Wall Street bulls, which dominated in the first three quarters of this year, continued their forward march in the first two months of the final quarter. Wall Street is on the verge of finishing November with an impressive rally.

Month to date, all three major stock indexes — the Dow, the S&P 500 and Nasdaq Composite — advanced 4.1%, 3.8% and 5%, respectively. All three indexes are currently at their all-time highs, having hit the zenith several times in November alone. Apart from these, small-cap centric Russell 2000 hit 52-week high this week, showing signs of breakout.

Three Major Drivers of November

First, on Nov 12, President Donald Trump said a U.S.-China trade deal “could happen soon,” and added that a phase one agreement is “close.” On Nov 23, U.S. national security adviser Robert O’Brien said that an initial trade agreement with China is still possible by the end of the year.

On Nov 26, Chinese vice premier Liu He, the country’s top negotiator on trade, had a telephonic conversation with the U.S. Trade Representative Robert Lighthizer and Treasury Secretary Steven Mnuchin regarding further discussions. All these developments raised the hope for an interim trade deal.

Second, third-quarter earnings results were not as disappointing as estimated at the starting of the reporting cycle. Moreover, overall guidance is not as weak till now as was feared. As of Nov 20, 469 S&P 500 members reported third-quarter results. Total earnings for these index members are down 1.2% year over year while revenues increased 4.3%. Notably, 72.7% companies surpassed earnings estimates while 57.6% beat on revenues.

Third, strong economic data strengthened investors’ faith in the U.S. economy. Third-quarter GDP estimate was revised upward from 1.9% to 2.1%. U.S. consumer spending rose 0.3% in October, marking the eighth consecutive month of growth. It is a good sign for the upcoming holiday shopping season. Moreover, decline in business investment in the third quarter revised to 2.7% from 3% reported earlier.

Future Catalysts

According to Conference Board report, the Expectations Index of November, which is a measure of consumers’ short-term (for the next six months) outlook for income, business and labor market conditions, increased to 97.9 from 94.5 in October. Notably, the University of Michigan report also revealed that the Expectations Index rose to 87.3 in November from 84.2 in October. Confidence levels remained high to support strong spending during the holiday season.

Moreover, similar findings of the two different studies clearly indicate that U.S. consumers are expecting a rebound of economic growth in the first quarter of 2020. On Nov 27, the CNBC/Moody’s Analytic’s rapid update of economists’ forecasts for fourth-quarter 2019 increased 0.1 % to 1.8%. Atlanta Fed’s fourth-quarter GDP forecast jumped to 1.7% from a mere 0.4% eight days ago. J.P. Morgan also raised GDP forecast to 2.1% from 1.25%.

Additionally, even a temporary trade truce between the United States and China will bolster business confidence and stabilize overall U.S. economic growth. On Nov 24, China’s government released a document supporting more protection of intellectual property rights. Notably, protection of U.S. intellectual properties, especially for high-tech products and termination of forced technology transfer by China’s government were the primary issues of the U.S.-China trade conflict.

Our Top Picks

At this stage, we have narrowed down our search to six stocks, which popped in November and still have strong momentum. Each of our picks carries a Zacks Rank #1 (Strong Buy) and a Momentum Style Score of A. You can see the complete list of today’s Zacks #1 Rank stocks here.

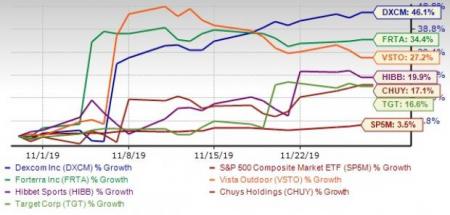

The chart below shows price performance of our six picks in the past month.

DexCom Inc. (NASDAQ:DXCM) is a medical device company, focuses on the design, development, and commercialization of continuous glucose monitoring systems in the United States and internationally. The Zacks Consensus Estimate for the current year has improved 44.7% over the past 30 days. The company has an expected earnings growth rate of 373.3% for the current year. The stock price has jumped 46.1% in the past month.

Forterra Inc. (NASDAQ:FRTA) manufactures and sells pipe and precast products the United States, Canada, and Mexico. It operates through Drainage Pipe & Products; and Water Pipe & Products segments. The Zacks Consensus Estimate for the current year has surged 76.2% over the past 30 days. The company has an expected earnings growth rate of 77.3% for the current year. The stock price has soared 34.4% in the past month.

Vista Outdoor Inc. (NYSE:VSTO) designs, manufactures, and markets consumer products for outdoor sports and recreation markets in the United States and internationally. The company operates through Outdoor Products and Shooting Sports segments. The Zacks Consensus Estimate for the current year has improved 23.1% over the past 30 days. The company has an expected earnings growth rate of 14.3% for the current year. The stock price has jumped 27.2% in the past month.

Hibbett Sports Inc. (NASDAQ:HIBB) engaged in the retail of athletic-inspired fashion products through its stores. Its stores offer a range of merchandise, including athletic footwear, athletic and fashion apparel, sports equipment and related accessories. The Zacks Consensus Estimate for the current year has jumped 11.9% over the past 30 days. The company has an expected earnings growth rate of 38.4% for the current year. The stock price has climbed 19.9% in the past month.

Chuy's Holdings Inc. (NASDAQ:CHUY) owns and operates full-service restaurants serving a distinct menu of authentic Mexican food. The Zacks Consensus Estimate for the current year has been raised 4.2% over the past 30 days. The company has an expected earnings growth rate of 12.5% for the current year. The stock price has rallied 17.1% in the past month.

Target Corp. Inc. (NYSE:TGT) operates as a general merchandise retailer in the United States. It offers beauty and household essentials; food assortments, like perishables, dry grocery, dairy, and frozen items; and apparel, accessories, home décor products, electronics, toys, seasonal offerings, and other merchandise. The Zacks Consensus Estimate for the current year has improved 3.7% over the past 30 days. The company has an expected earnings growth rate of 18.4% for the current year. The stock price has advanced 16.6% in the past month.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through Q3 2019, while the S&P 500 gained +39.6%, five of our strategies returned +51.8%, +57.5%, +96.9%, +119.0%, and even +158.9%.

This outperformance has not just been a recent phenomenon. From 2000 – Q3 2019, while the S&P averaged +5.6% per year, our top strategies averaged up to +54.1% per year.

See their latest picks free >>

FORTERRA INC (FRTA): Free Stock Analysis Report

DexCom, Inc. (DXCM): Free Stock Analysis Report

Vista Outdoor Inc. (VSTO): Free Stock Analysis Report

Target Corporation (TGT): Free Stock Analysis Report

Chuy's Holdings, Inc. (CHUY): Free Stock Analysis Report

Hibbett Sports, Inc. (HIBB): Free Stock Analysis Report

Original post

Zacks Investment Research