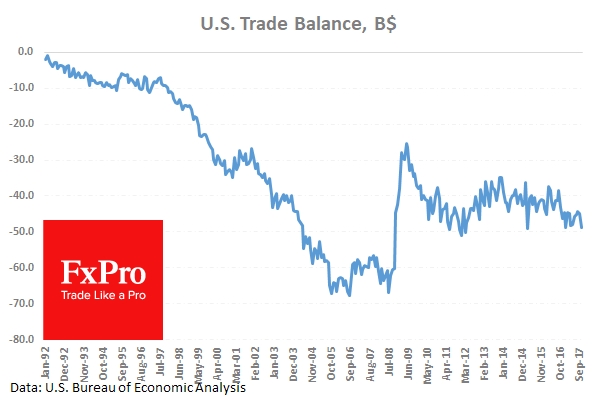

Data released by the US Commerce Department on Tuesday indicated that the US trade gap rose 8.6% in October from $44.9 billion in September, as imports from China and other suppliers hit a record high ahead of the holiday shopping season. Imports hit a record $244.6 billion in October, and exports were unchanged at $195.9 billion. For 2017, the US is running a trade deficit of $462.9 billion, up 11.9% over the same period in 2016. U.S. exports are up 5.3% this year. Imports totaled $48.2 billion from China, $39.4 billion from the EU and $28.7 billion from Mexico — all record highs. During President Trump's recent visit to Beijing, US companies signed contracts valued by the Commerce Department at around $250 billion. But it could be months before any of those transactions are reflected in U.S. trade data.

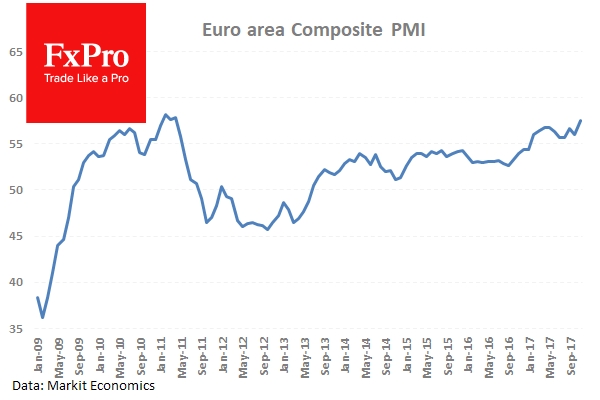

On Tuesday, data from Markit’s Eurozone Services PMI for November was released coming in at 56.2 (previously 55.0), the composite was higher at 57.5 (56.0 in October). The strong number reflects a strengthening of economic expansion across the big-four Eurozone countries, with output growth accelerating to the fastest in over 78 months. Additionally, job creation has risen to a 17-year high and price pressures have strengthened.

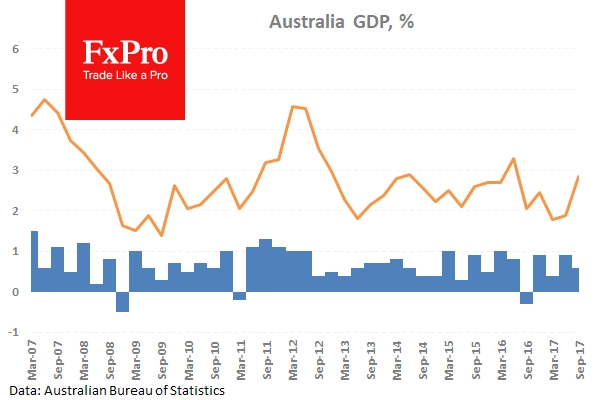

Data from the Australian Bureau of Statistics published earlier today showed Australian GDP grew by 0.6% in seasonally adjusted chain volume terms, slightly below the 0.7% level expected by the markets. Annualized GDP came in at 2.8%. This is markedly better than the 1.8% seen in Q2, but was below the 3% growth that the markets had hoped for. AUD/USD fell on the news to near month lows of around 0.75717 before stabilizing.

EUR/USD is 0.15% higher in early Wednesday trading at around 1.1840.

USD/JPY is 0.4% lower in early trading at around 112.11.

GBP/USD is 0.15% lower in early session trading at around 1.3422.

AUD/USD is 0.3% lower following the GDP release, trading around 0.7585.

Gold is 0.1% higher overnight, currently trading around $1,267.5 after touching close to 2-month lows around $1,264.11.

WTI is little changed overnight, trading around $57.45.

Major data releases for today:

At 08:00 GMT: the European Central Bank (ECB) Non-monetary policy meeting is scheduled to take place in Frankfurt, Germany.

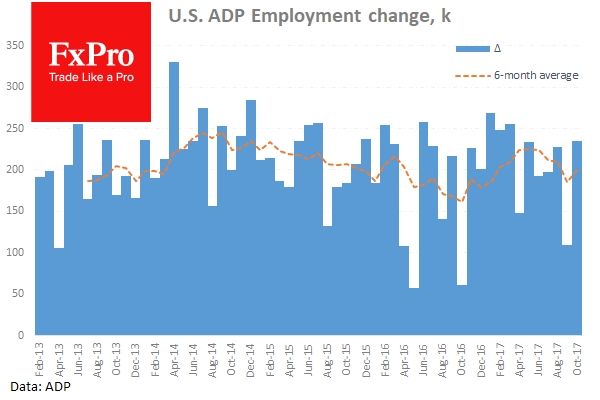

At 13:15 GMT: Automatic Data Processing Inc (NASDAQ:ADP) in the US will release ADP Employment Change for November. The markets are forecasting a gain of 190K, a drop from Octobers’ gain of 235K. The ADP data may hold clues as the markets await Friday’s all-important NFP release.

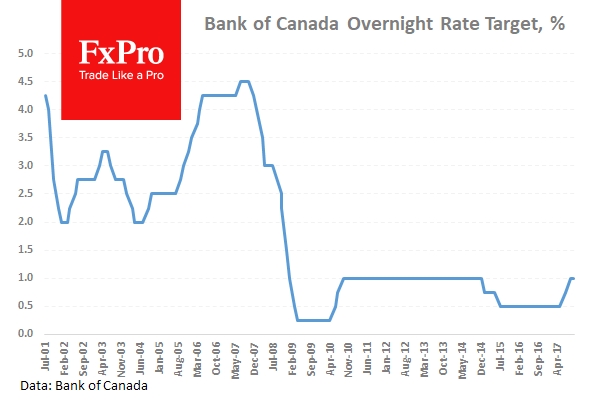

At 15:00 GMT: The Bank of Canada (BoC) is scheduled to provide a rate statement and interest rate decision. The markets are forecasting that the BoC will keep interest rates on hold at 1%. If there is a change in Canadian monetary policy and rates are hiked we can expect to see CAD volatility. That said, many believe the likelihood of such a hike is unlikely until Q2 of 2018.