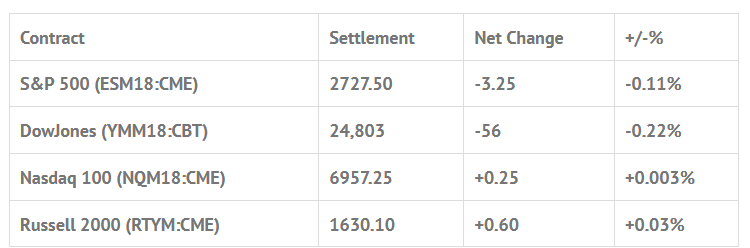

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 6 out of 11 markets closed lower: Shanghai Comp -0.40%, Hang Seng -0.56%, Nikkei +0.06%

- In Europe 9 out of 13 markets are trading higher: CAC +0.30%, DAX +0.75%, FTSE +0.13%

- Fair Value: S&P -081, NASDAQ +3.78, Dow -14.16

- Total Volume: 1.26mil ESM & 1,054 SPM traded in the pit

Today’s Economic Calendar:

Today’s economic calendar includes Durable Goods Orders 8:30 AM ET, Jerome Powell Speaks 9:20 AM ET, Consumer Sentiment 10:00 AM ET, Charles Evans Speaks 11:45 AM ET, Raphael Bostic Speaks 11:45 AM ET, Robert Kaplan Speaks 11:45 AM ET, and the Baker-Hughes Rig Count 1:00 PM ET.

S&P 500 Futures: #ES ‘It’s All About The Headline News’

Yesterday started with the Asian and European markets closing ‘mixed’. Japan’s Nikkei fell -1.1%, and the Stoxx Europe 600 was up by +0.2%. On Globex the S&P 500 futures (ESM18:CME) had an overnight trading range of 2720.25 To 2733.25. The first print of the 8:30 futures open was 2727.25, down -3.50 handes. After the open the ES traded up to 2730.50 and then started to pull back to 2727.00. At around 8:45 a headline hit the tape saying ‘President Trump Cancels North Korea Summit’, and by 10:00 the ES had traded down to 2705.75, a 25 handle drop, and just 5 ticks above Wednesday’s Globex low at 2704.50.

Once the low was in and the selling dried up the ES traded all the way back up to 2729.00 going into 1:30 CT. The futures then pulled back down to the 2723.00 area as the early MiM started to show over $300 million to sell. When the MiM went from $467 million to sell to $739 million to sell, the ES traded up to a new late afternoon high at 2729.50. On the 2:45 cash imbalance reveal the ES traded 2726.75 as the MiM dropped to sell 1.1 billion (thats over $3 billion sold in the last 3 sessions). The futures then traded 2727.00 on the 3:00 cash close, and went on to settle at 2727.25 on the 3:15 futures close, down -2.75 handles, or -0.10% on the day.

In the end, the ES had another decent selloff, and recovered nicely. The other thing is it didn’t break 2700.00. The big thing on the horizon is the story below. Like I said the other day, the era of free money is over!

Companies Paying Up

From the Wall Street Journal:

Companies are having to pay up to borrow, one more sign that the easy-money post-crisis years are coming to a close.

Top-rated corporate bonds were trading this week at 1.14 percentage points above comparable U.S. Treasurys, according to Bank of America Merrill Lynch (NYSE:BAC) index data. While that’s still quite low by historical standards, it’s well higher than their recent low of 0.91 point in January.

Wider spreads and higher Treasury yields are pushing up the cost of borrowing for companies. The yield on triple-B rated corporate bonds, one approximation for the cost of selling that type of debt, was at the highest in more than two years recently at about 4.4%.

Higher borrowing costs for companies show how market conditions are starting to tighten as the Federal Reserve lifts rates, pulling back after years of easy-money policies. The central bank is expected to lift rates for the second time this year in June, and analysts and traders believe one or two more increases are in store later in 2018.

To be sure, the corporate bond market remains quite healthy at the moment. For example, S&P Global Ratings projects the default rate among speculative-grade companies to fall to 2.5% by next March from 3.4% this past March and 4.1% in March of 2017.

Additionally, S&P 500 companies reported the best three months for earnings in years during the first quarter, another sign of corporate health as large firms benefit from an improving economy and a tax-code overhaul.

But tightening financial conditions inject another dose of uncertainty into the financial markets. Substantially wider credit spreads could add resistance to a further rise in the stock market, some analysts say.

Already, rising yields are hitting bondholders. The iShares iBoxx $ Investment Grade Corporate Bond exchange-traded fund, the largest ETF tracking the space, is down 5.6% this year, far underperforming the S&P 500’s 2.2% rise.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.