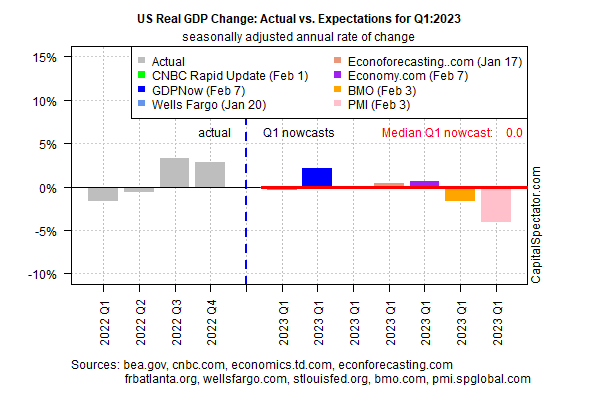

Depending on the source, the preliminary estimates for US economic activity in this year’s first quarter are encouraging, mediocre, or distinctly bearish, based on a set of nowcasts compiled by CapitalSpectator.com. But it’s still early in the quarter and it’s best to look at the numbers with a hefty dose of caution at this point.

The median estimate for Q1 is zero (seasonally adjusted annual rate). That marks a worrisome slowdown from Q4’s solid 2.9% increase, which marked a second quarter of healthy growth.

The nowcasts for Q1 currently reflect a wide array of estimates, which suggests that the current economic climate is unusually challenging for analyzing the macro trend. In this climate, it’s no wonder that key economic indicators are providing sharp contrasts in profiling economic risk.

The main source of optimism at the moment is the labor market. The surprisingly sharp gain in US payrolls in January suggests that the economy will continue to expand at a healthy pace.

Yet a number of business cycle indicators paint a substantially darker profile. The Conference Board’s US Leading Economic Index for December, for instance, continued to flag a recession warning.

Meanwhile, the S&P US Composite PMI, a survey-based GDP proxy, reflects an economic contraction in January. “Business activity in the vast US services economy contracted in January as companies reported a further deterioration in new business inflows,” says Chris Williamson, Chief Business Economist at S&P Global Market Intelligence. “Hiring has almost ground to halt as firms reassess their payroll needs in the light of the weaker demand environment.”

The acute mismatch in indicators and GDP nowcasts suggests developing a high-confidence read on the economy remains unusually difficult. Clarity is coming, for good or ill, in the coming weeks as new numbers are published. But at the moment there’s plenty of room for debate on how 2023 is unfolding.

“Making sense of the US economy after recent shocks requires a degree of humility,” observes the Financial Times. “Whether the landing for the US economy is soft or hard, there will be plenty of turbulence on the way there.”