"We jumped the gun": Morgan Stanley reverts back to call for December Fed rate cut

by Mike Zaccardi

It seems like ages ago when the SPDR® Gold Shares (NYSE:GLD), the gold ETF was the biggest in the world by market cap. The time was 2011—the global economy was still in the process of emerging from the Great Financial Crisis. We were facing a new but familiar foe—sovereign debt risk and credit downgrades. Recall S&P downgraded the credit rating of the US in August 2011—the S&P 500’s summer decline accelerated into early October that year.

Leading up to that rather severe correction, worse among small caps and emerging market stocks, gold was outperforming just about everything else. GLD was +30% for the year during much of 2011’s Q3. You must also be mindful of the shiny metal’s performance in the ten years leading up to the August 2011 peak. It had gone basically straight up aside from a 30% drawdown during 2008 when it was sold off with everything else.

Gold could do no wrong. Retail advisors were hearing from clients left and right about owning gold as a “long-term hedge” (famous last words, usually). Meanwhile, celebs were on CNBC featured, proclaiming that gold was a good asset because it was ‘safe’. 2010-2011 was really the epitome of a market top. Easy to claim in hindsight, admittedly.

The ensuing several years would be painful for newly-minted gold investors. Painful not only on an absolute basis, with the price of gold falling from $1,920 to $1,040, but also on a relative basis as October 2011 through early 2020 was a remarkable run for US stocks. Few investors point out that the S&P 500 nearly fell below 1,000 in the fall of 2011—three years after the more notorious October 2008.

So, here we are in 2020. Central banks have expanded their balance sheets (shout out to the US Fed’s $7 trillion asset-size), the US dollar is little changed in recent years, and deflation risks appear greater than inflation risks for now. Is gold gearing up for a move higher? It's not exactly clear cut despite what some will tell you...

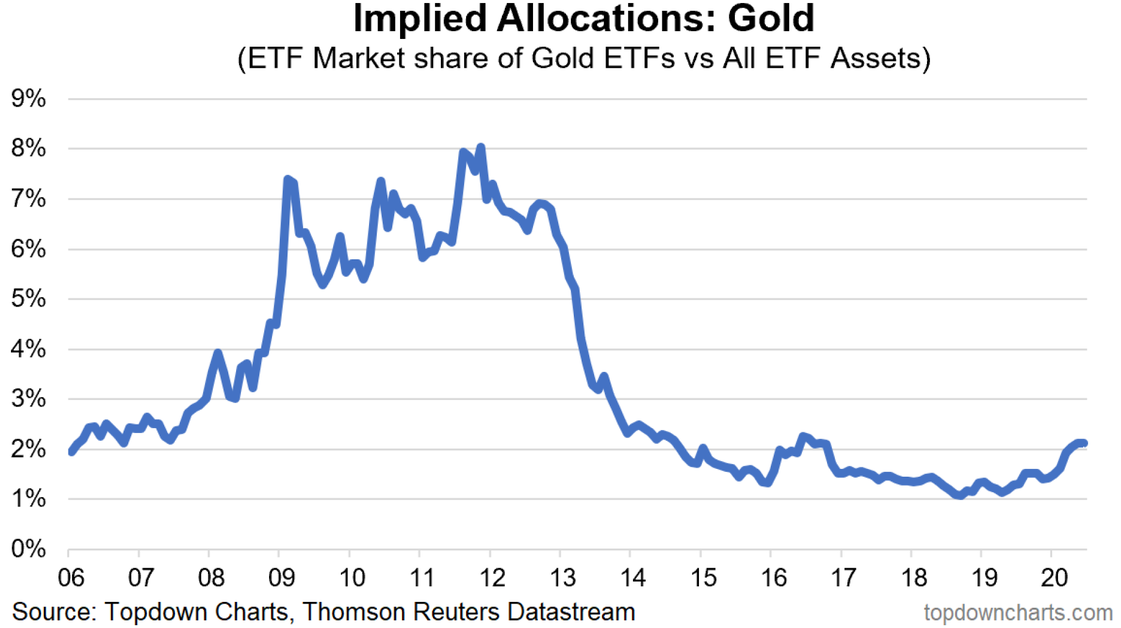

What’s interesting about today’s gold market is that ETF market share of gold is still near its lows despite spot gold climbing from $1,170 to nearly $1,800 in less than two years.

This edition of the Topdown Charts ‘Chart of the Week’ shows that gold ETFs peaked near 8% of total ETF market cap in Q3 2011. The chart bottomed near 1% during 2018 & 2019, and have just recently inched above the 2% level. So, allocations to ETFs that track physical gold are still quite low (compared to the actual gold price, which is at its best level since 2012).

We all know the play here—(GLD), the SPDR Gold Shares ETF. GLD follows the spot price of gold, less expenses and liabilities, using gold bars held in London vaults (sounds like it could be part of a cool finance/heist movie).

The ETF has existed since 2004, well before many Robinhood investors have been alive, and has a 0.40% expense ratio. Together with other gold-tracking ETFs, there are $90 billion in total assets, near the peak from 2011. Bear in mind equity ETFs have surged since 2011, so that’s why the market cap relative to total ETF market cap is nowhere near the highs.

Turning to the macro environment, deflation was mentioned earlier. 10-year real yields may be breaking down right now while gold is shooting for a technical breakout. A similar situation took place in the early 2000s—and the rest is history as spot gold surged from $250 in 2001. When gold gets going, it can move fast. As such, investor flows into gold have been increasing on this confluence of bullish indicators.

While flows to gold are strong, implied allocations are still light relative to history. This tell us that there may be more to this move yet to come. And there is another way to play the gold market as we described in this week’s S&P 500 Weekly ChartStorm (with gold mining stocks potentially needing to play a bit of catch up).

Here’s the point – Spot gold is near 8-year highs while investor allocations are well below the peak from the early 2010s. Fund flows suggest significant money is pouring into the gold ETFs—the story may be just beginning.