- Concerns of additional sanctions dent market sentiment

- Oil prices rally

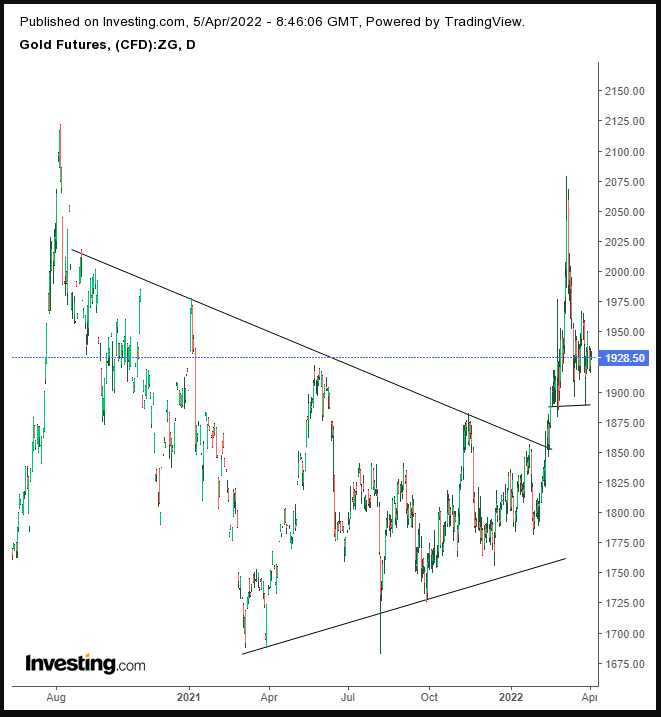

- Gold slips

- The US Federal Reserve publishes the minutes of its last meeting on Wednesday.

- On Wednesday, Canada reports its Ivey PMI.

- Philadelphia Fed President Patrick Harker is due to speak on Wednesday.

- The STOXX 600 was little changed

- Futures on the S&P 500 were little changed

- Futures on the NASDAQ 100 were little changed

- Futures on the Dow Jones Industrial Average were little changed

- The MSCI Asia Pacific Index rose 0.2%

- The MSCI Emerging Markets Index rose 0.2%

- The Dollar Index fell 0.2%

- The euro was little changed at $1.0973

- The Japanese yen was little changed at 122.69 per dollar

- The offshore yuan fell slightly to 6.3687 per dollar

- The British pound rose 0.1% to $1.3132

- The yield on 10-year Treasuries advanced three basis points to 2.42%

- Germany's 10-year yield rose to 0.55%

- Britain's 10-year yield increased to 1.63%

- WTI crude advanced 1.59% to $104.94 a barrel

- Brent crude rose 1% to $108.77 a barrel

- Spot gold fell 0.2% to $1,928.64 an ounce

Key Events

US futures on the Dow Jones, S&P 500, NASDAQ 100 and Russell 2000 slipped and European stocks wavered in trading ahead of the New York open on Tuesday. The prospect of more severe sanctions being placed on Russia saw Treasuries sell-off and oil prices stiffen, both of which are headwinds for equities.

The US dollar wobbled as investors moved out of Treasuries.

Global Financial Affairs

Equity market selloffs so far this year have been the result of rising global inflation and concerns about interest rate hikes. Rallies in Treasury yields were triggered by market expectations of interest rate hikes, which make bonds more attractive to investors than equities.

The Treasury yield curve, a leading indicator of a recession, inverted. The yield curve inverts when shorter-dated bonds provide a higher yield than longer maturity issues which means investors are not willing to commit to the long term as they believe newer notes will provide higher yields as interest rates rise.

After yesterday's tech rally on Wall Street—which saw the NASDAQ close up 1.9% while the Russell 2000 barely moved higher, ending the day up 0.05%—this morning, futures on the small cap index were outperforming though they've since reversed lower. The tech sector was lifted on Tuesday by the surprising news that Tesla (NASDAQ:TSLA) founder and CEO Elon Musk bought a 9% stake in Twitter (NYSE:TWTR), making him the largest shareholder of the social media platform .

On Tuesday, European stocks listed on the STOXX 600 Index opened higher but slipped into negative territory on concerns of stricter sanctions against the world's second largest oil exporter.

Asian stocks also joined the tech-led rally, though thin trading provided bulls with little resistance, as China and Hong Kong markets were closed for a holiday. Japan's Nikkei 225 and Australia's ASX 200, both rose 0.19%, outperforming the main regional benchmarks.

Treasury yields on the 10-year note rallied, but the focus was on the yield curve which has been inverted for three days straight. At the time of writing, the 2-year yield is 2.4671%, whereas the 10-year yield is just 2.449%. Though some analysts are concerned that a recession could be in the cards, others argue the yield inversion is not as significant this time.

Yields completed a continuation pattern—either a falling flag or pennant—suggesting rates will continue to rise.

The dollar edged lower as Treasury selling increased, ending a three-day rally.

The greenback found resistance at the top of a rectangle, which is more likely to act as a continuation rather than a reversal pattern, following an H&S of the continuation variety, whose neckline continues to endure. The bearish MACD and RSIs increase the chances of another retest of the range's bottom and the H&S neckline.

Gold also slipped.

The yellow metal is maintaining the possibility of an H&S top after a year-and-a-half-long Symmetrical Triangle was the mechanism in which the yellow metal neared its August 2020 record.

Bitcoin has been raging after hitting the neckline of an H&S top. However, bulls have been challenging it with the help of a potential bottom, followed by a pennant. We remain bearish for as long as the neckline holds.

The possibility of further disruptions in oil supplies, if additional sanctions on Russia are put in place, pushed up the price ahead of Wednesday's inventory report.

Technically, bulls and bears have been at a standoff that could be resolved soon. All things being equal, the price is likely to break the upside of a Symmetrical Triangle, bullish within the underlying uptrend.