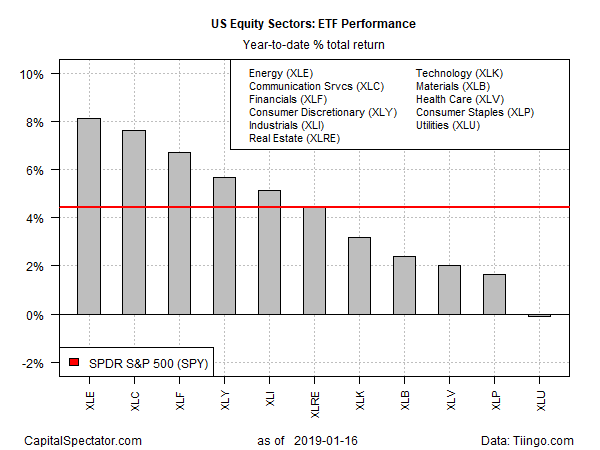

The partial government shutdown could be a slow-moving train wreck for the US economy, but for the moment the crowd’s inclined to reprice the major equity sectors higher in the new year following 2018’s haircut. With the exception of utilities, year-to-date returns are positive across the board through yesterday’s close (Jan. 16), based on a set of sector ETFs.

Energy stocks are in the lead: Energy Select Sector SPDR (XLE (NYSE:XLE)) has roared ahead by 8.1% so far in 2019. Nipping at XLE’s heels is Communication Services Select Sector (XLC), which is up 7.6% year to date.

The rebound in commodities prices is supporting shares of energy firms. By one analyst’s outlook, the rebound in raw materials has more room to run. “We’re bullish on commodities,” said Jeff Curries, global head of Commodities Research at Goldman Sachs (NYSE:GS), in an interview with CNBC on Wednesday. His reasoning:

“One, because you don’t have the rising (interest) rates anymore and in fact, they’ve come off and they’re on pause. Two, the dollar’s really strong and likely to weaken from here as opposed to strengthen like it did last year.” History suggests that a firmer greenback tends to align with higher commodity prices, which are typically prices in dollars.

Today’s report that OPEC cut oil production in December offers another source of bullish support for energy shares.

The only sector with red ink so far this year: utilities. The Utilities Select Sector SPDR (XLU) has edged down 0.1% year to date. One reason for the weakness in this corner is the spillover of negative sentiment following news that PG&E Corporation will file for bankruptcy – news that crushed the stock and contributed to weakness in other utility shares.

Meanwhile, the broad US stock market continues to post a solid gain: SPDR S&P 500 (NYSE:SPY) is ahead 4.4% year to date.

A key risk factor that may weigh on this year’s rally in the days and weeks ahead: the partial government shutdown. The outlook for the US economy is increasingly coming under pressure from the budget stalemate in Washington. Although the macro trend is still moderately positive, fallout from furloughing 800,000 federal workers and 1 million-plus contractors is starting to pinch.

The economic repercussions have been limited so far, but if the shutdown drags on it’s likely that the headwinds will build and help strengthen the slowdown that was already underway in late-2018.

Unfortunately, there are still no signs that a political solution to the shutdown is near and so analysts are factoring in the potential for trouble.

“You can take the ruler out right now and calculate the exact impact from missed paychecks and contracts and you don’t have to go many months to get to zero growth,” advises Torsten Slok, chief international economist at Deutsche Bank (DE:DBKGn). “But this is not just some linear event. It can get exponentially worse in very unpredictable ways, from government workers quitting, to strikes, to companies not going public. It’s no longer just a political sideshow, it’s a real recession risk.”