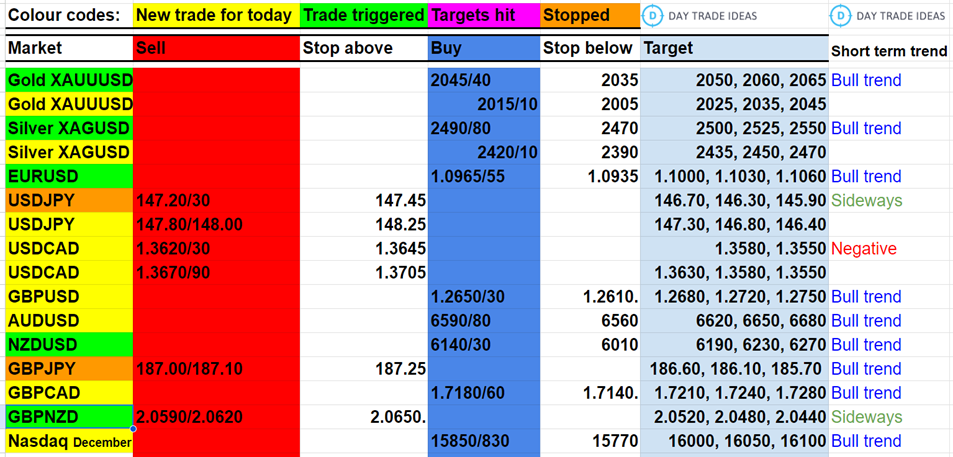

Today’s Trade Ideas

Gold XAU/USD beat 2018 this week for our buy signal to hit the next target of 2029/30 and even reached 2051. The outlook remains positive so on a break above 2053 we are likely to retest the all-time high at 2069/2072. A daily close above here would be the next buy signal.

We dipped to support at 2045/40 yesterday and held above 2035 so bulls appear to remain in control this morning. However a break lower today risks a slide to to support at 2015/10. Longs need stops below 2005.

Silver XAG/USD traded sideways for 6 days and then beat the upper end of the range late on Friday for a buy signal targeting 2465/70, 2480/85, 2500 and my next target of 2520/25 (hit yesterday as predicted). A high for the day exactly at this target but further gains look like towards 2550/60 before the end of the week.

We should have support again at 2490/80 after we saw a low for the day exactly here. Longs need stops below 2470. A break lower risks a slide to a buying opportunity at 2420/10 and longs need stops below 2390.

We also caught a low for the day in EUR/USD but selling USD/JPY was more challenging.

The first sell order at 147.20/30 was stopped (and now we are trading below that level) and then we held 10 pips from 148.00 - you know my outlook for the pair is negative and has been for 2 weeks so I hope somehow you are still holding a short position.

I am sure you remember I have downside targets as far as 146.00 and even 140.00 is not out of the question.

GBP/USD buying opportunity unfortunately missed by 12 pips yesterday but I am sticking with that level today.

AUD/USD should have very strong support at 6590/80 in the short-term bull trend.

NZD/USD made a low for the day exactly at the buying opportunity at 6140/30.

Unfortunately, I made a mess of the GBP/JPY trade and got us in too early the pair has fallen back below the sell level. I am going to leave this and watch.

Treasury yields and Dollar movement

-

Treasury yields fell on Wednesday.

-

The dollar gained, reaching a 3-1/2 month low, with MSCI's global stock index barely rising.

US Equities performance

-

S&P 500 edged lower, Nasdaq dipped, while the Dow rose slightly.

-

Investors awaited a key inflation reading scheduled for early Thursday.

Commerce Department's GDP data

-

U.S. GDP rose at a 5.2% annualized rate in Q3, revised up from 4.9%.

-

Fastest expansion since Q4 2021, indicating an encouraging sign for the economy.

-

GDP report confirmed inflation trending lower, suggesting a potential "Goldilocks scenario."

Mixed messages from Federal Reserve officials

-

Fed officials on Wednesday provided mixed messages on monetary policy.

-

Fed Governor Christopher Waller suggested rate cuts could begin in months if inflation eases.

-

Fed Bank of Atlanta President Raphael Bostic expects U.S. growth to slow, anticipating easing inflation.

-

Richmond Federal Reserve Bank President Thomas Barkin is "skeptical" about inflation easing, considering another rate hike.

Dollar performance

-

Dollar climbed from its lowest level in over three months after four days of losses.

-

Greenback rose against most currencies except the Swiss franc and New Zealand dollar.

-

On track for its biggest monthly decline in a year due to expectations of Fed rate cuts by H1 2024.

US Gross Domestic Product (GDP) data

-

U.S. GDP increased at a 5.2% annualized rate in Q3, faster than the previously reported 4.9%.

-

Dollar extended gains supported by robust economic data.

Financial conditions and rate cut expectations

-

U.S. financial conditions are the loosest since early September, easing 100 basis points in a month.

-

U.S. rates futures markets are pricing in over 100 basis points of rate cuts in 2024, starting in May.

-

Two-year Treasury yield at its lowest since July, down nearly 40 basis points in the week.

Currency movements

-

Dollar Index rose 0.205%, euro down 0.16% to $1.0972.

-

Japanese Yen strengthened 0.15% versus the greenback, Sterling last trading at $1.2696, up 0.02%.

Oil prices

-

Oil prices rose more than $1 on the possibility of OPEC+ extending or deepening supply cuts.

-

Brent crude advanced by $1.42 to settle at $83.10, WTI crude gained $1.45 to settle at $77.86.

Gold prices

-

Spot gold reached a seven-month high of $2,051 an ounce.

-

Gold futures gained 0.28% to $2,045.70 an ounce.

Upcoming events

- Euro zone-wide inflation figure and the Fed's preferred measure of U.S. inflation (PCE) are due out on Thursday.