Fed to signal gradual rate hikes on Thursday

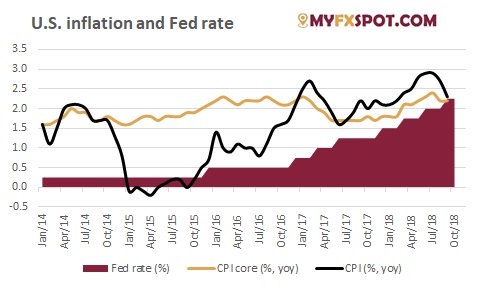

At next week’s FOMC meeting, the Fed is widely expected to keep its target range for the federal funds rate at an unchanged 2.00-2.25%. The statement is likely to reiterate the outlook for further gradual hikes and thus corroborate the outlook for a 25bp move in December.

Rather than making any immediate policy changes, the Fed will likely use the meeting to discuss the size and composition its balance sheet should have after the normalization is completed. According to the minutes of the August 1 FOMC meeting, Fed Chair Jerome Powell suggested that such a discussion of operating frameworks would likely resume in the fall. Previously, the committee had said that it wanted the smallest balance sheet that is consistent with a good monetary policy. At some point, that general statement will need to be translated into a target size for excess reserves; we expect a ballpark range of USD 500 bn to USD 750 bn, compared to the current level of USD 1.7 tn and a maximum level of USD 2.7 tn, which was hit in 2014. With regard to the composition, the Fed has suggested before that it ultimately targets a Treasury-only balance sheet, which means that all MBS and agency debt holdings would be wound down. This is likely to be confirmed. A circumstance that is adding some urgency to the topic is the fact that the effective fed funds rate continues to push against the interest paid on excess reserves. Unless the situation changes by the December meeting, it seems likely that the Fed will once again raise the interest paid on excess reserves by less than the target range in order to push the effective fed funds rate back to the middle of the band.

Friday's jobs report much better than expected

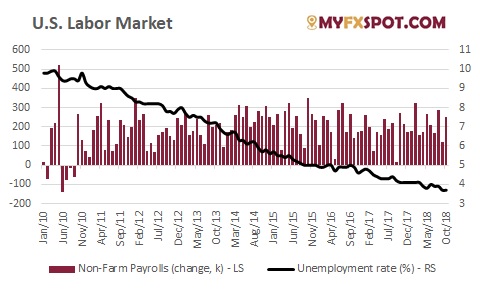

U.S. nonfarm payrolls increased by 250k jobs in October as employment in the leisure and hospitality sector bounced back after being held down by Hurricane Florence, which drenched North and South Carolina in mid-September.

There were also big gains in construction, professional and business services payrolls, and manufacturing, where employment increased by the most in 10 months. The economy created 118k jobs in September.

The Labor Department's closely watched monthly employment report on Friday also showed the unemployment rate was steady at a 49-year low of 3.7% as 711k people entered the labor force, in a sign of confidence in the jobs market.

The market had forecast payrolls would increase by 190k jobs in October and the unemployment rate would be unchanged at 3.7%.

Average hourly earnings rose five cents, or 0.2%, in October after advancing 0.3% in September. That boosted the annual increase in wages to 3.1%, the biggest gain since April 2009, from 2.8% in September.

Employers also increased hours for workers last month. The average workweek rose to 34.5 hours from 34.4 hours in September.

EUR/USD trading strategy?

We used stronger-than-expected NFP report and a corrective move in the EUR/USD to open a long position. In our opinion Thursday's long white candle will weigh on market for some time and change the market picture. What is important EUR/USD closed above 7-day exponential moving average on Friday, which suggests bulls are getting stronger.

Trading strategies:

EUR/USD

Trading strategy: Long

Target (NYSE:TGT): 1.1570

Stop-loss: 1.1345

Economic research and trading signals by MyFXspot.com