- An August poll showed that nearly half of millennials surveyed claimed to have sold investments over the past year

- Other age groups largely kept with their portfolio plan

- With a big stock market drop in 2022, it’s likely an ideal time to beef up investment contributions

- Inflation

- Geopolitical turmoil

- Disruptive technologies

- Interest rate hikes

Investing strategy is most important when times get tough. This year’s big stock market decline, the fifth worst on record through this point on the calendar for the S&P 500, might leave you unsure about whether your portfolio is truly right for you. Take heart! You are not alone if you feel a bit of anxiety about your money.

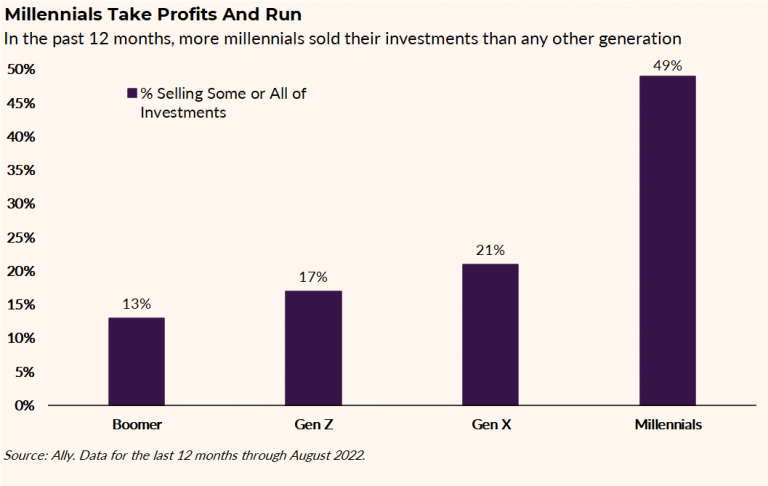

Last month, Ally Financial (NYSE:ALLY) conducted a survey with some surprising results regarding my fellow millennials and what they have been doing with their investments. According to data gathered in August, a whopping 49% of millennials claimed to have sold investments in the preceding year. Compare that to just 21% of Gen X and even lower percentages for the youngsters in Gen Z and seasoned baby boomers.

Survey Says: Millennials Selling Out

Source: Ally Invest

It’s my hope that millennials, the oldest of whom are pushing 40, were selling securities for the right reasons. What might those be? Paying for life events such as buying a first home, covering costly daycare bills, or perhaps helping out aging parents who might not have enough saved.

What would be unfortunate is seeing folks in their 20s and 30s capitulate due to market volatility, recession risks, or just seeing all that red on their investment account landing page. Also, while the pandemic was tough, splurge-spending using cash from selling what were supposed to be long-term investments is not a great strategy to reach financial freedom sooner rather than later.

The key point here is that panicking during a bear market is no way to properly manage your investments. Young investors must recognize that owning stocks for the long haul means accepting inevitable bear markets and high volatility.

As the poetic quip goes, “the tide rises, and the tide falls.” The same goes for the world of investing. There are easy-breezy bull markets and grueling bear markets. Financial writer Morgan Housel often says volatility is like a fee worth paying, not a fine worth avoiding. While it is hard to do in real-time, ignore the volatility and focus on your long-term portfolio plan.

If you’re like me, you as a millennial have potentially decades before you will tap your investments. That means not only must you endure volatility, but you can also embrace it! After all, when bear markets come about, we can buy shares on the cheap. According to Keith Lerner, buying the S&P 500 after a 20% drop from a record high has historically resulted in a solid 29% total holding period return over the ensuing three years. That means we are likely better served buying during 2022 rather than selling.

The Bottom Line

This year tests all investors’ mettle. Steep declines in the stock and bond markets with prolonged volatility make the bull market of late 2020 and 2021 seem like ages ago. Now’s the time to take advantage of attractive valuations even though more pain might take place in the near term. Sticking with a strategy of periodically buying into stocks will prove to be a smart move.

Disclosure: Mike Zaccardi does not own any of the securities mentioned in this article.

***

The current market makes it harder than ever to make the right decisions. Think about the challenges:

To handle them, you need good data, effective tools to sort through the data, and insights into what it all means. You need to take emotion out of investing and focus on the fundamentals.

For that, there’s InvestingPro+, with all the professional data and tools you need to make better investing decisions. Learn More »