But before we begin, I want to take this opportunity to remind you that we have reviewed many larger banks in our public articles. But I must warn you: The substance of that analysis is not looking too good for the future of the larger banks in the United States.

Moreover, if you believe that the banking issues have been addressed, I'm sorry to inform you that you likely only saw the tip of the iceberg. We were able to identify the exact reasons in our public article that caused SVB to fail well before anyone even considered these issues. And I can assure you that they have not been resolved. It's now only a matter of time.

If you have been following our work on banks, you would know that we have been discussing the issues to which Moody's (NYSE:MCO) was recently referring for the past 18 months. We also noted that Moody’s, as well as other rating agencies and research departments of investment banks, have mostly ignored several major issues that were revealed by the U.S. banks’ 1H23 results. In our view, each of these issues is a major risk for bank stability, and each of them is worth a separate article. This is the first in this series of articles within which we will discuss consumer lending.

Credit card balances rose by 16% YoY in Q2 and surpassed the $1T mark

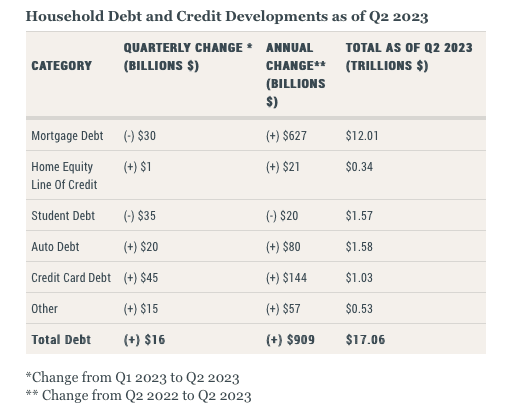

According to the latest household debt report, published by the Federal Reserve Bank of New York, credit card balances in the U.S. rose by 16.2% YoY in 2Q23 and reached $1.03T. Moreover, credit card balances have seen seven quarters of YoY growth. As the table below shows, credit cards saw the largest QoQ increase in absolute terms across all types of retail lending.

NY Fed

Another interesting observation from the NY Fed’s report is that there are 70MM more credit card accounts open now than there were in 2019. Furthermore, about 69% of Americans had a credit card in Q223, up from 65% in December 2019 and 59% in December 2013.

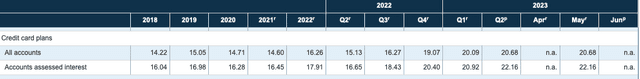

The most important thing here is that such a massive increase in credit card portfolios occurred in a rising rate environment. As the table below shows, according to the Fed, the average rate on credit cards surpassed 22% in May, and it was less than 17% before the pandemic.

The Fed

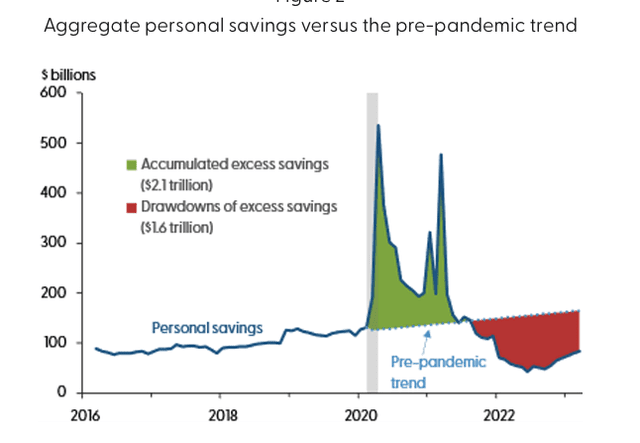

We believe that the pandemic-related savings are fading, but consumers want to continue spending more than they are earning. As a result, we see massive growth rates in credit cards. Here's the chart from the Federal Reserve Bank of San Francisco that confirms our assumption.

San Francisco Fed

Despite significant risks, banks continue to approve those 22%-rate credit cards, as they need to somehow supplement their margins on the back of rising funding costs.

The quality of the unsecured retail lending portfolio is deteriorating

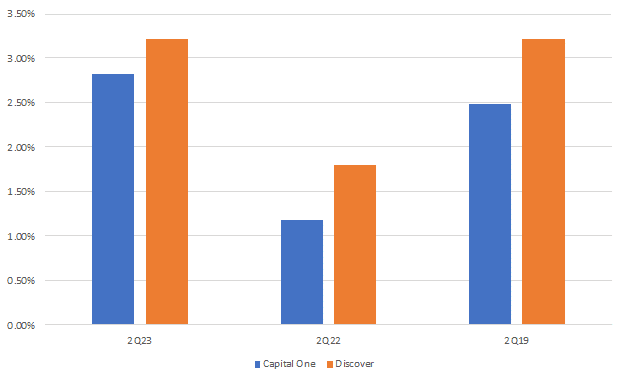

If we look at the latest results of Capital One (NYSE:COF) or Discover Financial Services (NYSE:DFS), we'll see that charge-off ratios and delinquency ratios already are at or even above pre-pandemic levels.

Capital One’s net charge-off rate was 2.82% in 2Q23, up compared to 1.18% in 2Q22 and up from 2.48% in 2Q19. DFS’s net charge-off rate was 3.22% in 2Q23, up from 1.80% in 2Q22 and flat compared to 3.22% in 2Q19.

Net charge-off rates

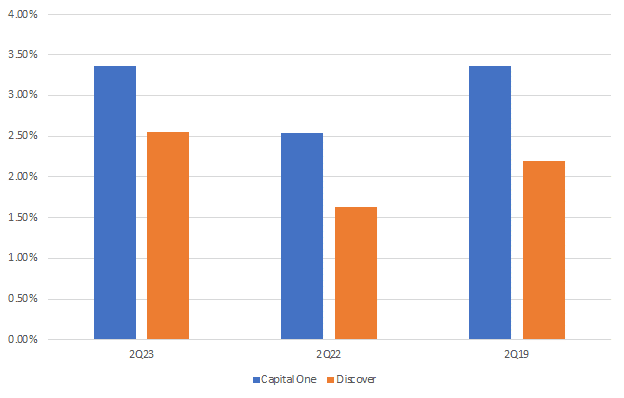

Capital One’s delinquency rate was 3.36% in 2Q23, up from 2.54% in 2Q22 and 3.35% in 2Q19. DFS’s delinquency rate was 2.56% in 2Q23, up from 1.63% in 2Q22, and up from 2.19% in 2Q19.

Delinquency rates (30+ days)

Some experts and analysts say that charge-off rates and delinquency rates are just “normalizing,” as they were low during the pandemic. However, the pre-pandemic operating environment for banks was completely different from what we have now. Rates are higher nowadays, while the labor market is very favorable for consumers. Obviously, even a mild slowdown in the labor market is very likely to have a significant negative impact on charge-offs and delinquency rates for credit cards.

Car loans and a resume of student loan repayments are other issues

We have discussed major issues in the auto lending segment in our previous articles on Ally Financial (NYSE:ALLY) and Capital One. If a major recession comes, there will be not only a larger slump in car prices, particularly in used cars, but also a big increase in unemployment as well.

Another risk, which is being largely ignored now, is that federal student loans will start accruing interest again on Sept. 1, and payments will be due starting in October.

The bottom line

The current rise in consumer lending will likely place greater pressure on the already weak banking system in the coming years. This is just one of the many issues we have identified, upon which very few are currently focusing. We will be following up with additional articles on the other issues.

At the end of the day, we're speaking of protecting your hard-earned money. Therefore, it behooves you to engage in due diligence regarding the banks which currently house your money.

You have a responsibility to yourself and your family to make sure your money resides in only the safest of institutions. And, if you're relying on the FDIC, I suggest you read our prior articles which outline why such reliance will not be as prudent as you may believe in the coming years.

It's time for you to do a deep dive into the banks that house your hard-earned money in order to determine whether your bank is truly solid or not.