It is always refreshing to step away from the keyboard for a few days and hit the “reset button,” which is exactly what I did last week. My wife and I took a quick trip to Mexico to get a little sun on our face while we wiggled our toes in the sand.

I came back astonished.

Over my 30-odd years of working with money in various capacities, I learned to “shut-up and listen.” This is particularly the case when you are in an airport lounge or packed like sardines in a missile-shaped tube hurling through the air at 35,000 feet.

People love to talk…if you let them.

I had a dozen “listening sessions” with a wide variety of people who each told me roughly the same thing summarized as follows:

- The market is a “can’t lose” proposition.

- So is “Bitcoin” (even though they had no idea what it really is when I asked them.)

- The market is only going higher from here because the Fed won’t let it go down.

You get the idea.

And just when I thought I was sure I had the most bullish views wrapped up – Kevin Matras from Zack’s Research hit my inbox with the following:

“The S&P will double. And not just eventually. But over the next 5 years (or sooner).

Sounds like a Herculean task on the surface, but it’s really not. In fact, the market only needs to gain on average of 14.9% per year in order to do so. That’s not such a stretch given the market has been averaging 14.9% per year since this bull market began in early 2009, even though GDP (prior to this year) has only been increasing at an anemic 1.48% annual rate.

My 5-year doubling thesis also means that we won’t see another recession until stocks double again, nor will we see another bear market until stocks double again.“

So, there you have it.

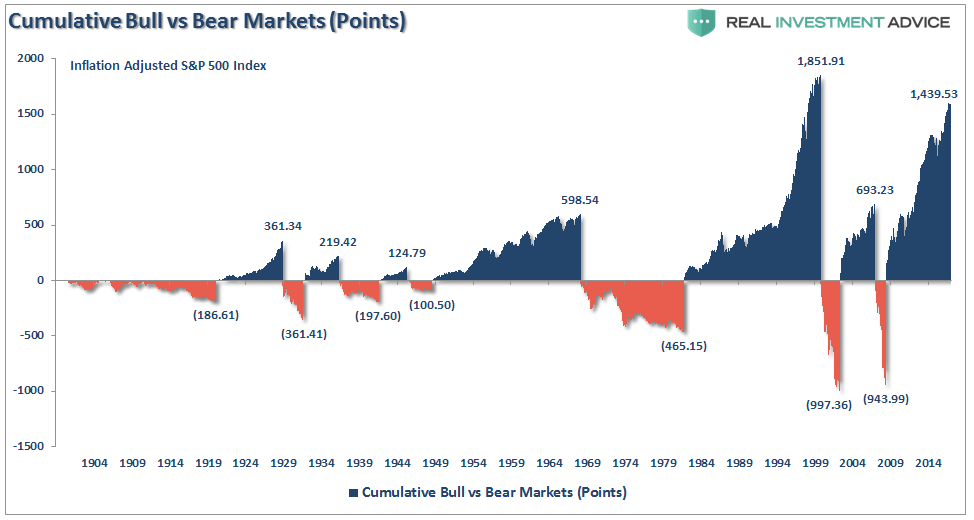

No bear market until the market racks up another 2600 points and dwarfs every other economic growth cycle in history.

Meanwhile….Back On Earth

Before I go further, let me clarify one thing.

As a portfolio manager, I am neither bullish nor bearish. I don’t really care which way the market is headed personally. If it is rising, as it is now, I am long equities. When it reverses that trend, I will be short equities and long bonds and cash.

That’s my job.

My job is also to pay attention to the risks that could quickly remove large chunks of investment capital from my client’s portfolios. Like any professional gambler knows, you can only play the game as long as you have a “stake” to play with. Lose your capital, and you lose the game.

The Perfect Storm Cometh

In the movie, “The Perfect Storm,” George Clooney plays the Captain of the “Andrea Gail.” The captain, after having a bad start to the fishing season, convinces his crew to go out one last time and they venture well past their usual fishing grounds, leaving a developing thunderstorm behind them. After ignoring repeated warnings, a desperate captain and crew head into a confluence of two powerful weather fronts and a hurricane in order to cash in on their bounty.

They all died.

Investors today, after having missed out on the first few years of the current bull market cycle, have now decided to throw all caution to the wind and ignore the repeated warnings in hopes of attaining the “riches” they have been promised.

And, like the “Andrea Gail,” they are currently heading into a perfect storm.

Storm One

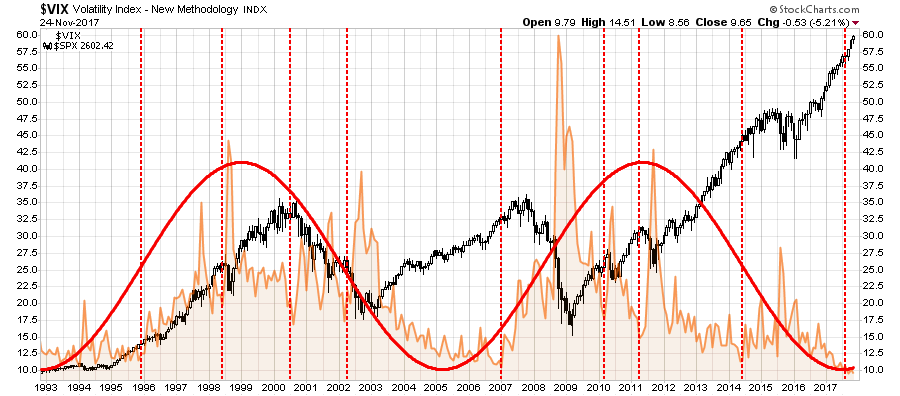

Currently, there are many articles pointing out various risks in the market. One that caught my attention over the weekend was a note on the volatility index by Kevin Muir.

“For the longest time, I felt the concerns from the VIX were overblown. For years, market pundits have been bandying about charts meant to scare investors about the potential dislocation in the VIX market. I even wrote a piece called, The VIX Article no one will like.”

He is right. For the last several years, each time the volatility index hit new lows, there were fears of a massive reversal on the horizon. Yet stocks marched higher while the volatility index made even lower lows.

But Kevin goes on to make an important point:

“Yet the frenetic pace of VIX shorting has intensified to a level that frightens me. There is now $1.2 billion of market cap of the inverse VIX ETF XIV, with another $1.3 billion of SVXY (another inverse ETF). This is insanity.

If we get a sharp move higher in VIX, there will be a snowball effect. If it is big enough, monster positions, like $2.5 billion of short VIX ETFs will have to be bought back in a hurry. And let me break it to you, there is no one large enough to take the other side of that trade. At least no one willing to do it without extracting many pounds of flesh first.”

Kevin is absolutely correct.

The only question is how far does it have to rise before the “margin calls” begin to occur. More importantly, volatility runs very long cycles which, unsurprisingly, follow the psychological investment cycles of the market from fear to greed back to fear.

But that is not the only problem.

Storm Two

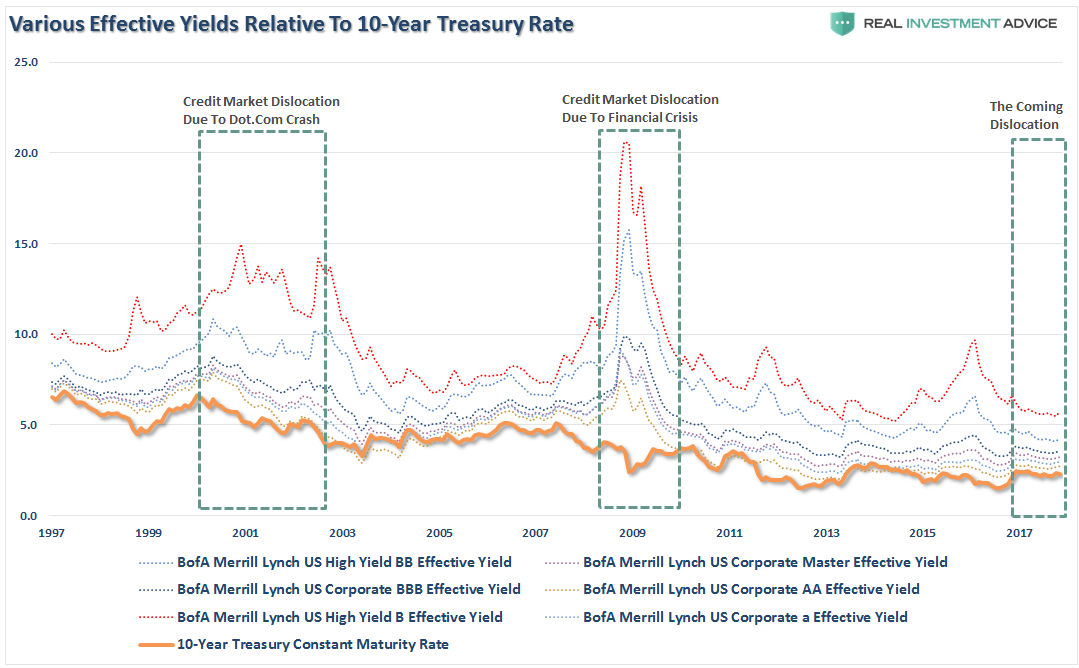

Once the VIX trade begins to fail, investors will find themselves almost immediately confronted the “high-yield bond storm.”

American corporations are levered to the hilt with total corporate debt surging to $8.7 trillion – its highest level relative to U.S. GDP (45%) since the financial crisis. In just the last two years, corporations have issued another $1 trillion of new debt NOT for expansion but primarily for share buybacks to boost bottom line earnings per share.

Note: This is also why “repatriation” won’t lead to massive economic growth, wages or employment. Instead, it will go to share buybacks, dividends, and executive compensation.

For the last 9-years, the Fed’s “zero interest rate policy” has left investors chasing yield and corporations were glad to oblige. The end result is the risk premium for owning corporate bonds over U.S. Treasuries is at historic lows.

I have written for some time that during the next market reversion, the 10-year rate will fall towards “zero” as money seeks the stability and safety of the U.S Treasury bond. However, corporate bonds are an entirely different issue. When “high yield,” or “junk bonds,” begin to default, as they always do, which is why they are called “junk bonds” to begin with, investors will face sharp losses on the one side of their portfolio they “thought” was supposed to be safe.

Let the panic selling begin.

As shown below, when the rout begins, the yields on junk bonds sharply deviate from that of the U.S. Treasury bond. Again, the 10-year Treasury rate is not going higher anytime soon, but everything else likely will.

Storm Three – The Hurricane

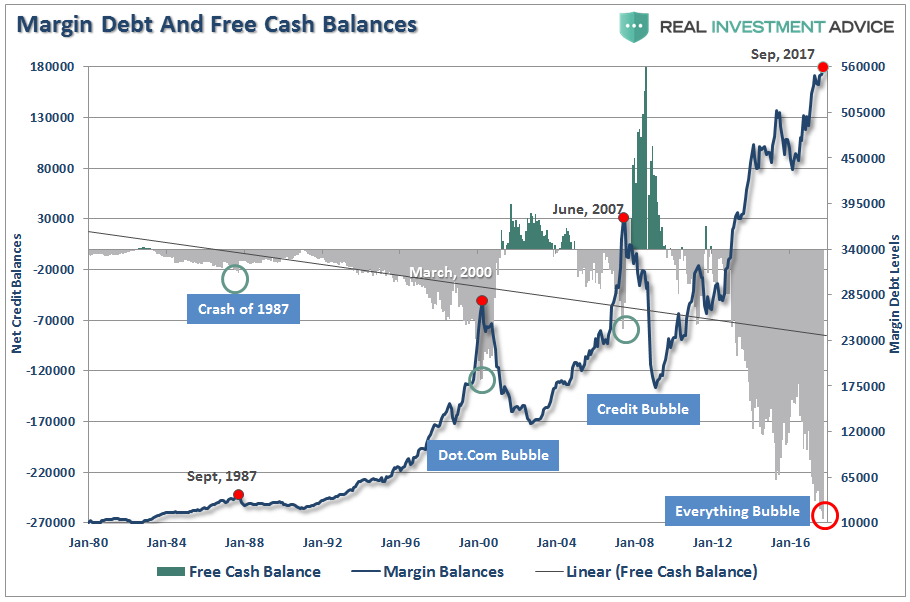

Of course, as investors begin to get battered by the “volatility and junk bond storms,” the subsequent decline in equity valuations begins to trigger “margin calls.”

As the markets decline, there will be a slow realization “this decline” is something more than a “buy the dip” opportunity. As losses mount, the anxiety of those “losses” mounts until individuals seek to “avert further loss” by selling.

There are two problems forming.

The first is leverage. While investors have been chasing returns in the “can’t lose” market, they have also been piling on leverage in order to increase their return.

It is often stated that margin debt is “nothing to worry about” as they are simply a function of market activity and have no bearing on the outcome of the market.

That is a very short-sighted view.

By itself, margin debt is inert.

Investors can leverage their existing portfolios and increase buying power to participate in rising markets. While “this time could certainly be different,” the reality is that leverage of this magnitude is “gasoline waiting on a match.”

When an “event” eventually occurs, it creates a rush to liquidate holdings. The subsequent decline in prices eventually reaches a point which triggers an initial round of margin calls. Since margin debt is a function of the value of the underlying “collateral,” the forced sale of assets will reduce the value of the collateral further triggering further margin calls. Those margin calls will trigger more selling forcing more margin calls, so forth and so on.

That Sinking Feeling

Unwittingly, investors have compounded their risks by piling into exchange-traded funds under the mistaken assumption it is an “easy way to invest.”

Over the past 9-years, the number of ETF’s available to investors has now eclipsed the number of stocks available for them to invest in. This leads to a liquidity problem and the risk of a “disorderly unwinding of portfolios.” As the head of the BOE, Mark Carney, warned:

“Market adjustments to date have occurred without significant stress. However, the risk of a sharp and disorderly reversal remains given the compressed credit and liquidity risk premia. As a result, market participants need to be mindful of the risks of diminished market liquidity, asset price discontinuities and contagion across asset markets.”

The issue of liquidity is not a small one.

Investors mistakenly assume there is ALWAYS a buyer at the price at which they wish to sell.

This is wrong.

While the answer is “yes,” as there is always a buyer for every seller, the question is always “at what price?”

At some point, that reversion process will take hold. It is at that point where the storms all collide into a massive wave of panic driving selling. It will not be a slow and methodical process, but rather a stampede with little regard to price, valuation or fundamental measures.

It will be the equivalent of striking a match, lighting a stick of dynamite and throwing it into a tanker full of gasoline.

Importantly, as prices decline it will trigger margin calls which will induce more indiscriminate selling. The forced redemption cycle will cause catastrophic spreads between the current bid and ask pricing for ETF’s, junk bonds, and option pricing. As investors are forced to dump positions to meet margin calls, the lack of buyers will form a vacuum causing rapid price declines which leave investors helpless on the sidelines watching years of capital appreciation vanish in moments.

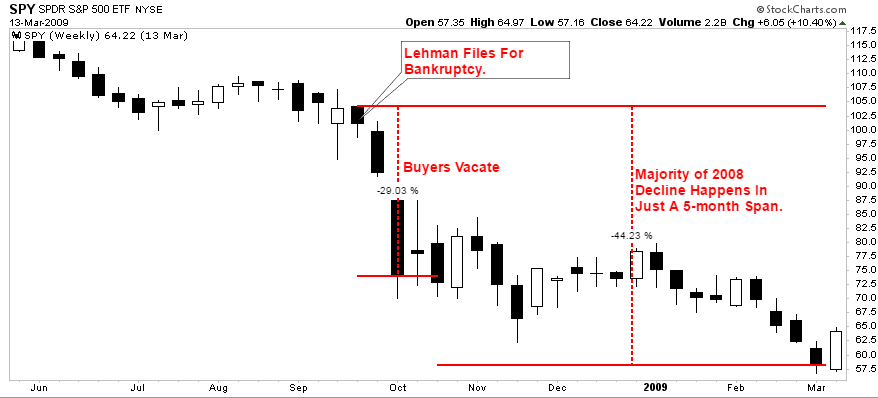

Don’t believe me? It happened in 2008 as the “Lehman Moment” left investors helpless watching the crash.

Over a 3-week span, investors lost 29% of their capital and 44% over the entire 3-month period. This is what happens during a margin liquidation event. It is fast, furious and without remorse.

Currently, with complacency and optimism near record levels, no one sees a severe market retracement as a possibility. But maybe that should be warning enough.

Where the majority of mainstream punditry gets it wrong, in my opinion, is they keep saying we “can’t have another ‘great financial crisis’ again” because things are different.

That’s true.

NO market “mean reverting” event has EVER been based on the same issues that caused the previous event.

The next event won’t be the same as any past event either.

Only the outcomes remain the same.

The “perfect storm” is coming.