With Walmart's (NYSE:WMT) scheduled earnings Thursday morning, May 18th, 2023, it is thought that the earnings season unofficially ends with Walmart’s report every quarter probably since as of Friday, May 12th, 2023, 457 companies have reported their Q1 ’23 results.

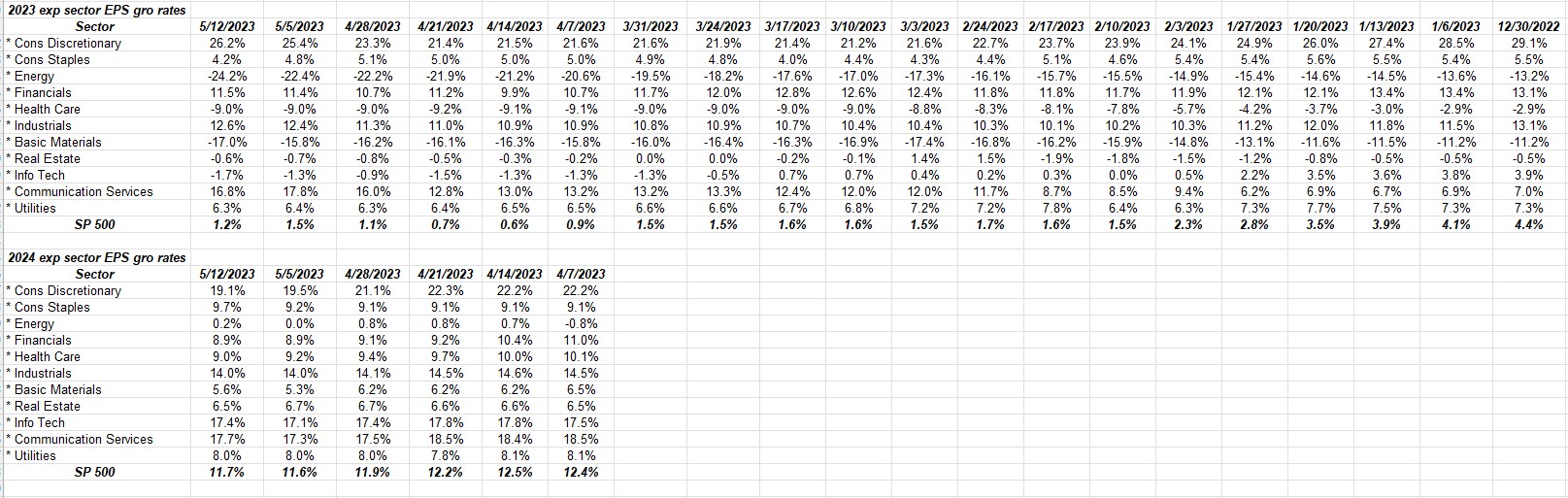

The above table, courtesy of IBES data by Refinitiv, shows full-year 2023 and 2024 expected sector EPS growth rates.

Since the energy and financial sectors lay next to each other in the alphabetical listing of the 11 S&P 500 sectors, readers can get a quick look at the EPS revisions and expected 2023 growth rates for each sector.

Strangely, the financial sector hasn’t seen much degradation of its expected 2023 growth rate of +13%, even with the regional bank issues.

A lot of this is due to the fact that JPMorgan Chase & Co (NYSE:JPM), Bank of America (NYSE:BAC), Wells Fargo (NYSE:WFC), etc. have a much higher “earnings weight” within the financial sector than the regional banks.

It just goes to show you what’s important in the financial news media may not have the same “weight” (no pun intended) as the stock market.

Despite the headlines, negative EPS revisions for the energy sector have been far worse than for the financial sector.

That being said, these are full-year growth expectations, so they are still subject to change after Q2 ’23 earnings.

As measured by the SPDR ETFs, the XLE is down -9.53% YTD, while the XLF is down -6.75% YTD, with the SPY still down 4% y.y, all return data courtesy of Bespoke.

Here are the 4 sectors expecting negative EPS growth for 2023:

- Energy

- Health Care

- Basic Materials

- Technology

The big surprise on that list is health care (in my opinion).

Conclusion

This blog will be paying close attention to the major retailers reporting the next few weeks, and in particular with Walmart (NYSE:WMT), Target (NYSE:TGT), Kroger (NYSE:KR), etc. reporting, what these companies say about grocery and household inflation will be critical (in my opinion). Grocery inflation has remained stubbornly high, and Walmart has not really given investors anything like an “all clear” on grocery prices yet, so what they say on their conference call will be critical this coming Thursday, May 18th, 2023.

With Walmart’s gross margin issue starting with Covid, inflation is a double-edged sword for the retailer.

Grocery retailers like Walmart are found in the consumer staples sector of the S&P 500. Typically the sector doesn’t get a lot of attention since it’s not very volatile, EPS and revenue are typically consistent and stable. and the sector is only 7% of the S&P 500’s market cap.

Walmart’s always interesting because it’s America’s largest private sector employer, and it’s expected to do $632 billion in revenue this year (current estimate consensus), the largest stock when ranked by revenue within the S&P 500. However, Exxon (NYSE:XOM) gets close when crude oil prices are high.

Take all this with healthy skepticism, and none of this is advice. Past performance is no guarantee of future results. While this blog is written weekly, the above data – courtesy of IBES data by Refinitiv – may or may not be updated, and that may not happen in a timely fashion. Capital markets can change quickly – for both the good and the bad – so weigh your risk level towards your emotional reaction to highs and lows.