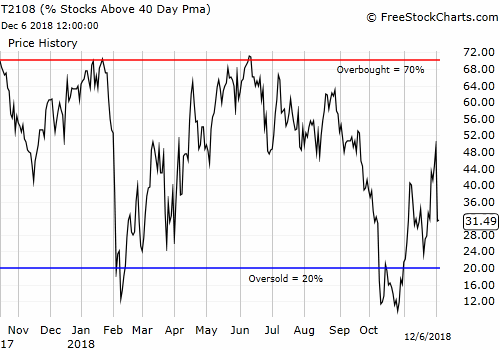

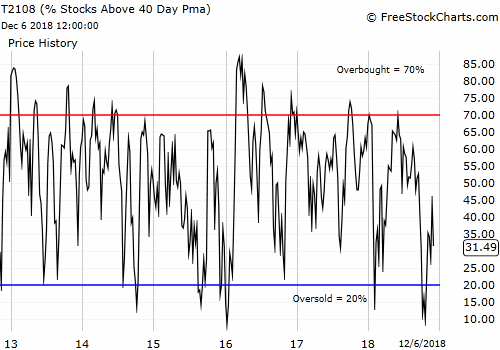

AT40 = 31.5% of stocks are trading above their respective 40-day moving averages (DMAs)

AT200 = 25.5% of stocks are trading above their respective 200DMAs (just off a 32-month low)

VIX = 21.2 (as high as 25.9)

Short-term Trading Call: cautiously bullish

Commentary

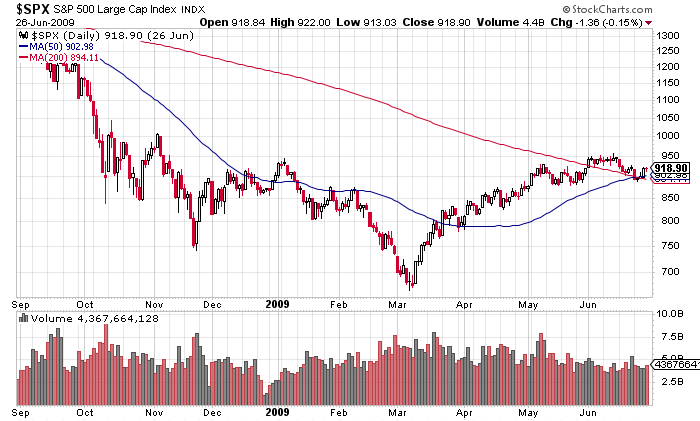

I have become convinced that 2019 is going to deliver another one of those poor trading starts. The stock market is unstable. The stock market is chaotic. Headline risk is extremely high. Resistance levels are holding firm on the major indices. The gyrations in the stock market take me back to the temporary market bottom in the fall of 2008 as the financial crisis unfolded.

In 2008, the market roiled in October, plunged in November, calmed in December, and then setup the final of all final sell-offs into the epic March, 2009 low.

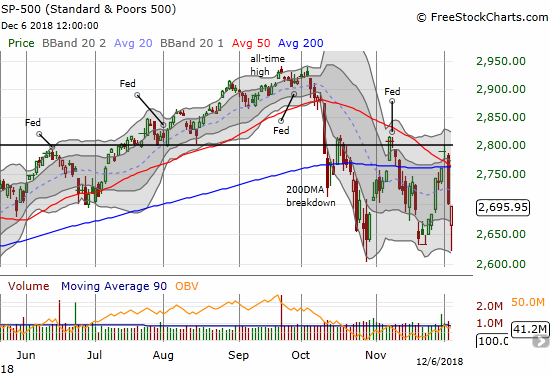

This time around, the S&P 500 (NYSE:SPY) is stuck in a 2-month and counting trading range of wild gyrations starting with the massive October 10th breakdown from its 50-day moving average (DMA) to the 2600 level on an intraday basis. The index has yet to retest its low for 2018, but the rapidly sinking sentiment in the market makes it FEEL like the index has retested a multi-year low!

The S&P 500 (SPY) sliced through its October and November closing lows, but stopped short of October’s intraday low. Buyers rallied the index from a 2.9% loss to a mere 0.2% loss.

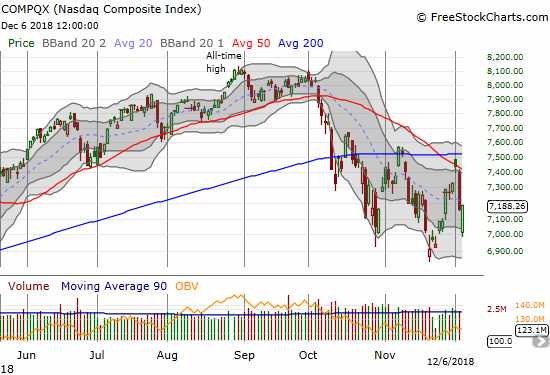

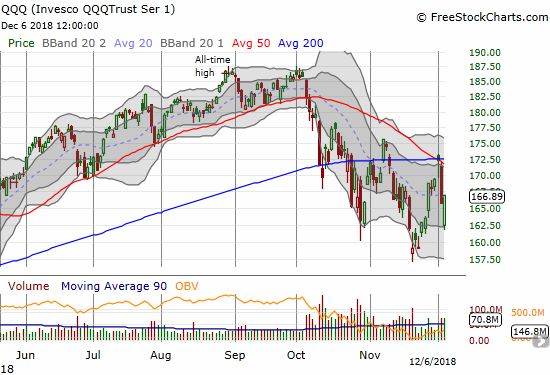

The NASDAQ and the Invesco QQQ Trust (NASDAQ:QQQ) staged comebacks that were sharp enough to close out the day with gains. These tech-laden indices were both down as much as 2.4% and ended the day UP 0.4% and 0.7% respectively.

The NASDAQ left its November low well intact on its way to an incredible snapback rally from a 2.4% intraday loss.

The Invesco QQQ Trust (QQQ) left its November low well intact on its way to an incredible snapback rally from a 2.4% intraday loss.

All three of these major indices confirmed major resistance at their 50 and 200DMAs. The simultaneous failures followed almost exactly the scenarios I warned about in the last Above the 40 post in the immediate wake of the post-G20 euphoria. I executed my plan at the time and took profits on all my short-term long positions and initiated several big market fades, including Caterpillar (NYSE:CAT) puts and CALL options on ProShares Ultra VIX Short-Term Futures (NYSE:UVXY). There is no time to celebrate that market call because the market quickly transformed from the “Cramer bottom” right back to near oversold levels.

The major lows occurred on the heels of a big drop in the futures, which produced several trading halts and then news of the arrest of the CFO of China’s Huawei. The surprising news confirmed the need to end the euphoria over a 90-day “truce” in the China versus U.S. trade war. Trade tensions may even rise all over again. Recall that I claimed that the 90-day truce would merely give us 90 more days to gnash our teeth about on-going trade headlines. Still, I am taken aback that this scenario only took a day to get started!

Despite the heavy weight of negativity, the intraday lows felt like a panic low and a major washout of sellers, especially with tech stocks in the cloud space and home builders rebounding so strongly that they posted decent gains at the close. That was a time to buy (and I did). This is still a time to buy, so I flipped my short-term trading call to cautiously bullish. The intraday lows provide a very clear line in the sand for stopping out of short-term bullish positions. Overhead resistance at the 50 and 200DMAs provide an upside target and a point to initiate new fades.

My favorite technical indicator, AT40 (T2108), the percentage of stocks trading above their respective 40DMAs, plunged “close enough” to oversold conditions (below 20%). At one point during the day, AT40 dropped as low as 23% or so (unfortunately a charting error in FreeStockCharts.com has for the past week shown distorted lows after the close of trading). AT200 (T2107), the percentage of stocks trading above their respective 200DMAs, is still languishing in the 20% range as a reminder of the depressed positioning of so many individual stocks.

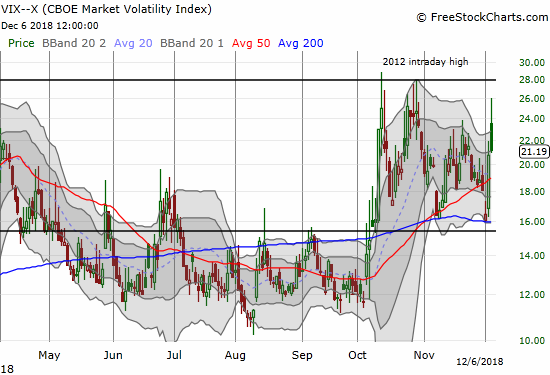

The volatility index, the VIX, added to the buy signal when it soared as high as 26. The 25.4% surge came one trading day after a 26.2% gain. Combined, these moves represent a highly concentrated lift in fear. The VIX last closed above 26 during the February swoon. The volatility faders went to work from there and pushed the VIX to a mere 2.2% gain on the day. The VIX still closed at elevated levels (above 20), so opportunity remains to fade the VIX even from here. I chose to flip intraday the put options I bought on ProShares Ultra VIX Short-Term Futures (UVXY) because I loaded up enough on bullish trades like QQQ call options and calls on cloud stocks.

The volatility index, the VIX, is swinging through a wide 2-month range. below 30 and above the 15.35 pivot line.

While I am more constructive on the market, I am only cautiously bullish because the upside from here seems limited to overhead resistance. More importantly, there are enough signs remaining that the market could retest its intraday low in the near-term, perhaps even retest the 2018 low in short order (perhaps in January).

Firstly, the Australian dollar (NYSE:FXA) versus the Japanese yen (NYSE:FXY) continues to show weakness and thus flag waning risk tolerance in financial markets. If AUD/JPY closes below its 50DMA, I will assume the currency pair is flashing a freshly bearish signal.

AUD/JPY sliced through 200DMA support and bounced back from a 50DMA breakdown. The important currency pair still looks weak with a downward bias.

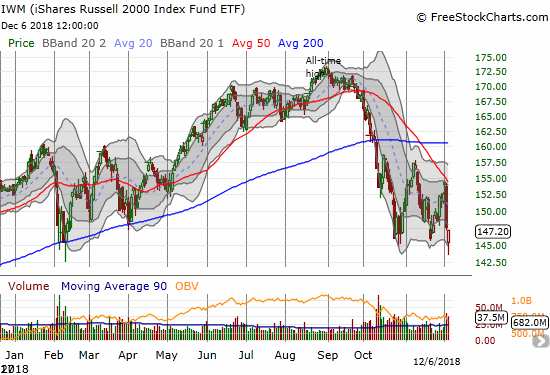

Small caps are taking a harsh beating and are under-performing. The iShares Russell 2000 ETF (IWM) lost 0.3% for the day. IWM gapped down to open right at its 2018 closing low and traded as far down as a 15-month low before rebounding. I think IWM’s hold on its low is particularly tenuous because the index faded its entire post-G20 gain at one point on Monday. Its 4.3% loss the next day wiped out its entire rally from the November low in one fell swoop!

The iShares Russell 2000 ETF (IWM) looks like it is working on a major breakdown of its 2018 lows. A loss for the year is almost certain.

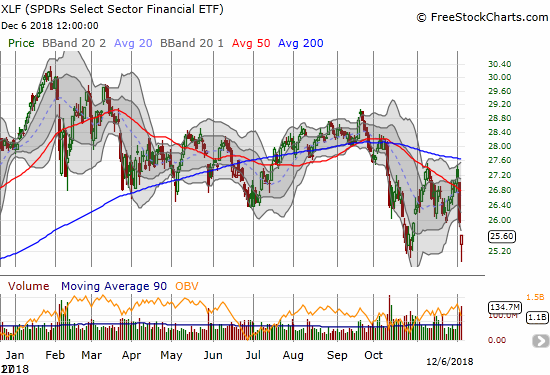

The financials also continue to look sick. I have been amazed at the muted alarms over this persistent weakness and under-performance. Financials were supposed to be big beneficiaries of the current environment. I have duly noted persistent narratives from pundits of lower regulations, lower taxes, a strong economy, low valuations, and strong balance sheets. Yet, the sellers keep fading and pushing the Financial Select Sector SPDR ETF (NYSE:XLF) ever lower. Today, XLF closed with a 1.5% loss, underperformed the market yet again, and at one point traded at a 15-month low.

The Financial Select Sector SPDR ETF (XLF) formed a hammer patter as it snapped back from a 15-year low. Sellers still kept the ETF below its lower Bollinger® Band (BB).

This latest cycle continues to fascinate me. The mild bullish divergence that I essentially dismissed before last week’s rally turned out to be meaningful. I noted that lesson and so am more inclined to treat this latest close call as a bullish sign. Next up on Friday is the November jobs report waiting to twist the minds of traders and investors alike. Another Fed meeting follows with a pronouncement on monetary policy on December 19. If a late-breaking report from the Wall Street Journal is accurate, then the Fed appears already prepared to capitulate to market fears. The may soon back down from its plan to steadily and regularly hike interest rates.

Federal Reserve officials are considering whether to signal a new wait-and-see approach after a likely interest-rate increase at their meeting in December, which could slow down the pace of rate increases next year.

The return of the Plunge Protection Team (PPT) already?

CHART REVIEWS

There are a LOT of charts that demonstrate the market’s drama and buying/shorting opportunities. I will wait until after Friday’s close to post a sample so I can be more conclusive. In the meantime, I DO want to post a quick note on a home builder.

Lennar (NYSE:LEN) continues to get a lot of focus on CNBC’s Fast Money. For some reason, the stock has become a favorite bottom-fishing stock on that show especially after a big block of call options were purchased earlier in the year. Once again, LEN was rolled out as an ideal value play where all the negatives are already priced in. I will address this notion soon in the context of the earnings of Toll Brothers (TOL) and the stock’s amazing post-earnings comeback.

As I have done each time before, I have to issue an objection to this trading call. This time, I am turning my thumbs down even in the wake of a seasonally strong period and my plan to pick up selective home builder stocks to play this seasonally strong period. Unfortunately for LEN, the stock has yet to demonstrate convincing, renewed strength. The stock is not a buy until it can pull away from 50DMA resistance and what now looks like a double peak.

Lennar Corporation (NYSE:LEN) made a promising move to print a double bottom at its 2016 closing low, but the stock has yet to follow-through and confirm that low with a higher high and breakout.

“Above the 40” uses the percentage of stocks trading above their respective 40-day moving averages (DMAs) to assess the technical health of the stock market and to identify extremes in market sentiment that are likely to reverse. Abbreviated as AT40, Above the 40 is an alternative label for “T2108” which was created by Worden. Learn more about T2108 on my T2108 Resource Page. AT200, or T2107, measures the percentage of stocks trading above their respective 200DMAs.

Active AT40 (T2108) periods: Day #24 over 20%, Day #8 over 30% (overperiod), Day #2 under 40% (underperiod), Day #52 under 50%, Day #68 under 60%, Day #121 under 70%

Black line: AT40 (T2108) (% measured on the right)

Red line: Overbought threshold (70%); Blue line: Oversold threshold (20%)

Be careful out there!

Full disclosure: long QQQ calls, long AUD/JPY