As 2021 closes, it’s time to consider how sector themes in the markets are likely to perform in 2022.

Years like 2021 saw a solid broad-based performance in many stock market sectors. Relatively simple approaches such as indexing and sector rotation did well. But with macro changes in play and many uncertainties for 2022, we may very well see broad indexes underperforming, while individual sectors dominated by a few stocks really shine.

Dips will continue to be bought unless something significant changes. But let’s not forget that we’re long overdue for a substantial correction. Significant risk catalysts are:

- Fed actions.

- International conflicts (i.e., Russia and China).

- Pandemic developments that are not currently known.

There’s always the risk of the unknown – the literal definition of a “Black Swan” event. We shouldn’t get too complacent, knowing that we may need to get defensive to protect capital suddenly. When it’s time to be defensive, let’s not forget that cash is a position.

Sector Theme Drivers For 2022

Many uncertainties about COVID and the lingering effects on the economy remain. Inflation has roared back to 30-year highs. Strong employment numbers and consumer spending are fuelling significant growth in corporate earnings. We also have a shift in bias at the Fed on interest rates and quantitative easing. These are the “knowns” and are theoretically priced in.

For these reasons and more, we should expect more of a “Stockpicker’s Market” in 2022. Certain sectors will do well and weather corrections better than the broader markets.

Even short-term traders can gain an edge by paying attention to what sectors are strongest. Traders tend to benefit most from playing the strongest stocks in the strongest sectors for bullish trades and choosing the weakest stocks in weaker sectors for bearish trades. That “tailwind” can make a significant difference in results.

Let’s look at some sector themes and individual names to keep an eye on in 2022.

Economic Normalization

A long-anticipated return to a “normal” economy will continue to be a theme. We just don’t know if that will be post-COVID or co-COVID. Or, when. Air travel, theme parks, hotels, cruise lines, etc., have all suffered in the persistent pandemic. What does seem to be changing is the idea of a “new normal,” where virus variants may be with us for years to come. We will adjust socially and economically to that for the foreseeable future. Delta Air Lines (NYSE:DAL), United Airlines (NASDAQ:UAL), Southwest Airlines (NYSE:LUV) and American Airlines (NASDAQ:AAL) are airlines to watch, and the U.S. Global Jets ETF (NYSE:JETS) may be a good way to play a general recovery in this sector.

5G Internet

The much-hyped rollout of 5G network technology had its share of setbacks and technology disappointments. But 2022 should see the 5G deployment start to take off as technical issues are worked out, and the promise of widespread coverage with transformational performance becomes real. In the background supplying the 5G infrastructure are Advanced Micro Devices (NASDAQ:AMD), Qualcomm (NASDAQ:QCOM), Analog Devices (NASDAQ:ADI), Marvell Technology (NASDAQ:MRVL), American Tower (NYSE:AMT), Xilinx (NASDAQ:XLNX) and Keysight Technologies (NYSE:KEYS). Along with infrastructure and testing companies, shares of major carriers AT&T (NYSE:T), T-Mobile (NASDAQ:TMUS) and Verizon (NYSE:VZ) languished for much of the second half of 2021 and looked poised for recovery in the coming year.

Artificial Intelligence

In all its various forms (including autonomous vehicles), AI will remain a developing trend. Big players in the space to watch include Microsoft (NASDAQ:MSFT), Applied Materials (NASDAQ:AMAT), Alphabet (NASDAQ:GOOGL), NVIDIA (NASDAQ:NVDA), Apple (NASDAQ:AAPL) and Qualcomm (NASDAQ:QCOM).

EVs And Autonomous Vehicles

Electric vehicles are nearing an inflection point, where widespread adoption is poised to take off. Technology and cost competitiveness have improved where some EVs will reach price parity with their traditional internal combustion counterparts.

While there are many smaller players in the EV space, automotive stalwarts Ford (NYSE:F), General Motors (NYSE:GM) and Toyota (NYSE:TM) are investing very heavily. Tesla (NASDAQ:TSLA) has been grabbing the headlines, but many others want to stake out their territory in the space, including whole tiers of manufacturers and infrastructure enablers like Workhorse Group (NASDAQ:WKHS), Xpeng (NYSE:XPEV), Nikola (NASDAQ:NKLA) and ChargePoint (NYSE:CHPT).

Materials And Mining

Gold, silver and related miners underperformed for much of 2021 and now look poised for a recovery year as inflation, and monetary concerns grow. GLD (NYSE:GLD), iShares Silver Trust (NYSE:SLV), VanEck Gold Miners ETF (NYSE:GDX), VanEck Junior Gold Miners ETF (NYSE:GDXJ), Global X Silver Miners ETF (NYSE:SIL), ETFMG Prime Junior Silver Miners ETF (NYSE:SILJ) look good as both longer and mid-term plays. Metals and miners may get hit initially with a significant downturn in stocks but could ultimately demonstrate their safe-haven potential.

Specific to the growth in EVs, battery technology, etc., copper, lithium and related basic materials should see stronger demand ahead. FCX looks particularly interesting as a dual play on gold and copper. Global X Lithium & Battery Tech ETF (NYSE:LIT) may be a good ETF play on lithium battery technology.

Semiconductors

The market for chips is primed for exponential growth. EV’s have about ten times the number of specialty semiconductors as conventional vehicles. AI, crypto, 5G, mobile devices, and ubiquitous computing should drive growth in the semiconductor sector for some time to come.

Real Estate

Real estate and homebuilders should continue to do well while employment numbers remain strong and if interest rates don’t rise too quickly. The inventory shortage in most real estate markets will likely persist well into the new year.

Storage REITs like Public Storage (NYSE:PSA), Life Storage Inc (NYSE:LSI) and CubeSmart (NYSE:CUBE) have been big winners in the COVID economy and still have room to run.

SUMMARY

Many sectors still look bullish after gains in 2021. But there are storm clouds on the horizon, and we must not take future performance for granted.

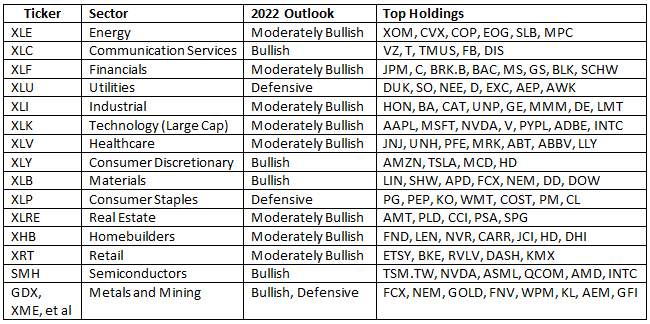

Lastly, one of the simplest ways to assess how sectors are measuring up is to watch the charts for the S&P SPDR series sector ETFs and a few others. Here are some notable ones to watch:

These can give us a good starting place to look for leading stocks in winning sectors as the year unfolds.

Let’s remain vigilant for possible market corrections and may the wind be at our backs!