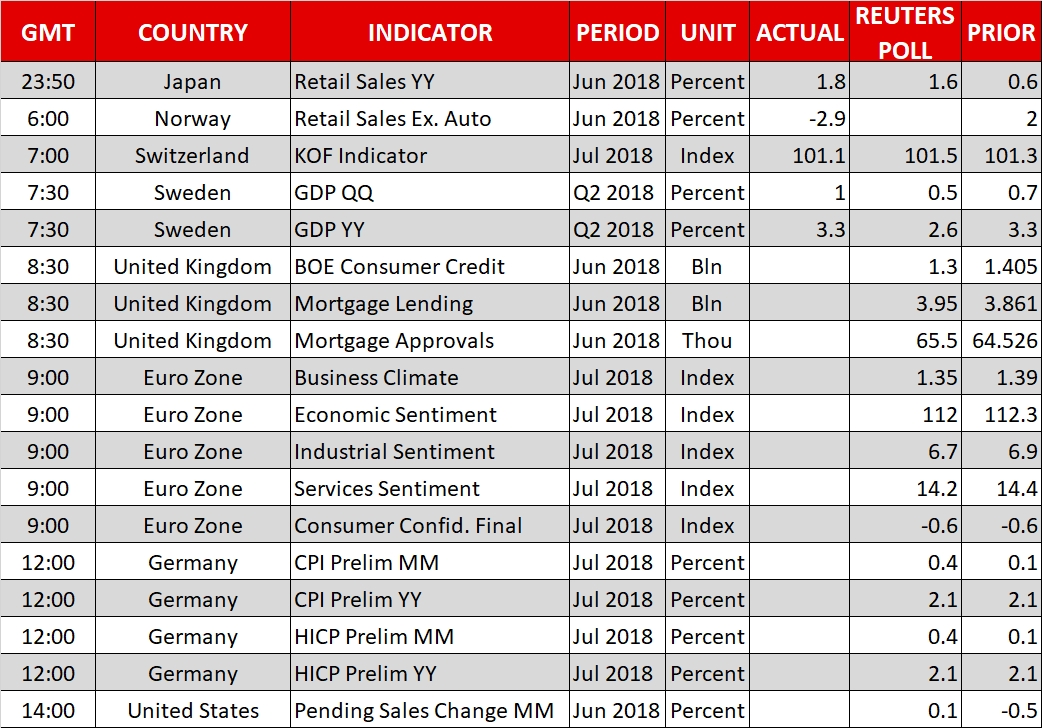

Day ahead: Eurozone business surveys, German inflation and US pending home sales due

In a busy week in terms of central bank meetings, Monday’s calendar features numerous business surveys out of the eurozone, advance estimates of German inflation for July, and pending home sales data out of the US.

Swedish growth figures for the second quarter will be hitting the markets at 0730 GMT, with economic activity expected to ease relative to the previously tracked quarter.

UK data on June’s consumer credit, mortgage lending and approvals are due at 0830 GMT.

At 0900 GMT, the European Commission’s Directorate General for Economic and Financial Affairs will be releasing numerous surveys gauging business sentiment in the eurozone, all of which are expected to reflect a slight worsening in morale during July relative to June. The final consumer confidence reading for July, again released by the same authority, will also be made public at the same time, with the relevant index anticipated at -0.6, the same as in June and at its lowest since late 2017.

Germany, the eurozone’s largest economy, will be on the receiving end of preliminary inflation data for the month of July at 1200 GMT. Inflationary pressures as gauged by the consumer price index (CPI) are projected to grow by 0.4% m/m, reflecting an acceleration compared to June’s 0.1%, while they’re forecast to expand by 2.1% y/y, the same pace as in June. The Harmonised Index of Consumer Prices (HICP), that uses a common methodology across EU countries, will also be attracting attention. It should be kept in mind that these figures are coming one day ahead of the eurozone’s respective numbers and may be seen as giving an indication as far as tomorrow’s release is concerned; in other words, euro pairs may prove sensitive to the release.

Out of the US, pending home sales are expected to increase by 0.1% m/m in June, after declining by 0.5% in May.

US Secretary of State Mike Pompeo, Commerce Secretary Wilbur Ross and Energy Secretary Rick Perry will be speaking at the Indo-Pacific Business Forum at 1230 GMT. Meanwhile, President Trump is scheduled to meet Italian PM Guiseppe Conte at the White House.

In equities, Caterpillar (NYSE:CAT) will be releasing quarterly results on Monday.

Lastly, the current week includes numerous central bank meeting that are likely to offer short-term direction in FX (and other) markets; the Bank of Japan, the Federal Reserve and the Bank of England will be concluding their meetings on monetary policy on Tuesday, Wednesday and Thursday respectively.

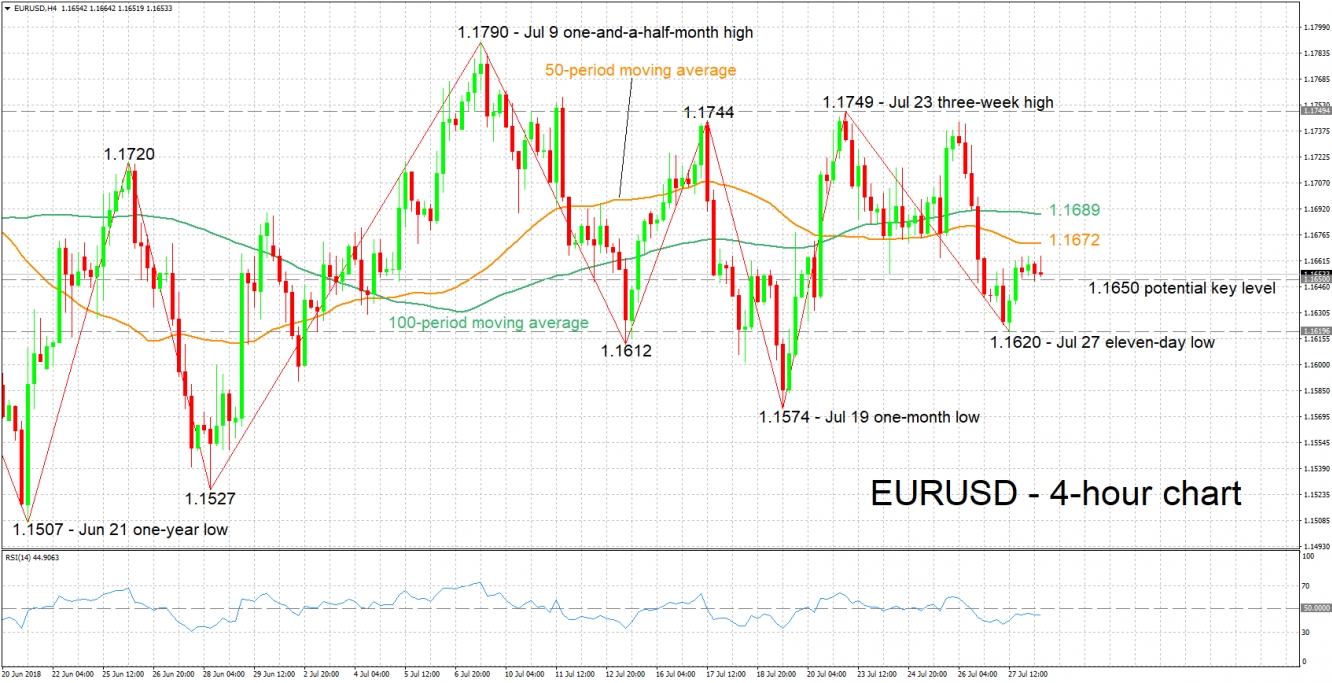

Technical Analysis: EURUSD looking mostly neutral in the short-term

EUR/USD is moving sideways after gaining some ground from the 11-day low of 1.1620 hit on Friday. The RSI, which is also moving sideways after a previous rise, is projecting a predominantly neutral picture in the near-term.

Upbeat German inflation data may boost the pair, with resistance to advances potentially taking place around the current levels of the 50- and 100-period moving average lines at 1.1672 and 1.1689 respectively; the region around the latter also encapsulates the 1.17 round figure. Further above, the three-week high of 1.1749 from July 23 would increasingly come into scope.

Conversely, subdued German inflationary pressures could weaken EUR/USD. Given a fall below the zone around 1.1650, which was congested in the past, support may come around Friday’s 11-day low of 1.1620, including the 1.16 handle. Steeper losses would turn the attention to the one-month low of 1.1574 posted on July 19.

Eurozone business sentiment data can also spur some movements in the pair.