We like to think of ourselves as optimists at MetalMiner.

If given the option, we prefer the glass half full than the glass half empty, so an article in the London Telegraph and many other newspapers this week reporting RBS Bank’s (L:RBS) latest client note makes depressing reading, but unfortunately worthy of discussion.

The note advises clients to “Sell everything except high-quality bonds. This is about return of capital, not return on capital. In a crowded hall, exit doors are small,” RBS has advised clients to brace for a “cataclysmic year” and a global deflationary crisis, warning that major stock markets could fall by a fifth and oil may plummet to $16 a barrel.

It All Must Go!

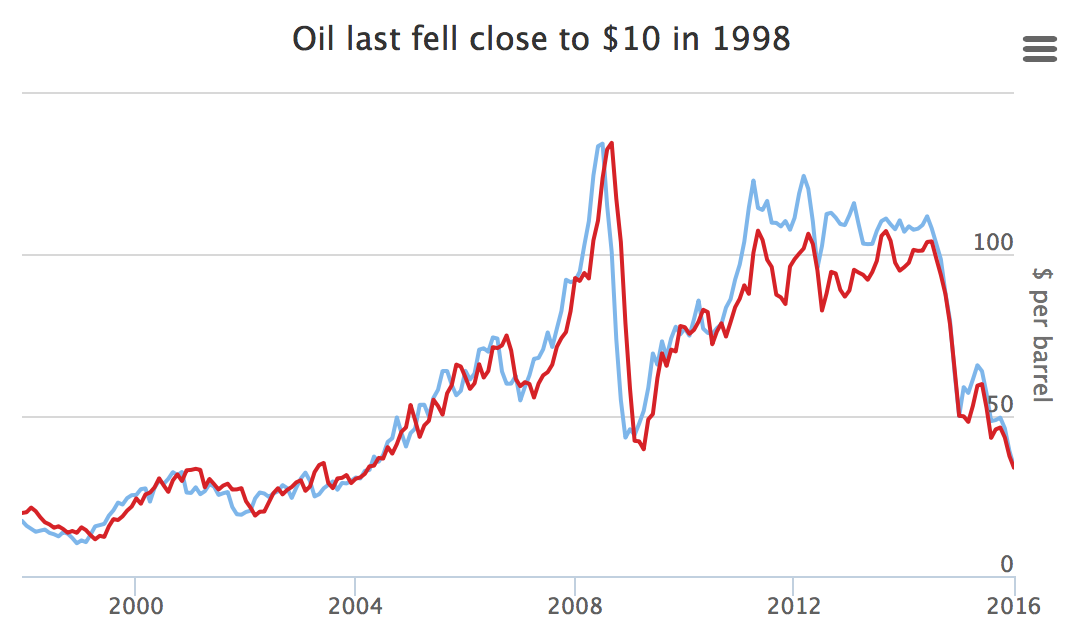

Nor is RBS playing a new tune, since November they have been warning the oil price and stock markets are headed lower, sure enough the oil price has continued to fall, dropping to a 12-year low of $30.41 for Brent and $30.43 for West Texas Intermediate this week.

Source: Telegraph Newspaper

The markets are clearly spooked and by a number of factors. China’s stock market is being kept alive only on the oxygen of government support via state enterprises buying shares. Oil consumption has stalled due to slow growth and warm weather, and oil supply continues to grow as Iran gears up to enter the market.

This year, the biggest factor seems to be the fear of a devaluation of the Chinese yuan, a move Beijing is seeking to reassure the markets is not on the cards. But, guess what? no one believes them.

Fears over China, therefore, are multiplying and RBS says “China has set off a major correction and it is going to snowball. Equities and credit have become very dangerous, “and the bank’s Andrew Roberts, research chief for European economics and rates, expects Wall Street and European stocks to fall by 10% to 20% this year. Larry Summers, the former US Treasury Secretary, in more measured terms, agrees saying it would be a mistake to dismiss the current financial squall as froth.

What’s This Mean for Metals?

Metals prices have taken their cue from energy and been weak since the start of the month, but if RBS is right, they could see support in the months ahead. Prices have, in part, been weak due to a stronger dollar but RBS suggests the Federal Reserve won’t raise rates again at the March meeting and by the summer may be looking at a rate reduction. Either way, if rates don’t rise as the market had been expecting, and had priced into the dollar, we could see dollar weakness in 2016 removing one of the factors depressing metal prices.

It’s true, global growth is muted, global trade is down and loans are contracting, all in an environment of record debt — not a great backdrop for companies to invest and create growth. Yet, there are some bright spots, growth in Europe is looking more positive as austerity has largely come to an end, money supply in Germany is up 10% and growth in the US has remained solid if unspectacular.

What to Do?

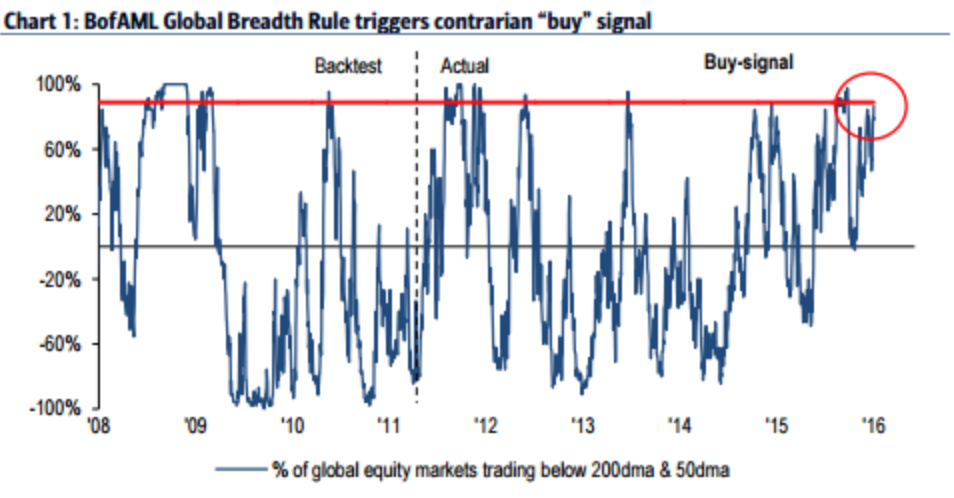

Would you follow RBS’ advice if you were their client? Would you get out of everything? Bank of America (N:BAC) runs a Bull & Bear Index that tracks global equity prices and is supposed to give warning of contrarian buy signals — we have all heard of the saying ‘the night it is darkest just before the dawn” well BOA’s index is supposed to peak over the horizon and see if dawn is approaching.

Source: Bank of America.

As you can see. 88% of global indexes are now trading below their 200-day and 50-day moving averages. The index is therefore at an ultra-negative level of 1.3 but BOA is not suggesting we take our cue and rush out to buy shares. Even though the index has a good track record, the bank says we need certain “catalysts” to be in place, not least a stabilization of the Chinese yuan and oil prices, better Purchasing Managers Index data and a halt to the rising dollar before they would say, with any confidence, RBS has got it wrong and the BOA index has it right.

As so often before, then, it is down to China. We watch and wait, and hope events unfold more positively in the weeks and months ahead than they have started to so far this year.