For those of you who read our Daily are, by now, learning about the value of our scanning tools, quants, and the Complete Trader.

What we are trying to accomplish is how best to use the product and how to focus on key patterns, especially those in line with megatrends.

For example, on Feb. 21, Classic Short Setup in Tech featured Akamai (NASDAQ:AKAM). At the time, the stock closed at $76.40. The stock fell to a low of $72.14 in 6 trading days.

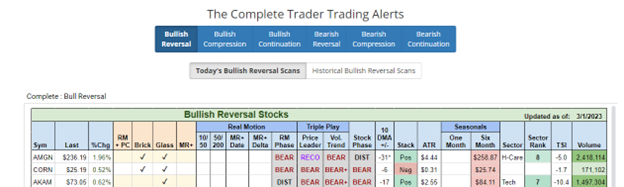

Now, you see it on the Bullish Reversal Scan. However, buying it does not interest us.

The stock is in a major downtrend. So, I would take the information to either take some profit if short or lower the stop to cover to ensure a profit regardless of what happens from here.

What does interest us, though, is the Bullish Reversal in CORN.

Incidentally, Amgen Inc.’s (NASDAQ:AMGN) is a bit more interesting as it also reversed right after it touched down on the 200-week moving average.

But not the focus for now. The Teucrium Corn Fund (NYSE:CORN) is of interest as agricultural commodities have fallen a lot lately.

As far as we can tell, food supply and shortages remain a concern going into the spring and summer growing seasons. The Complete Trader Scan checks off two boxes. Brick and Glass Bottoms.

The Brickwall pattern is a 2-day pattern where the stock puts in a new 60-day low on a wide-range move, reverses, and closes the next day in the upper portion of its trading range.

The price phase is bearish. Momentum, as illustrated by Real Motion, indicates a bearish trend. Although, as you can see from the chart of CORN, it has the potential for a mean reversion. The monthly chart is also interesting.

Note how the price holds the 23-month moving average or the 2-year business cycle-still intact. That is positive. And a good risk point.

Going back to the daily chart, we would want to see the price clear over Tuesday’s high or the reversal day high.

Moreover, watch for a mean reversion on Real Motion. It is a bit of a trip back to the overhead 50 and 200-DMAs-but REMEMBER:

We never know the future, but we can ascertain the past by seeing where to place a good stop loss to control risk.

Last note-the topic of Mar. 1 Daily-Steel Dynamics (NASDAQ:STLD) and comment, “may be on the verge of another breakout after a month of price consolidation.”

The stock closed up nearly 3% today.

ETF Summary

- S&P 500 (NYSE:SPY): 390 support with 405 closest resistance.

- iShares Russell 2000 ETF (NYSE:IWM): MA support around 184. 190 has to clear.

- Dow Jones Industrial Average ETF Trust (NYSE:DIA): 326 support 335 resistance.

- Invesco QQQ Trust (NASDAQ:QQQ): 284 big support 300 resistance.

- S&P Regional Banking ETF (NYSE:KRE): Back to a weak link under 60 could be a warning.

- VanEck Semiconductor ETF (NASDAQ:SMH): 228 support 240 pivotal 248 key resistance.

- iShares Transportation Average ETF (NYSE:IYT): 240 resistance is the best Mod Fam performer, and 230 support.

- iShares Biotechnology ETF (NASDAQ:IBB): 125-130 new range.

- S&P Retail ETF (NYSE:XRT): Came back a little but had to clear 66.40 or warning like KRE.