Fed Chairman Jerome Powell succinctly summed up the state of the US labor market at Wednesday’s FOMC meeting press conference, noting that it “remains extremely tight” and that it’s “essential that [the Fed] bring down inflation” to support the labor market. In other words, the central bank is satisfied with the “employment” half of its dual mandate, but increasingly concerned with the “inflation” component.

Against that backdrop, it will be interesting to see how employment data evolves in the coming months as financial conditions (read interest rates) shift from a tailwind to a headwind for the US economy. Thankfully, economists don’t expect that to be a major factor for this month’s NFP report, with consensus expectations centered on roughly 400K net new jobs and average hourly earnings projected to rise by 0.4% month-over-month:

Source: StoneX

With another NFP report scheduled before the next monetary policy meeting (and the Fed seemingly well set on another 50bps rate hike as things stand), the market reaction to this month’s jobs report may be more limited than last month’s, but it’s still worth watching how the report comes in relative to the market’s expectations.

Are these expectations justified? We dive into the key leading indicators for Friday’s critical jobs report below!

NFP forecast

As regular readers know, we focus on four historically reliable leading indicators to help handicap each month’s NFP report:

- The ISM Services PMI Employment component printed at 49.5, down sharply from last month’s 54.0 reading and indicating an outright contraction in service sector employment.

- The ISM Manufacturing PMI Employment component came in at 50.9, showing a nearly 5% decline of its own from last month’s 56.3 print.

- The ADP Employment report showed 247K net new jobs, well below expectations and a notable decline from last month’s upwardly-revised 479K reading.

- Finally, the 4-week moving average of initial unemployment claims rose to 188K, up from last month’s historically low 178K reading.

As a reminder, the state of the US labor market remains more uncertain and volatile than usual as it emerges from the unprecedented disruption of the COVID pandemic. That said, weighing the data and our internal models, the leading indicators point to slightly below-expectation reading in this month’s NFP report, with headline job growth potentially coming in somewhere in the 300-400K range, albeit with a bigger band of uncertainty than ever given the current global backdrop.

Regardless, the month-to-month fluctuations in this report are notoriously difficult to predict, so we wouldn’t put too much stock into any forecasts (including ours). As always, the other aspects of the release, prominently including the closely-watched average hourly earnings figure which came in at 0.4% m/m in the most recent NFP report.

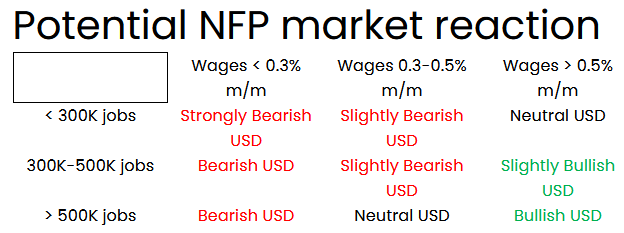

Potential NFP market reaction

The US dollar index rallied to test nearly 20-year highs in the 103.00 area over the last month, though the more-cautious-than-expected comments from Fed Chairman Powell has stalled the uptrend so far this week. From a macro level, there’s a case for more profit-taking heading into the weekend after an impressive rally, so it may take a particularly strong NFP report to push the greenback to new highs.

As for potential trade setups, readers may want to consider USD/JPY buy opportunities on a strong NFP report. The pair has spent the last week in a controlled pullback (possible bullish flag pattern) and the medium-term momentum still remains firmly in bulls’ favor.

On the other hand, a soft jobs report could present a buy opportunity in AUD/USD. The commodity currency complex has generally held up well against the greenback, and with the Aussie showing signs of forming a “higher low” in the mid-0.7000s, the pair could extend its gains toward 0.7300 if traders opt to take profits on the (US) dollar ahead of the weekend.