Communications software and IP transport solutions provider Ribbon Communications (NASDAQ:RBBN) stock surged to multi-year highs in February 2021. The Company is also recovering from the pandemic as both fundamentals and technicals are turning the corner. The back-to-normal acceleration spurred by COVID-19 vaccine rollouts is fertile context.

The Company merged with ECI Telecom in 2019 and the software-as-a-service (SaaS) model is finally hitting its stride in terms of stability, growth, and improved margins. The Company is the second-largest player in the session border controller (SBC) segment of network and cybersecurity. Tailwinds for increased network cybersecurity demands and 5G growth should enable multiple expansion for its shares. Prudent investors seeking a key benefactor in network security and optical packet transport can watch for opportunistic pullbacks in Ribbon shares for exposure.

Q4 2020 Earnings Release

On Feb. 17, 2021, Ribbon released its fiscal four-quarter 2020 earnings report for the quarter ending in December 2020. The Company reported an earnings-per-share (EPS) profit of $0.18, excluding non-recurring items, versus consensus analyst estimates for $0.14, a $0.04 beat. Revenues grew 51.6% year-over-year (YoY) to $244.2 million beating consensus analyst estimates for $243.8 million. The Company ended the year with $136 million in cash. The principle balance of $393 million as of Dec. 31, 2020, with interest on the term loan at 4.4% in Q4. The Company is in the process of refinancing a portion to lower effective interest rate moving forward.

Conference Call Takeaways

Ribbon CEO, Bruce McClelland, said the right things:

“We were very successful in the integration of ECI, repositioning Ribbon to participate in the very large IP Optical systems market. As part of the integration, we streamlined the organization and realigned our portfolio to improve profitability and shift investment to higher growth areas.”

The Company was able to bolster IP Optical revenues by 15% sequentially, which better represents the organic improvement and accretive synergies, rather than misleading YoY growth which didn’t include ECI numbers. The Company was able to secure its first top four cable win MSO Altice and extended the momentum with “new business from five regional telco carriers.”

CEO McClelland noted, “We leveraged Ribbon relationships for customer wins in all but one of the cases.” IP Optical revenues were up 105% sequentially from Q3 2020 and Q4 2020 revenues matched nearly all of ECI sales for 2019. By end of Q4, the Company booked nearly 60% of maintenance renewals for 2021 across 900 customers. This figure rose to 70% by end of January 2021, with many of these renewals being multi-year durations. Direct customer renewal rates for business remains in the upper 90%. The Company has progressed to the final stages of “several important Tier 1 service provider opportunities outside of the U.S.” The continued integration of ECI with Ribbon progressed in Q4 as the Company enabled automated cross selling processes and consolidated sales CRM platforms.

2021 Guidance

The Company guided Q1 2021 non-GAAP EPS of $0.01 to $0.03 matching $0.02 guidance and revenues in the range of $190 million to $200 million versus $197.1 million. The Company raised full-year 2021 non-GAAP EPS of $0.49 to $0.54 compared to $0.46 consensus analyst estimates and full-year 2021 revenues to $925 million to $945 million versus $911 million estimates. Much of the growth was from the merger with ECI Telecom, which closed in March 2020, rather than organic growth. However, the integration to bolster synergies and cost efficiencies appears to be executing well.

The Company established two business segments composed of the Cloud and Edge business composed of legacy Ribbon products and the fast growing IP Optical networks which include ECI products. Amkor (NASDAQ:AMKR) continues to see work-at-home trends continue for years which underscore the need for “great broadband networks”. CEO McClelland summed up a major tailwind:

“The sentiment towards Chinese equipment provides has turned very negative, ensuring significant market share shifts in Europe and multiple Asia-Pacific regions. And we believe the ability of focused, specialized providers such as Ribbon is a competitive advantage against larger competitors attempt to compete across a broad range of technologies.”

RBBN Opportunistic Pullback Levels

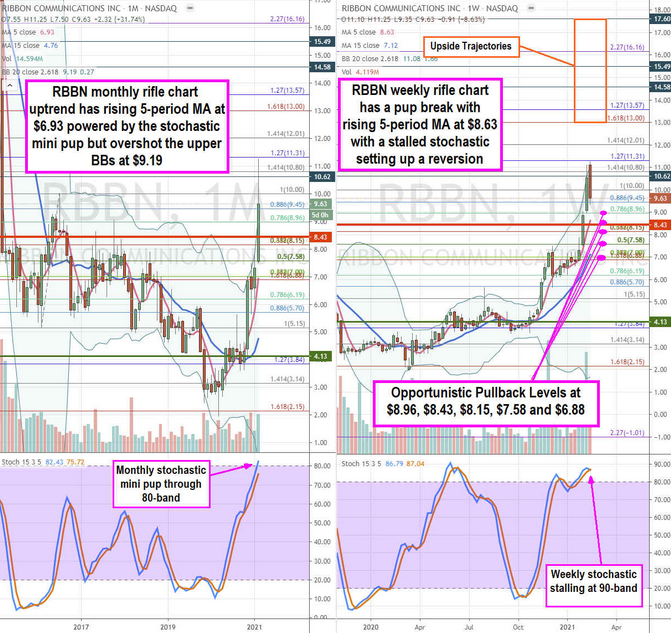

Using the rifle charts on the monthly and weekly time frames provides a full view of the price action playing field for RBBN stock. The monthly rifle chart broke out to peak at the $11.31 Fibonacci (fib) level as the monthly 5-period moving average (MA) tries to catch up at $6.93.

The weekly rifle chart formed a pup breakout with rising 5-period MA at $8.63 as the reversion off the top stalls out the weekly stochastic at the 90-band. The weekly upper BBs sit at $11.08. Since the stock fell back under the weekly upper BBs, gravity takes over as a deeper reversion back towards the weekly 5-period MA and potential weekly 15-period MA can form.

The daily market structure low (MSL) buy triggered above $4.13, but also formed a market structure high (MSH) sell trigger under $8.23. Prudent investors can watch for opportunistic pullback levels at the $8.96 fib, $8.43 fib, $8.15 fib, $7.58 fib, and the $6.88 monthly 5-period MA/fib. The upside trajectories range from the $13.00 fib up to the $17.60 level.