- Stocks wavered, then sold off throughout Friday in wake of a sobering speech from Fed chair

- Treasuries largely shrugged off the event, though a rally in the 30-year bond is cause for concern

- Commodities staged a comeback last week, while gasoline futures printed six-month lows

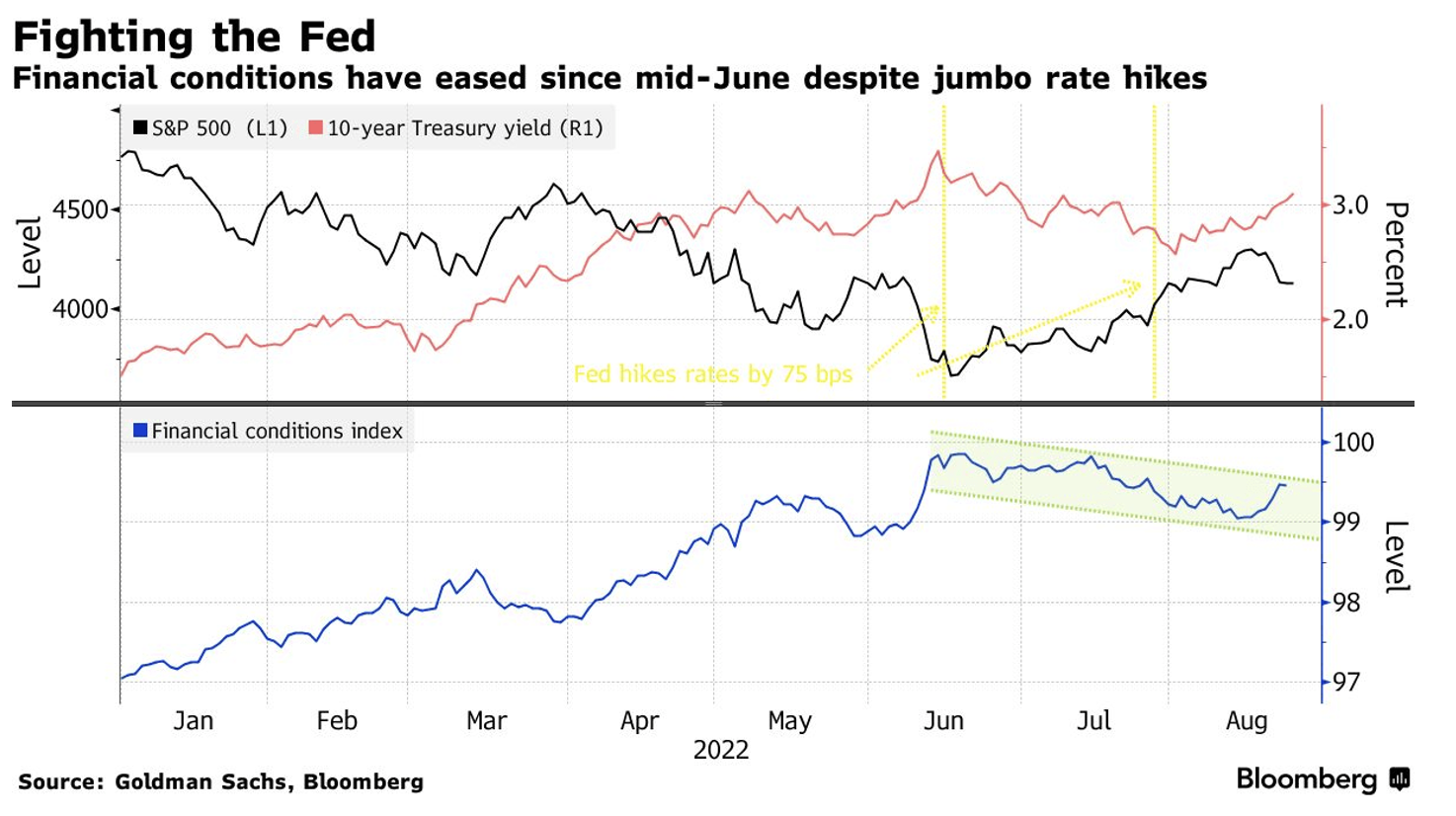

Financial conditions loosened over the summer as the S&P 500 rallied big off its June 16 low. The Fed closely monitors four key indicators of how tight the general economic conditions are. Given the rebound in optimism and hope that the worst of inflation is in the rearview mirror, traders were somewhat sanguine heading into Chair Jerome Powell’s Jackson Hole Economic Symposium speech.

Financial Conditions Eased During Summer, Sparking A Hawkish Message From Powell

Source: Bloomberg

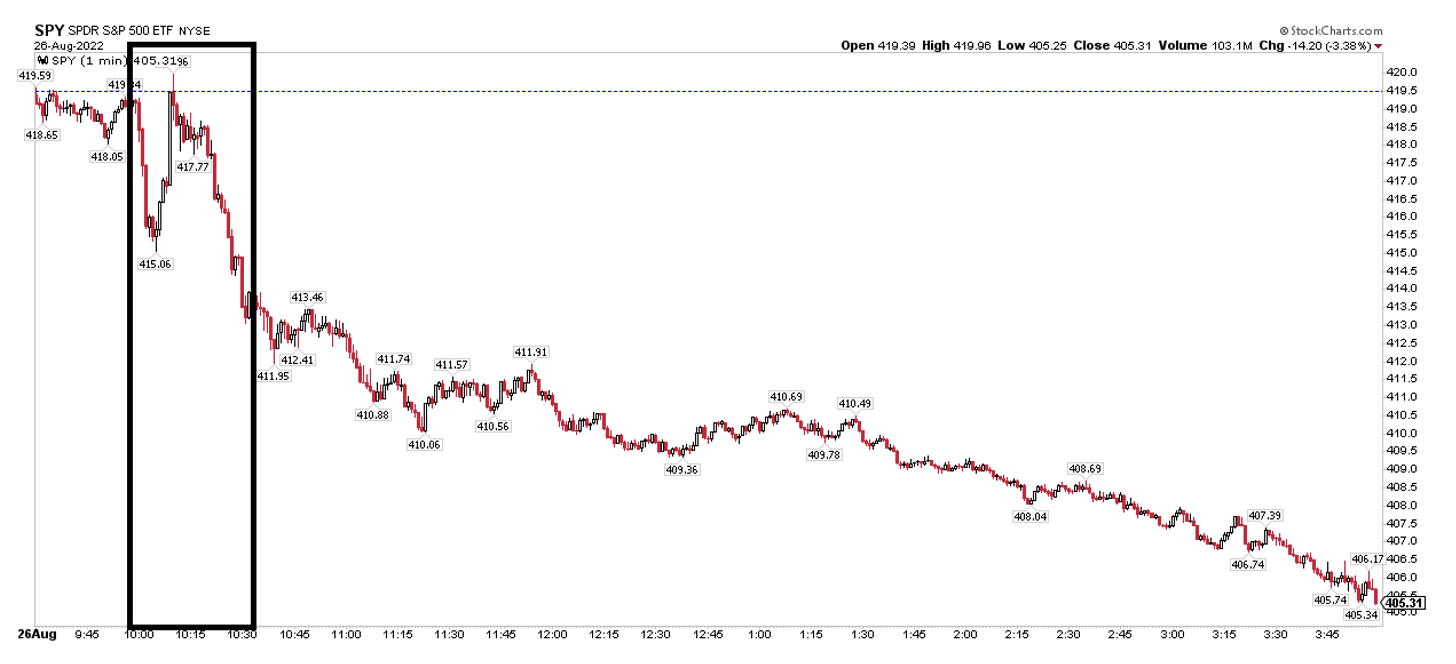

Alas, Powell’s short eight-minute address ultimately sent shockwaves across the equity markets. Interestingly, however, stocks wobbled in the minutes after Powell stepped down from the podium. There was no sudden and dramatic drop in equities. Technicians would describe last Friday’s action as a trend-lower day as ‘the reaction to the reaction’ was ultimately determined.

Stocks Sold Off, Then Rallied Friday Before Bleeding Lower Throughout The Day

Source: Stockcharts.com

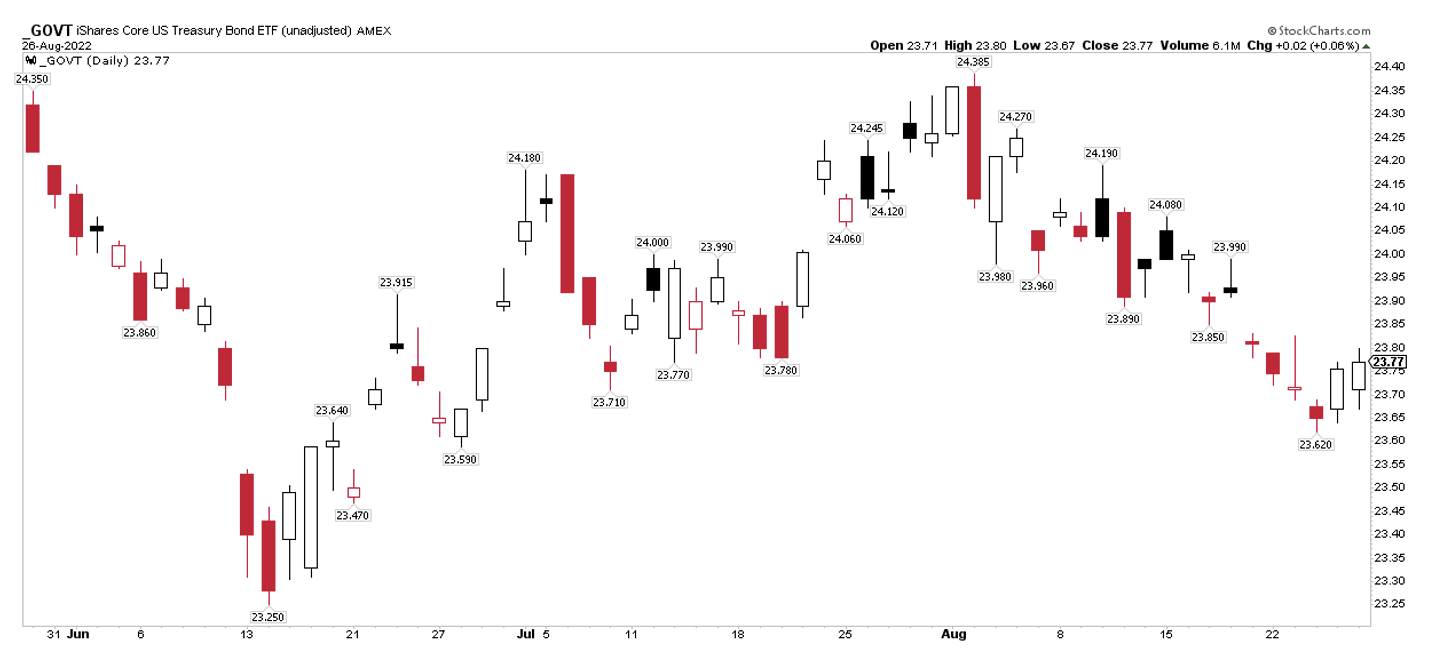

What’s also fascinating about the price-action to cap off last week was that the Treasury market was effectively unchanged, as measured by the iShares U.S. Treasury Bond ETF (NYSE:GOVT). Did the bond market know or understand something the stock market did not? Had it already priced in a hawkish Fed? I found that intermarket dynamic particularly intriguing following the Jackson Hole hoopla. Also of potential concern was the rally in the long bond post-Powell – maybe that’s a sign that the Fed might be on the cusp of overtightening.

Treasuries Flat On Friday, Though 2s-10s Spread Was Volatile And Corporate Credit Fell

Source: Stockcharts.com

Commodities managed to finish slightly higher to end the week, but there wasn’t too much action. Some pundits posit that the recent pullback in equities and selloff in bonds is reminiscent of the kind of market action that was seen during the tumultuous first half of the year. I’m not ready to call the latest behavior a continuation of that trend. I think it’s still quite possible that both stocks and Treasuries notched their cycle lows in mid-June given the intense interest rate volatility spike we saw then. Though equities never did reach a capitulation moment.

Last Week’s ETF Performance Heat Map: Commodities Higher

Source: Finviz

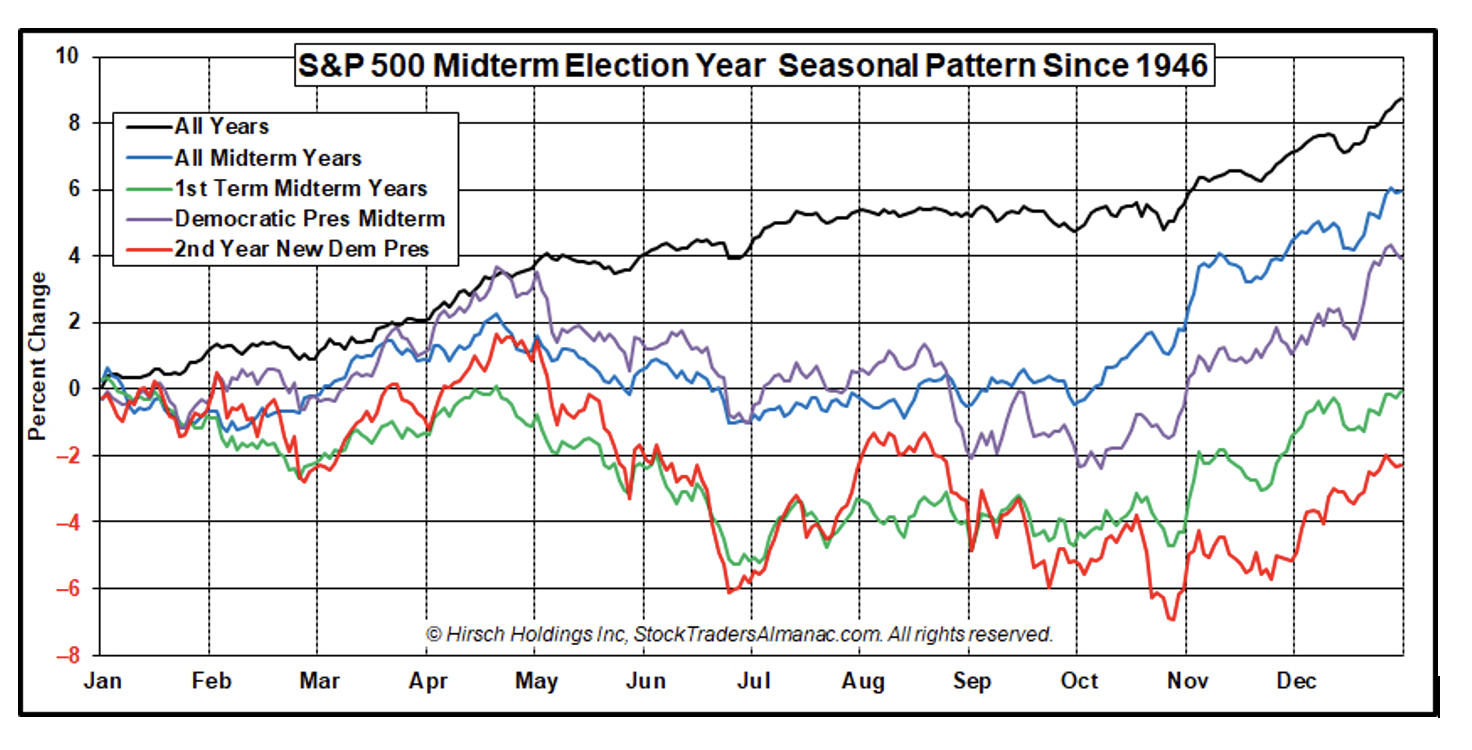

Looking ahead, investors must batten down their hatches as we head into one of the worst seasonal periods: September into October of a mid-term year. President Joe Biden and incumbents in Washington have already unleashed a series of legislative pieces aimed to shore up support ahead of Nov. 8. Is more on the way? Will it help markets? History suggests such efforts usually result in volatility, not rallies until we get to mid-October.

Seasonality Suggests Volatility Ahead

Source: Stock Traders’ Almanac

I’ll end with a piece of good news for American consumers. RBOB gasoline futures will roll from the September contract to October this week. That’s the first month in which the cheaper ‘winter blend’ of fuel trades as the prompt contract. So drivers should continue to see retail pump prices ease – perhaps toward $3.50 – as RBOB printed its lowest price since February to cap off the last full week of August.

Gasoline Futures: Six-Month Lows

Source: TradingView

The Bottom Line

Markets have digested Powell’s to-the-point and ‘painful’ speech. The market now must look ahead to key economic data this week and the September Fed meeting in three weeks. We now embark down a historically volatile road ahead of the all-important mid-term election. Buckle up.

Disclaimer: Mike Zaccardi does not own any positions mentioned in this article.