Last week’s review of the macro market indicators noted that heading into the holiday shortened week the equity markets showed some strength with a strong rebound. Elsewhere looked for Gold (SPDR Gold Shares (NYSE:GLD)) to continue higher while Crude Oil (United States Oil (NYSE:USO)) consolidated with a bias lower. The US Dollar Index (PowerShares DB US Dollar Bullish (NYSE:UUP)) was also consolidating but with a bias higher while US Treasuries (iShares 20+ Year Treasury Bond (NYSE:TLT)) were set to continue higher.

The Shanghai Composite (Deutsche X-trackers Harvest CSI 300 China A-Shares (NYSE:ASHR)) looked to continue its bottoming process and Emerging Markets (iShares MSCI Emerging Markets (NYSE:EEM)) looked to continue higher in consolidation. Volatility (iPath S&P 500 VIX Short-Term Futures Exp 30 Jan 2019 (NYSE:VXX)) had fallen back and looked to remain in the normal zone keeping the bias higher for the equity index ETF’s SPDR S&P 500 (NYSE:SPY), iShares Russell 2000 (NYSE:IWM) and PowerShares QQQ Trust Series 1 (NASDAQ:QQQ). Their charts all agreed with this on the shorter timeframe, and the IWM on the longer timeframe, while the SPY (NYSE:SPY) and QQQ remained in consolidation longer term.

The week played out with Gold pushing higher before retrenching to end the week while Crude Oil continued the move lower. The US Dollar moved higher while Treasuries started higher but then churned at the highs all week. The Shanghai Composite started week moving higher and consolidated while Emerging Markets started the week lower but improved as it went on.

Volatility continued the move to the lower part of the range from April. The Equity Index ETF’s started the week lower but then rose to end it at higher highs, with the SPY less than 1% from its all-time high, the IWM approaching its pre-Brexit high and the SPY and QQQ surpassing it. What does this mean for the coming week? Lets look at some charts.

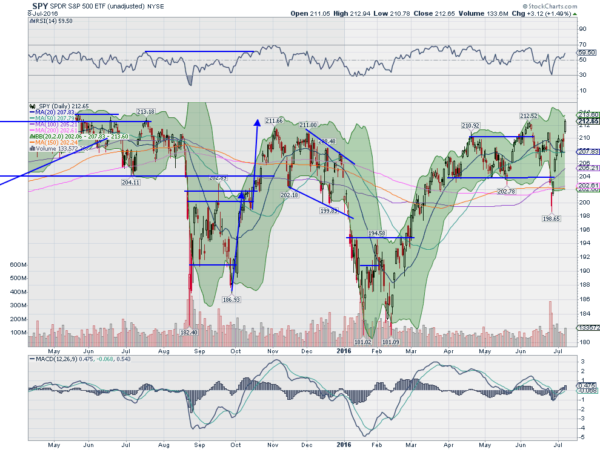

SPY Daily

The SPY started the week pulling back from 210 again. That was short lived though as it found support at the 20 and 50 day SMA’s Wednesday and advanced higher. Thursday saw a Spinning Top, indecision candle take it back near the pre-Brexit high, and the indecision was resolved sharply to the upside Friday. It ended the week up over 1.2% and at the highest close since May 27th, less than 1 point from the all-time high close.

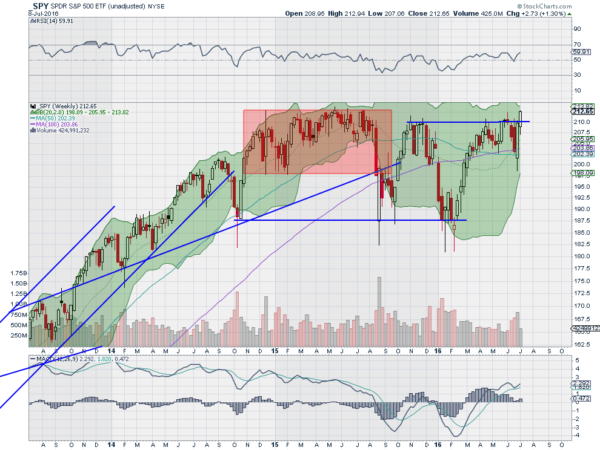

The daily chart shows a third higher high and an RSI that is moving up and back into the bullish zone. The MACD is positive and rising, also supporting the upside. On the weekly chart the candle has pushed through the 210 resistance that has been in place since November. Only the top of the red box is left before new all-time highs. The RSI on this timeframe is again back at the edge of the bullish zone and the MACD avoided a cross down and is rising. These both support follow through higher next week.

There is resistance at 213.50 and then nothing to stop it. Fibonacci projections give stupid high targets, so let’s see if it stick next week first. Support lower stands at 211.5 and 210 followed by 208.50 and 207.60. Continued Upward Price Action.

SPY Weekly

Heading into July Options Expiration week the equity indexes are strong and looking for new highs. Elsewhere look for Gold to continue higher but perhaps see a short term pullback first, similar to the picture for Crude Oil. The US Dollar Index looks to continue higher toward the top of the broad consolidation while US Treasuries are continue higher but with some caution as they are getting extended.

The Shanghai Composite and Emerging Markets both look better to the upside in their consolidation ranges. Volatility looks to remain subdued and possible moving lower keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ. Their charts agree, with the SPY looking for new all-time highs quickly, the IWM chasing and the QQQ looking to break a range by making a new 2016 high. Use this information as you prepare for the coming week and trad’em well.

DISCLAIMER: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.