For today, I am reprinting an interview I did for Kitco News with Neils Christensen, written by Neils.

(Kitco News) - The gold market remains in a solid holding pattern as it waits for some direction from the Federal Reserve, and one market strategist is warning potential precious metals investors that they need to be patient as 2024 will be the year of nuanced trading.

In a recent interview with Kitco News, Michele Schneider, Chief Strategist at MarketGauge, said that while she is bullish on gold and silver in the new year, the precious metal market could see some volatility and weakness in the first half of the year.

The comments come as gold remains stuck below resistance at $2,050 an ounce. February gold futures last traded at $2,034.10 an ounce, up 0.43% on the day.

Although the Federal Reserve is expected to cut interest rates this year, Schneider said that the gold market appears to have gotten ahead of itself as it has priced in aggressive easing of five or six rate cuts.

She added that it is more likely that the Federal Reserve will cut rates maybe three times, with the first cut coming in June.

Schneider said the Federal Reserve remains focused on inflation because the threat hasn’t disappeared as economic activity remains reasonably robust, driven by solid consumer demand.

At the same time, consumers have been living beyond their means, spending with credit, which could significantly threaten future growth.

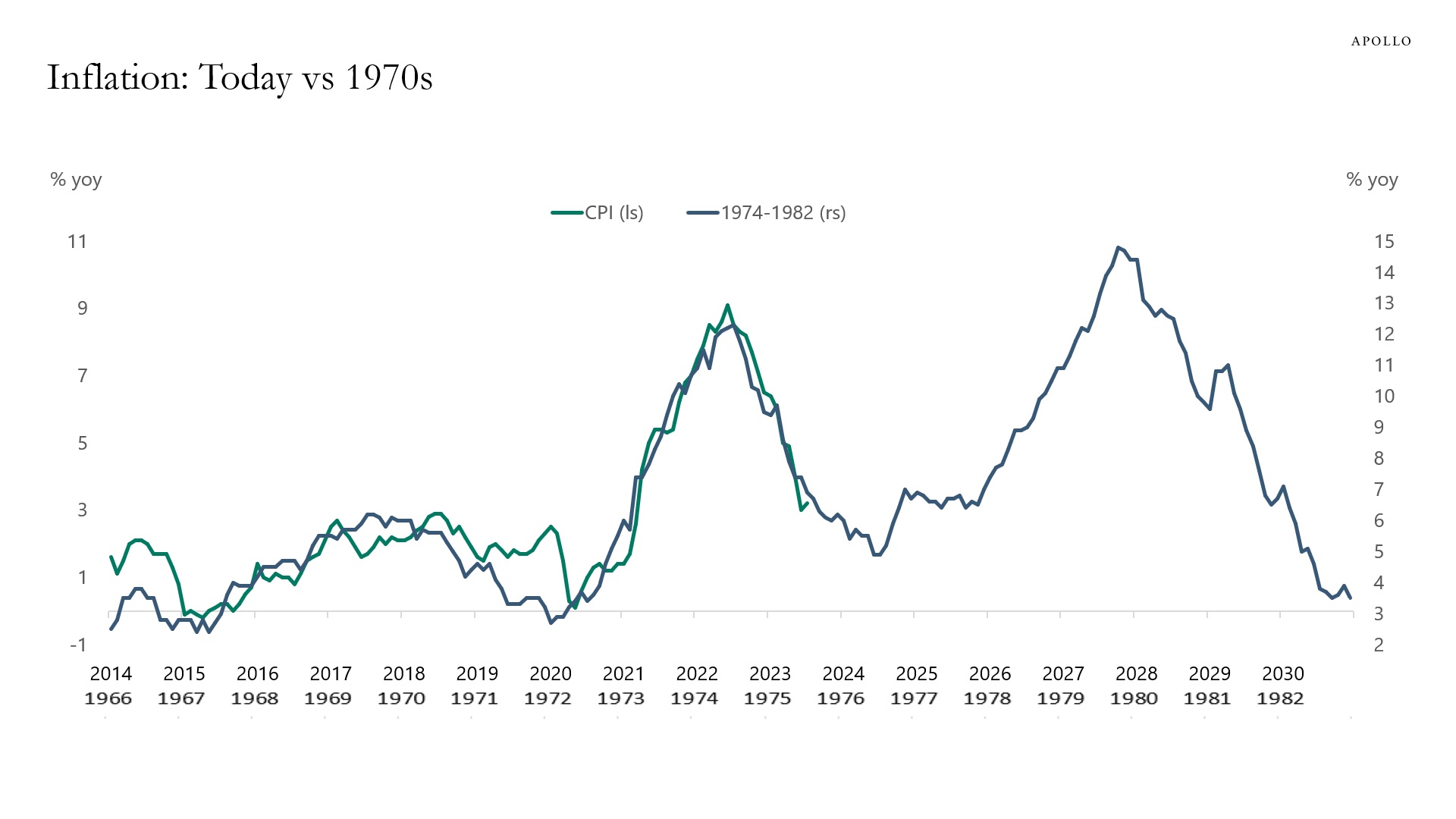

She noted that inflation is currently following the same pattern created in the 1970s. Given the history, she doesn’t expect that the U.S. economy has seen a significant change in inflation pressures.

“Right now, what we are seeing is more of a correction than anything else. I don’t think it is a sea change,” she said. “This is why the Fed has been so two-faced on monetary policy because there are reasons to cut, and there are reasons to remain higher for longer.”

Schneider said that the Federal Reserve is dancing on a pinhead, hoping inflation has truly bottomed and consumers see some normalization in the economy. She added that this uncertainty will weigh on gold.

Looking at the gold market, Schneider said that she could see prices dropping below $2,000 an ounce and testing initial support around $1,980 an ounce, potentially falling back to $1,940 an ounce within the first half of this year.

However, she added that she expects that to be a significant buying opportunity as a weakening economy forces the Federal Reserve to ease interest rates, giving up on the inflation battle.

“I don’t see a massive selloff in gold, but it’s more like a slow deterioration in the price,” she said.

In the second half of the year, as recession fears start to gain momentum, Schneider said that she would expect the Fed not to hesitate in its support for the economy. Although the economy has held up fairly well, Schneider said there are clear indications that employment has peaked.

Looking to the second half of the year and into 2025 and beyond, Schneider said that she expects any selloff now would mark the low point for gold, and she would then expect a long-term uptrend with prices pushing to $2,400 an ounce.

“I can’t say that we are definitely going to see a hard landing, but at the same time, I can’t completely rule out that scenario,” she said. “If conditions to breakdown, I think the Fed would rather err on the side of keeping the economy moving than rising prices, and this is when you want to have that price hedge like gold."

Schneider said the Fed’s worst-case scenario would be stagflation, an environment of higher prices and slower growth.

“Gold is seeing choppy trading because we just don’t know what will happen, so you need to be patient and wait. Generally, I think it’s better to prepare for a hard landing than to assume a soft landing,” she said.

ETF Summary

- S&P 500 (SPY) 480 now the pivotal zone

- Russell 2000 (IWM) 195 pivotal, 190 support to hold

- Dow (DIA) 375 support

- Nasdaq (QQQ) 415 support

- Regional banks (KRE) 50 key to hold

- Semiconductors (SMH) 184 support

- Transportation (IYT) 262 now pivotal

- Biotechnology (IBB) 135 pivotal

- Retail (XRT) Flirting with 70, which has to clear and hold to stay very bullish