The U.S. dollar was seen posting gains on Friday as price action remained strong toward the close of the week. The economic data was quiet for the most part. Switzerland's PPI figures released earlier in the day showed a 0.2% increase on the month as expected.

The U.S. import prices fell 0.4% missing estimates of a 0.1% increase instead. Previous month's data was revised higher to 0.9%.

Earlier in the day, China’s GDP report showed that the economy advanced 6.7% matching estimates. Industrial production was however weaker, rising just 6.0% and falling short of the 6.5% forecast.

The economic data for the day includes the U.S. retail sales figures. Economists forecast that headline retail sales increased 0.4% on the month. This marks a slower pace of increased compared to the 0.8% gain seen the month before. Core retail sales are also forecast to rise 0.4%.

New Zealand will be releasing its quarterly CPI later tonight. Forecasts point to a 0.5% increase in inflation during the second quarter.

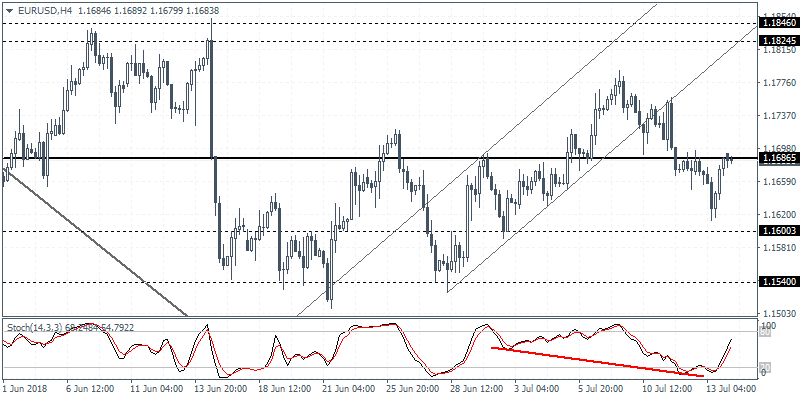

EUR/USD intra-day analysis

EUR/USD (1.1683): The EUR/USD was seen falling to a fresh 10-day low on Friday as price action touched 1.1608 on the day. However, the intraday declines recovered as the currency pair managed to close slightly bullish. Price action was seen closing near 1.1695 on Friday's close which marks the previously breached support level. A rebound off this level is required in order to confirm the upside in prices. If the EUR/USD posts a reversal near this price level we expect to see further declines that could send the common currency falling toward 1.1600 region.

USD/JPY intra-day analysis

USD/JPY (112.48): The USD/JPY currency pair rallied to a six month high on Friday before giving up the gains. Price action quickly reversed back to 112.28 level. As long as this minor support holds, the currency pair could be seen consolidating at the currency levels. In the event of a break down below this level, then USD/JPY could extend the losses toward the next lower support at 111.13. However, the major falling trend line is expected to act as dynamic support in the short term.

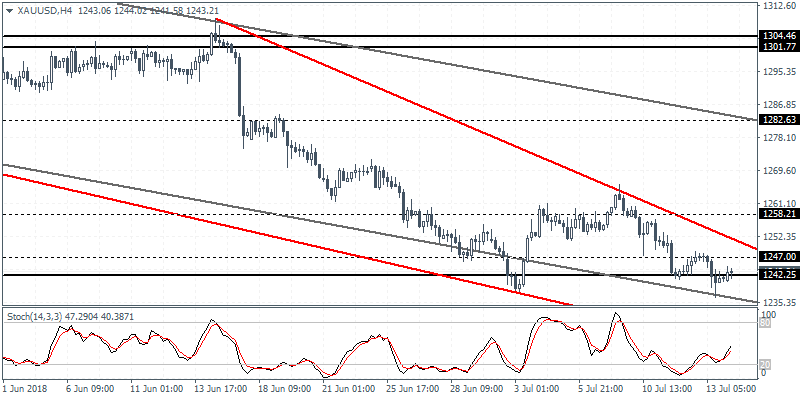

XAU/USD intra-day analysis

XAU/USD (1243.21): Gold prices were seen posting declines on the day as price touched fresh intraday lows of 1240.81. The recovery in the declines saw gold prices trading back near the price level of 1242. A breakout above this level is required to confirm the upside momentum that could be building up. Failure to close above 1247 could however trigger further gains that could push the price of spot gold toward the 1258 handle. To the downside, we expect to see price action consolidating at the current levels.