Barclays (NYSE:BCS) is scheduled to release third quarter earnings before the opening bell on Wednesday October 26. A conference call will be held on the same day at 7:00 am BST / 2:00am EDT.

Wall Street forecasts Barclays’ pre-tax profit will fall -8.2% from last year to £1.80 billion.

Like most businesses with extensive exposure to the UK credit markets, Barclays faces an uncertain outlook given the volatility in the market. Readers will recall the big spike in long-term gilt yields and the collapse in the value of sterling in late September, which may cast a pall over this quarter’s results.

In terms of what to watch, traders will key in on the bank’s expected credit loss (ECL), or loan loss provisions, which are expected to rise to £363 million compared to a £120 million provision in this quarter last year. While the year ago figure will represent the last tough comparison (i.e. Q3 last year saw relatively low provisions for losses), that will be little consolation for traders until next quarter’s earnings. Notably, Jefferies estimated that the UK government’s energy-price cap will reduce defaults on UK consumer loans, potentially limiting the increase in Barclays’ ECL.

Meanwhile, HSBC (NYSE:HSBC), like all other banks, should be a big beneficiary of rising rates, with analysts expecting a 33% increase in the bank’s net interest margin to £2.57B, with the bank’s net interest margin expected to increase to 33% vs. 2.9% previously.

Relative to more UK-centric rivals like Lloyds (NYSE:LYG) and Natwest (NYSE:NWG), the greater international exposure of Barclays (and HSBC, for what it’s worth) should insulate its profits somewhat. In addition, the ongoing across-the-board weakness in the pound should boost Barclays’ international profits in sterling terms.

Where next for BCS stock?

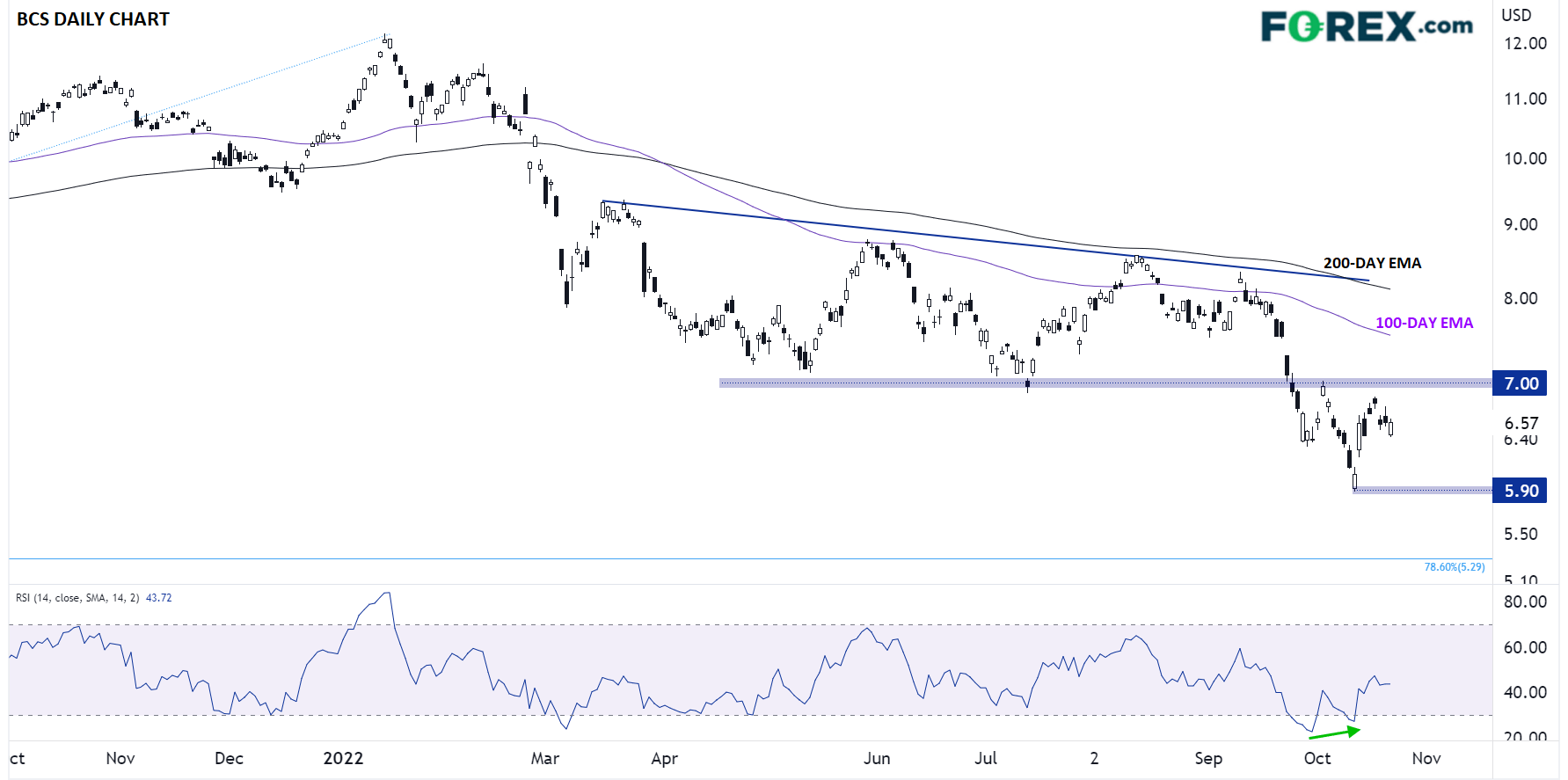

Stated bluntly, it’s been a brutal year for investors in BCS. After peaking above 12.00 in mid-January, the stock has put in a relentless series of lower highs, culminating (so far) in a drop to below 6.00 earlier this month.

Notably, that lower low in price was not confirmed by a lower low in the RSI indicator, creating a bullish divergence and suggesting that the selling pressure may be waning. Still, traders will need to see a stronger-than-expected earnings report and break back above previous-support-turned-resistance at 7.00 to turn constructive on the stock. Meanwhile, a soft earnings report and break below support in the 6.00 area would open the door for another leg down toward 5.30.

Source: TradingView, StoneX