There are really four key scenarios that can occur in this Sundays (Monday morning for us Aussie’s) French election and they could really shape the performance of markets like EUR/USD (and EUR crosses), France 40 cash and more indirect markets such as the ASX 200, FTSE 100 cash and gold.

Firstly, it’s important to understand that the first round vote could actually be key in the whole election process and while everyone is fixated on the second round on 7 May, there are permutations of the first round vote that could cause extreme moves in markets this Monday. Here is a very simplistic view of how EUR/USD could react depending on the outcome. One can extrapolate these moves into other financial markets.

Recall, the way French elections system works is the public vote and the two candidates with the most votes go through to the second round. Nice and simple, unlike the U.S. Electoral college system.

Expected times

Keep in mind the polls close on Monday at 04:00 aest (Sunday 20:00 local time), with the first exit polls released shortly after, there is a blackout of exit polls until the final polling station closes. IG will be offering Sunday markets for clients (Sunday markets close at 07:40 aest), so traders can still react to the numbers coming out.

By 06:00 aest (22:00 local time), just in time for the FX open, preliminary results will released and the projections for which two candidates could be headed for the second round run-off will start being issued. If we use 2012 as a guide, 80% of the vote was known by around 07:00 AEST, so the period between 06:00 aest and 07:00 aest could be very volatile indeed, obviously depending on the results coming out.

Popular traded futures markets (S&P 500, U.S. crude, gold, Nikkei) open at 08:00 aest, and IG will also start offering the ASX 200 (Australia 200) and other European indices such as CAC, DAX and FTSE at this time. By 08:30 aest (00:30 local time) we should have a complete picture of the votes.

Implied volatility

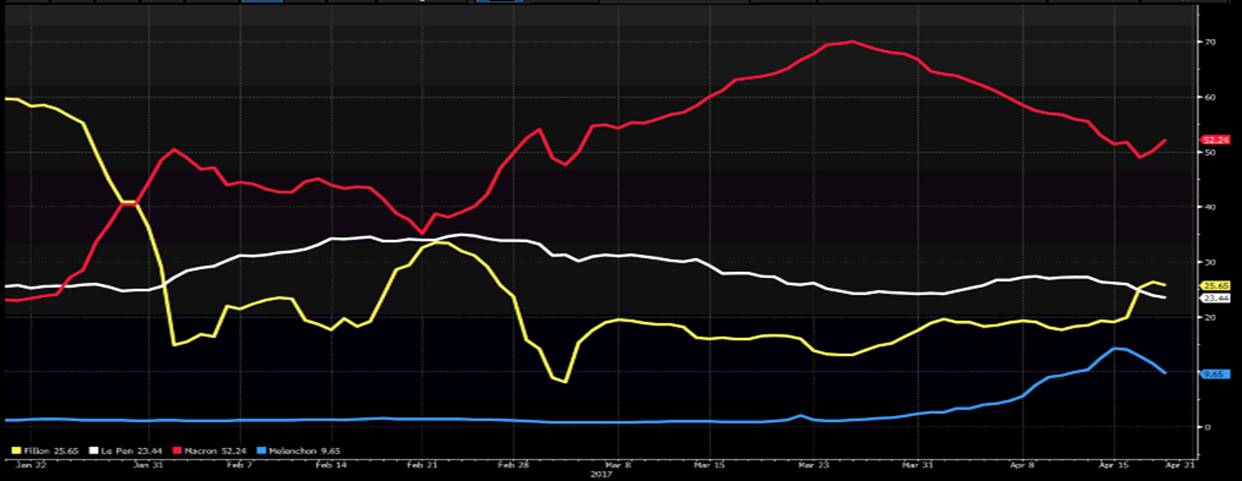

If we look at the EUR/USD $1.0700 (at-the-money) ‘straddle’ expiring on Monday we can see this costs around 180 pips in premium. The bottom line here is that the market is expecting a move of 180 points (in either direction) in EUR/USD from current levels of $1.0700. This is where traders can buy or sell volatility structures depending on their view of Monday’s outcome.

Recent polling

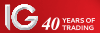

Using the elections in 2007 or 2012 as a guide polling was fairly accurate, which of course is something we can’t say about UK and U.S. elections/referendums. Still, it remains somewhat of a lottery which two candidates garner the most votes given there is a mere five point spread between the leading four candidates. Here is the average of recent polls for voting intensions in the first round, but who goes through will be what drives markets.

Emmanuel Macron – 23.8% (independent, centrist, ex-banker, is the establishment choice)

Marine Le Pen – 22.8% (far right, has fascist views, importantly is anti- Europe, anti-immigration)

Francois Fillon – 19.3% (centre candidate – was the huge favourite, but has had a number of issue including using tax payer funds to pay his wife a salary greater than what Donald Trump gets paid)

Jean-Luc Melenchon – 18.8% (far left – likes idea of wealth re-distribution, wants to renegotiate EU-terms, but is not interested in leaving the EMU)

As we can see from the below chart, the bookies have Emmanuel Macron as firm favourite with a 52% probability of winning the presidency on 7 May. Fillon and Le Pen are a close second. That seems logical if we see Macron and Le Pen go through the first round as the various polls have consistently put Macron as having a 30-35 percentage point lead in any head-to-head battle.

(Betting probability of who wins the actual presidency on 7 May – this will obviousy be detemrined by Mondays first round vote)

The playbook

The best-case scenario on Monday

The markets preferred scenario would clearly be a head-to-head battle between Emmanuel Macron and Francois Fillon. This would cause a wave of EUR hedging activity to be unwound and we could be seeing EUR/USD headed into and even above the March highs and onto $1.1000. There would even be scope for the November highs of $1.1100 to come into play, but it seems a stretch to think we will see a move here in just one day.

The likely scenario

Judging by recent polls on who the public want to vote for in the first round, it seems most likely that we will see Emmanuel Macron and Marine Le Pen go through to the second round. The reaction seems unclear given this is the outcome most had speculated on for weeks, but it seems unlikely EUR/USD will break the $1.0500 to $1.0850 range on this outcome. I would however favour EUR appreciation here and a relief rally in the CAC 40 cash, given the polls have consistently shown an easy win for Macron in this battle.

The worst-case scenario

Undoubtedly the worst-cast is an outcome involving Marine Le Pen and Jean-Luc Melenchon in the final round. This is the doomsday scenario, where both anti-globalisation candidates, one on the extreme left of politics goes up against the candidate from the extreme right. Clearly the prospect of Le Pen becoming president increases in this scenario and uncertainty reigns. EUR/USD likely heads towards and even tests parity in this scenario and the CAC will likely open around 8-10% lower – perhaps even lower.

A Fillon vs Melenchon would also be taken as a negative by markets too.

Le Pen vs Fillon

This scenario would likely play out in a similar manor as ‘the likely scenario’. Polls still suggest Fillon would win this battle, with a recently released poll by BVA giving Fillon a 14 percentage point advantage.

Of course these scenarios and the levels detailed are just rough guides, but it gives a sense of the moves expected on the different outcomes.

Other trades worth watching:

EU volatility / S&P volatility ratio – Traders have been buyers of EU vol, selling US vol. Could this change?

EUR/USD 1M risk reversal - Traders have been buying out of the money put volatility. This is where traders have hedged election exposures

French 10-yr credit default swap (CDS) – No stress here

France / German 2-yr bond spread – Some concern to hold French debt, but spread seems to be holding the 50bp level; When bond markets open I expect EUR/USD to follow this spread closely (algo’s).