The contrast could hardly be more striking. House Speaker Kevin McCarthy emerged from yesterday’s latest round of negotiations with the White House with an upbeat spin but no deal. Soon after, Fitch Ratings put the AAA credit rating for US debt on watch for a downgrade.

“I still think we have time to get an agreement and get it done,”

This is what McCarthy told reporters on Wednesday after another meeting with President Biden. A few hours later, Fitch said it was moving closer to downgrading US debt.

“The Rating Watch Negative reflects increased political partisanship,” the credit ratings firm advised. Fitch explained that the ongoing impasse in Washington is “hindering reaching a resolution to raise or suspend the debt limit despite the fast-approaching X-date (when the U.S. Treasury exhausts its cash position and capacity for extraordinary measures without incurring new debt).”

Nonetheless, Fitch offered a bit of optimism, noting that it “still expects a resolution to the debt limit before the X-date.” But with each passing day without a deal to lift the debt ceiling, the threat increases.

We believe risks have risen that the debt limit will not be raised or suspended before the x-date and consequently that the government could begin to miss payments on some of its obligations. The brinkmanship over the debt ceiling, failure of the U.S. authorities to meaningfully tackle medium-term fiscal challenges that will lead to rising budget deficits and a growing debt burden signal downside risks to US creditworthiness.

Republican House Majority Leader Steve Scalise highlighted the dark side of the still-evolving political dynamics when he advised that the House will recess after today’s (Thursday) voting. On Wednesday, he said:

“Following tomorrow’s votes, if some new agreement is reached between President Biden and Speaker McCarthy, members will receive 24 hours notice in the event we need to return to Washington for any additional votes, either over the weekend or next week.”

Meanwhile, some corners of the bond market continue to price in the potential for trouble. For Treasuries set to mature in the eye of a potential default storm, yields surged. Prices for so-called at-risk Treasuries – maturing between June 1 and June 7 — tumbled, lifting yields above 7%.

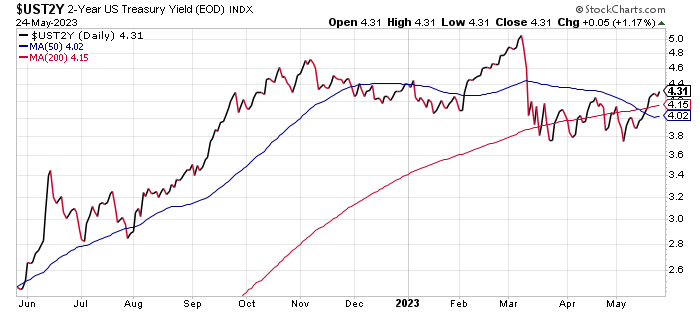

Treasury yields overall, however, remain relatively stable, although the policy-sensitive 2-year rate is edging up, closing at 4.31% on Wednesday (May 24), a two-month high. The benchmark 10-year yield also moved up to a two-month high yesterday.

Treasury yields will remain a crucial real-time measure of how the market is pricing in debt-ceiling risk. For the moment, the implied takeaway via the crowd is that a deal that averts default is still the baseline assumption. But the situation is increasingly precarious and is now evolving on a day-by-day and perhaps hour-by-hour basis.

Gregory Daco, chief economist at accounting firm Ernst & Young, said,

“The underlying assumption is that they will manage to pass some last-minute agreement — pulling out of the same playbook as 2011.”