The Fed and U.S. Treasury have made to decision to back-stop depositors at U.S. banks – a liability that could potentially hit $2 trillion. More interestingly, there must be a considerable amount of counter-party default risk embedded in the banking system because several Too Big To Fail U.S. banks have agreed to commit as much as $30 billion in capital to rescue First Republic Bank (NYSE:FRC), which would next to collapse.

The Swiss National Bank is ponying up $54 billion to prop up Credit Suisse, which is teetering on the brink of collapse. My bet is that $54 billion won’t be enough. The Central Banks have signaled that bank bailout 2.0 is a go. However, the scale of the problem this time, compared to 2008, is multiples larger. Furthermore, the legislation after the great financial crisis that was pimped as preventing another banking crisis served only to make it easier for the banks to hide their indiscretions.

For the record, I pegged Silicon Valley Bank as a short about 18 months ago. How? Because I spend most of my time analyzing public financial filings in the footnotes to those disclosures, where the good stuff is buried.

Aside from what the Fed is doing, the stock market is ignoring several event risks that could potentially trigger a stock market crash. First is the debt ceiling issue. Second is the conflict in Ukraine, which is a de facto war between Russia and the U.S. Third is the U.S. economy, which is in far worse shape than the stock market reflects. And finally, and perhaps foremost, is what could be the start of a series of bank and financial firm blow-ups.

Janet Yellen says the Treasury will run out of cash at the current cash burn rate by September or October. Everyone just assumes that Congress will go through the mating dance required to reach enough support to raise the debt ceiling. But right now, the one-year credit default swap spread is 80 basis points.

This means that the cost to buy insurance against the Government defaulting on its debt payments is close to 1% of the principal amount of the Treasury bond insured. The cost of Treasury default insurance is at its highest level since 2011 when a previous debt ceiling impasse led S&P to downgrade the Government’s debt rating from triple-A to AA+.

Another risk the market is ignoring is the escalation of the de facto war between the U.S. and Russia being fought in Ukraine. The U.S. has rejected Russia and China’s call for peace talks. By all indications, this conflict could take a turn for the worse, the potential of which is not remotely priced into the stock market.

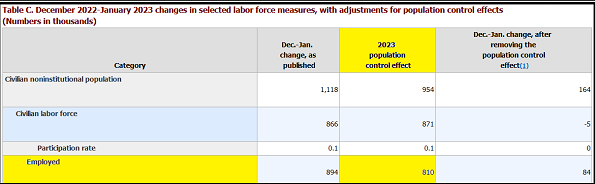

And the economy is in much worse shape than indicated by some of the economic reports – particularly the major reports conjured up by the Government. A prime example is the employment report, which is statistically manipulated to show a much higher rate of employment than reality. For example, the January report purported the economy added 517k jobs, comprised of 894k new jobs less 377k jobs lost. However, 810k jobs were created using a statistical gimmick the BLS refers to as the “population control effect:”

The “population controls” are statistical hocus pocus that uses the latest decennial population survey and adds an estimate of births and deaths and estimates of net international migration. It’s basically a statistical sausage grinder fed with dubious statistical ingredients to produce a highly unreliable statistical estimate of new jobs created.

Per the graphic above, the “population control effect” manufactured 810k new jobs. We already know (as detailed in a prior issue of SSJ) that most of the jobs created since March have been part-time and most of those part-time jobs are people working multiple part-time jobs. I literally cringe when I hear “experts” like Jerome Powell say that the labor market is strong…

Nevertheless, not only is the economy much weaker than is reflected by some economic reports like the employment report, but it is starting to look like the rate of inflation is heating up again, as some of the price measurement metrics are trending higher again and energy prices are starting to rekindle, led by the price of gasoline futures which are up 32% since mid-December. Additionally, Wall Street 2023 corporate earnings estimates have been trending lower and are expected to be cut further in the coming months. While P/E ratios on stocks have fallen over the last year, if earnings head south, P/E ratios will head south, which means stock prices head south.

In another indication of economic stress and soaring costs, General Motors (NYSE:GM) is offering voluntary buyouts to a majority of its 58,000 salaried workers in an effort to cut $2 billion in structural costs over the next two years. It is encouraging as many as possible to take it. I would bet those who don’t will be forced to “retire” at some point in the future. This to me is a “realignment” of costs in response to the expectations of higher manufacturing costs and lower sales volume over the next couple of years.

Finally, the collapse of Silicon Valley Bank (SIVB – $0.00) may be a signal that a financial system melt-down is beginning. But SIVB is not the first indicator. Credit Suisse has been on death watch for several months. FTX blew up and appears to have taken down Silvergate Capital (NYSE:SI) with it.

And now SIVB has been taken into receivership by the FDIC. How does anything go bankrupt? Slowly then suddenly – this shows just how inefficient the NYSE is in terms of discounting risks – largely because of stupid retail money and hedge fund/CTA algo trading programs. It was known by those who bother to take the time to analyze fundamentals that SVB was a ticking time-bomb of asset/liability mismatch – a socially correct way to say that SVB was egregiously mismanaged:

I actually recommended SIVB as a short maybe 18 months ago or so. I made some money on puts, but the stock ran up $750 by early November 2021. The chart above is deceptive because the stock traded down to $35 in the extended hours before the NYSE opened. It was halted in pre-market and never opened. The FDIC took SIVB into receivership Friday morning. The stock is worthless.

Many people were under the impression that SIVB was a conservative commercial/consumer bank. But that’s what happens when you listen to Jim Cramer on CNBC and do not do proper due diligence. A month earlier, Cramer was recommending SIVB, saying it was “still cheap” and has “room to run.”

Earlier in the week SIVB launched a $2.25 billion capital raise via stock, convertible preferred and money from a PE firm (General Atlantic). That deal failed almost as quickly as it was announced. Two days earlier (Wednesday) SIVB told investors in a mid-quarter update that it had $180 billion in liquidity – it turned out to be a fraudulent claim.

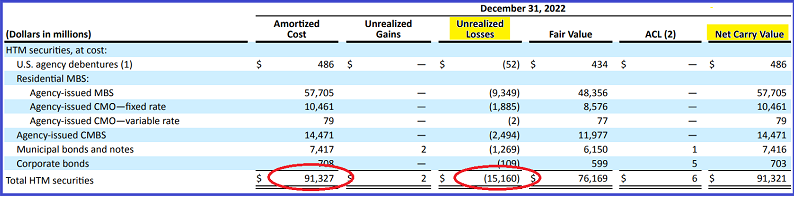

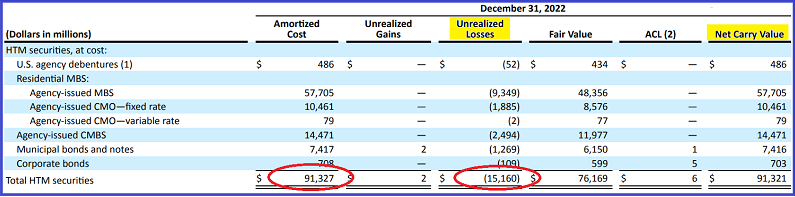

SIVB has $211 billion of assets against $173 billion in deposits $22 billion in other liabilities. $120 billion of the deposits were invested in Treasuries, agency-issued bond trusts (mortgages, collateralized mortgage obligations, commercial mortgage-backed securities, etc). On the surface those look safe. But with the big jump in interest rates, those securities are underwater vs SIVB’s cost. SIVB booked a $1.8 billion loss on part of those holdings when it sold its “available for sale” securities in a desperate attempt to raise cash.

What happened? SVB is a case-study on how not to manage a bank for which the primary source of funding is demand deposits. 54% of SIVB’s assets were in long-maturity, somewhat risky assets:

Because SIVB classified these as “hold-to-maturity” securities, it was not required to run mark-to-market losses through the income statement. It was entitled to show these assets on the balance sheet at their acquisition cost. But in fact, the market value assets at the end of 2022 were worth $15.1 billion less (16.5%) than the stated value. GAAP permits a Company is bury this mark-down in the shareholder equity section of the balance sheet.

Then, SIVB has a $73 billion loan portfolio of questionable credit quality:

This is how the Company describes the assets (from the 10-K footnotes): “We serve a variety of commercial clients in the private equity/venture capital, technology, life science/healthcare, commercial real estate and premium wine sectors. Loans made to private equity/venture capital firm clients typically enable them to fund investments prior to their receipt of funds from capital calls.” The bear market and Fed rate hikes shut off the money flow to PE and VC funds and it shut down the IPO market, which shut off the funding for these loans.

We don’t know the true nature of each individual line item because each separately is not big enough to require details from a regulatory standpoint. But the “investor dependent” and “cash flow dependent” loans are mezzanine securities that are worthless unless the private equity and venture capital funds that used those loans for portfolio companies are able to attract later-round financing for the companies or take them public. This part of the loan portfolio is $17.2 billion, or 23.8% of the total loan portfolio and it might be worth, best case, 10-20 cents on the dollar. I also suspect that the “innovation C&I (commercial & industrial)” loans are likely not worth much. That’s a big capital hole to fill.

SIVB had a book value of $16.2 billion at the end of 2022 per its 10-K. Per the math shown in the 10-K footnote, the investment securities, assuming SVB still had $13 billion in cash (mostly likely not), were down 16.5% – or $17.6 billion, on $107 billion of investment securities. Assume the $17 billion in investor/cash flow-dependent securities plus the “innovation C&I” loans are worth 15 cents (a generous assumption), that’s another $14.4 billion in losses. Among these assets, SVB was sitting on $32 billion in losses. That means SIVB had a real negative book value of $16 billion (minimally) at the end of 2022. It was technically insolvent before 2022 was over.

Earlier in the week, there was a capital call on SVB in the form of depositors who wanted to withdraw their cash from the bank. According to media reports, some venture capital titans advised their portfolio companies to withdraw their money held as deposits from SIVB, which led to $42 billion in withdrawals. This means that some people understood the degree to which SVB was potentially insolvent.

Bank runs are the market’s method of signaling information to the market that has been concealed by accounting gimmicks and unscrupulous management. However, the information was publicly available in the footnotes to the 10-K filed on February 23rd. The CEO, CFO and CMO (chief marketing officer) sold $4.5 million in shares representing a large percent of the stock holdings of each on February 27th. It would be naive to assume they did not know what would unfold. This classic bank run overtly exposed the truth about SIVB’s assets and liquidity.

On Wednesday last week, the CEO of SVB gave a presentation in which he made the claim that the bank had $180 billion in available liquidity. But $180 billion of “available liquidity” should have been ample to cover 100% of the deposits. If the assets were truly liquid, SVB could have sold enough to cover 100% of the deposits, not just the $42 billion in withdrawals during the week. The CEO thus lied about the nature of SVB’s assets. Even if SVB had managed to bamboozle those looking at the $2.25 billion equity raise, it would have not come close to keeping SVB liquid.

SIVB is emblematic of the giant asset bubble in which lending and Wall St institutions used near zero-cost capital to leverage up and take risks beyond the ability to manage while the regulators looked the other way. But in many ways this is a replay of 2008 only, I believe there will be bigger blow-ups coming.

And SIVB is not the first warning flare. Credit Suisse has been under care and maintenance by the Swiss National Bank and the Fed for several months. While SIVB likely won’t initiate contagion with the Too Big To Fail Banks, Credit Suisse will. Furthermore, the FTX blow-up, which has now taken down Silvergate Capital, shows the degree to which the financial system is infested with financial Ponzi schemes.

I believe what is starting to unfold will be 2008 x five unless the Fed and the other big Central Banks print enough money to monetize the fraud in the banking system. But if the Fed takes that kind of action, the dollar will likely collapse. It may take bigger blow-ups for the Fed to act. In which case, I am confident that Blackrock (NYSE:BLK), Citigroup (NYSE:C) and Goldman Sachs (NYSE:GS), among several others, are at risk. It’s also worth looking at some of SVB’s regional peer banks, like Signature (SBNY), PacWest Bancorp (PACW) and First Republic (FRC).