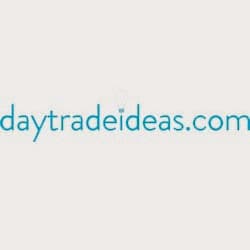

Gold XAU/USD trades mostly sideways for 4 days as we consolidate Wednesday's big rally. Yesterday we moved back up towards the high of the 4-day range. As I have said, eventually the market will probably refocus on lower interest rates and gold will climb again. We hit the 2038/41 target and reached 2046. A break above 2049 beats last week's high and should be a buy signal targeting 2053/55 then 2062/65 and even 2073/76 is possible.

Support at 2020/15. Longs need stops below 2010.

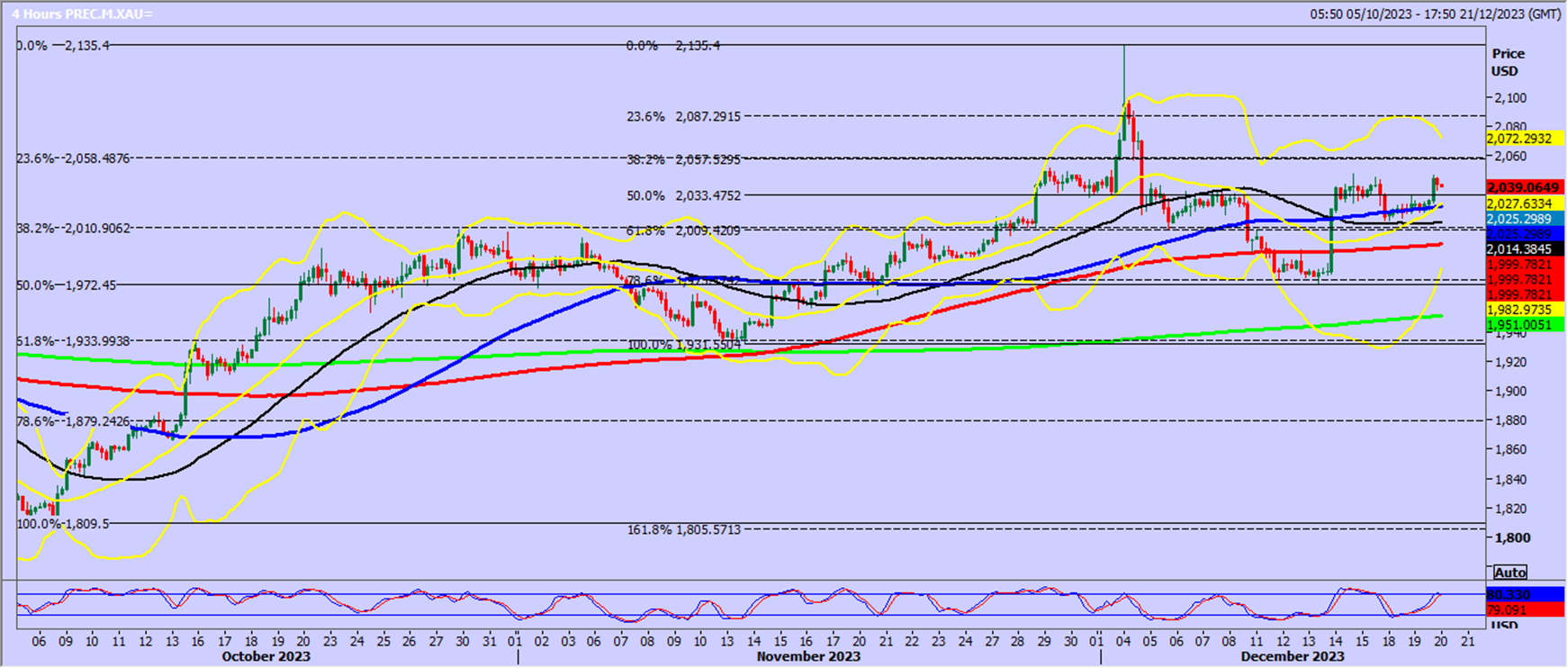

Silver XAG/USD still holding support at 2380/70 and longs need stops below 2350.

Targets: 2420, 2440, 2460.

WTI Crude January futures held 7250/00 on the downside and bounced to the target 7380/7420. A break above 7450 targets 7500/7520, perhaps as far as 7570/90.

Support again at 7250/7200. A break below 7200 retests support at 7080/40 and remember we are in a short-term bear trend so longs are risky on a 3rd test.

A break below 7010 should be a sell signal targeting 6970/50 and 6890/6860.