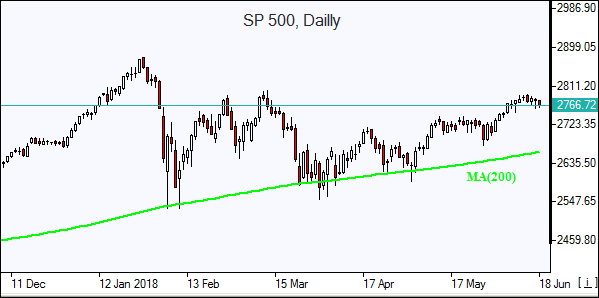

S&P 500 logs fourth weekly gain in a row

US stock market pulled back Friday as Trump announced tariffs on $50 billion of Chinese imports. S&P 500 slipped 0.1% to 2779.42, ending 0.01% higher for the week. Dow Jones industrial average fell 0.3% to 25090.48. The NASDAQ lost 0.2% to 7746.38. The dollar weakened as manufacturing production fell 0.7% in May: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, slipped 0.1% to 94.735 but is higher currently. Stock index futures point to lower openings today.

European stocks end choppy week higher

European stocks erased most of previous day gains on Friday on rising US-China trade war concerns. Both the euro and British pound turned higher against the dollar but are lower currently. The Stoxx Europe 600 Index lost 1%, however ending 1% higher for the week. The DAX 30 fell 0.7% to 13010.55. France’s CAC 40 retreated 0.5% and UK’s FTSE 100 tumbled 1.7% to 7633.91. Indices opened 0.1% - 0.4% lower today.

Asian indices mixed

Asian stock indices are mixed today after China retaliated to US $50 billion tariffs on Chinese imports Friday by announcing it would respond with tariffs “of the same scale and strength.” Nikkei ended 0.8% lower at 22680.33 weighed by yen rise against the dollar. Markets in China and Hong Kong are closed for Dragon Boat Festival. Australia’s ASX All Ordinaries is up 0.2% as the Australian dollar continued falling against the greenback.

Brent down

Brent futures prices are extending losses today on expectations of Russian and Saudi Arabia oil output boost. Prices fell Friday: Brent for August settlement lost 3.3% to close at $73.44 a barrel Friday, ending 4% lower for the week.