- The August CPI report showed headline annual inflation rising 3.7% compared to the 3.2% reading seen in July and a 3.0% increase in June.

- As inflation makes a comeback, I used the InvestingPro stock screener to identify some of the best stocks that tend to deliver strong returns during periods of elevated CPI.

- Looking for more actionable trade ideas to navigate the current market volatility? Members of InvestingPro get exclusive ideas and guidance to navigate any climate. Learn More »

The U.S. government has just released the August inflation report, with numbers revealing that CPI has continued to rise at a pace far more quickly than the 2% rate the Fed considers healthy for the economy.

The consumer price index rose by 0.6% on the month, after edging up 0.2% in July. The headline annual inflation rate rose above market expectations, at 3.7%, marking a significant acceleration from the 3.2% annual pace in the previous month.

To help you successfully navigate through the uncertain macro backdrop, I used the InvestingPro screener to identify some of the best stocks that tend to deliver strong returns during times of high inflation, like now.

My focus was on diversified companies that are defensive in nature and demonstrate solid profitability, a healthy balance sheet, strong growth prospects, and resilient dividend payouts thanks to their market-leading position.

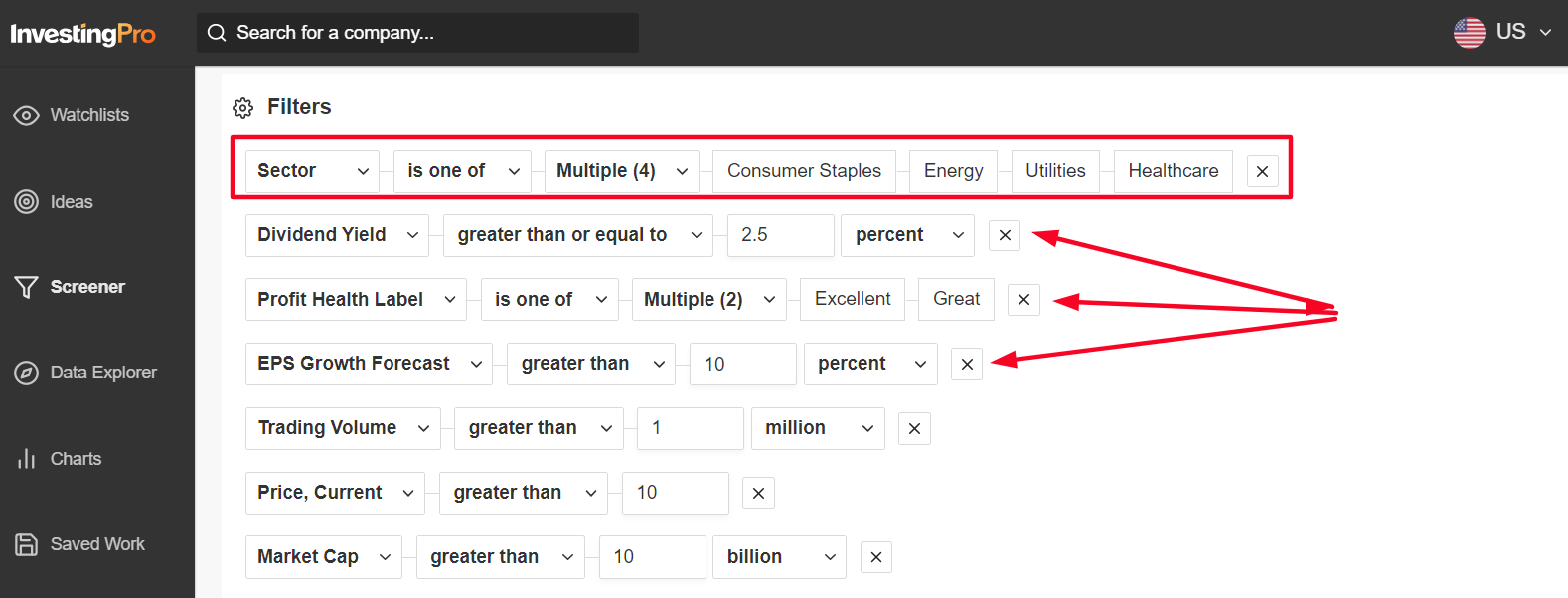

To kick off my process, I first searched for stocks that hail from defensive sectors of the market, such as consumer staples, energy, utilities, and healthcare, as their products and services are essential to people’s everyday lives.  Source: InvestingPro

Source: InvestingPro

I then filtered for stocks with a dividend yield above 2.5%.

Finally, I scanned for names that have an InvestingPro Profit Health Label of either ‘Excellent’ or ‘Great.’ The grade is based on the strength of the company’s projected earnings growth and cash flow trends.

My watchlist consists of companies with a market cap of over $10 billion, an average daily trading volume of at least one million shares, and a stock price of $10 or higher.

Only 26 stocks on U.S. exchanges met the criteria above. Of those, here are three standout companies to own as inflation fears return.

For the full list of stocks that made my watchlist, start your 7-day free trial with InvestingPro. If you're already an InvestingPro subscriber, you can view my selections here.

1. Johnson & Johnson

Johnson & Johnson (NYSE:JNJ) is one of the most valuable drug and medical device makers in the world, best known for its various blockbuster immunology, oncology, and cardiovascular drugs.

The healthcare giant recently spun off its consumer health business Kenvue (NYSE:KVUE), following in the footsteps of several other drugmakers that have slimmed down to focus on their pharmaceutical units.

J&J has a stellar track record of weathering economic storms and tends to exhibit resilience during periods of inflation as demand for medical products and services remains steady.

The New Brunswick, New Jersey-based company’s reputation for innovation and a robust pipeline of promising drugs positions it for growth, even as inflation returns.

Moreover, J&J’s relatively high annualized dividend and attractive yield - currently at $4.76 and 2.91%, respectively - further enhances the appeal of the diversified healthcare juggernaut.

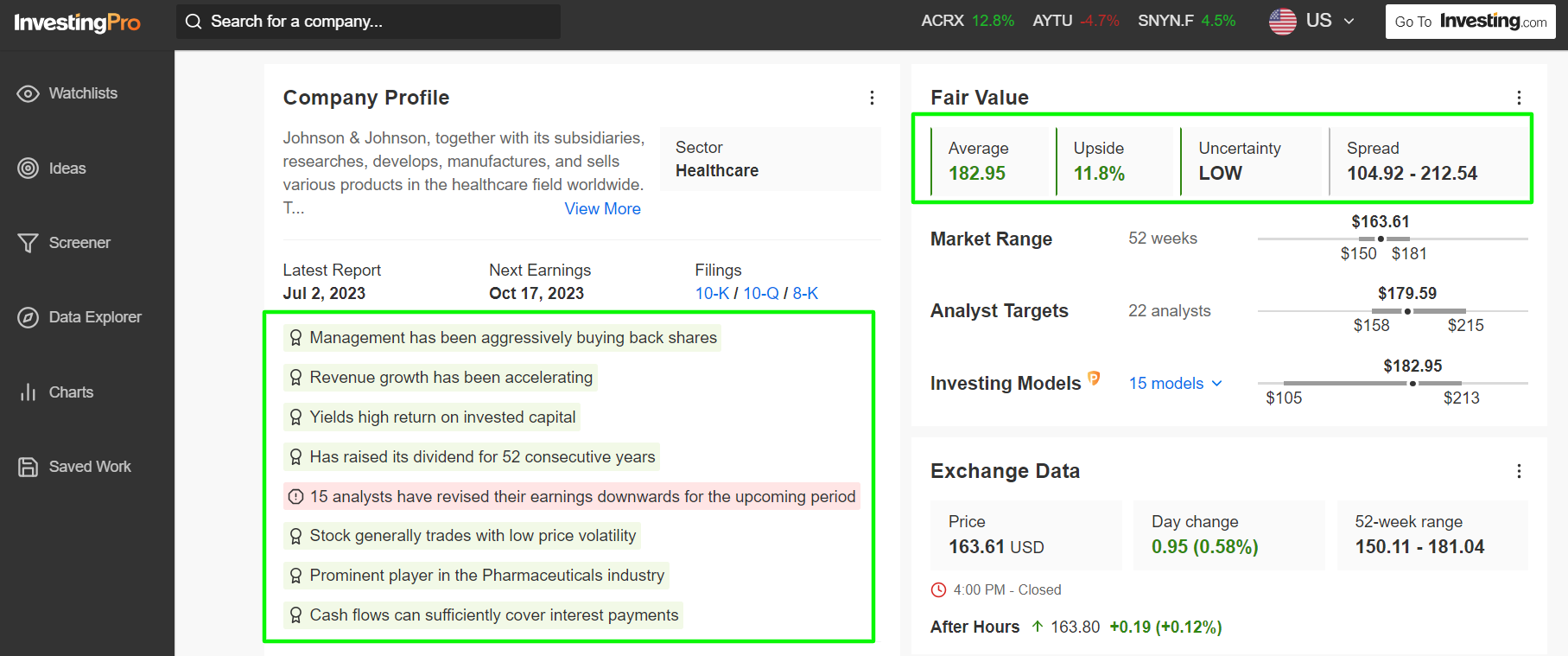

In fact, it is one of only two U.S.-based companies that has a prime credit rating of ‘AAA’, higher than that of the U.S. government and has raised its dividend every year for 52 consecutive years. Source: InvestingPro

Source: InvestingPro

According to a number of valuation models, including P/E multiples, the average ‘Fair Value’ price target for JNJ stock on InvestingPro stands at $182.95, a potential 12% upside from the current market value.

Taking that into account, owning Johnson & Johnson shares during times of rising inflation presents several advantages thanks to the company’s strong balance sheet and long history of not only paying dividends but also increasing them over time.

2. PepsiCo

PepsiCo (NASDAQ:PEP) meets my strict criteria of profitable blue-chip companies that do well in times of rising inflationary pressures and economic uncertainty.

The well-diversified consumer products company operates in 200 countries and sells a wide range of popular items that people consume regardless of economic conditions.

Additionally, PepsiCo's pricing power allows it to adjust to rising input costs, mitigating the impact of inflation on its profit margins.

The global beverage and snack giant currently has 23 brands in its portfolio that produce over $1 billion in annual sales, including notable soft drinks such as Pepsi, Gatorade, and Tropicana, as well as recognizable snack labels like Lay’s, Fritos, Doritos, and Cheetos.

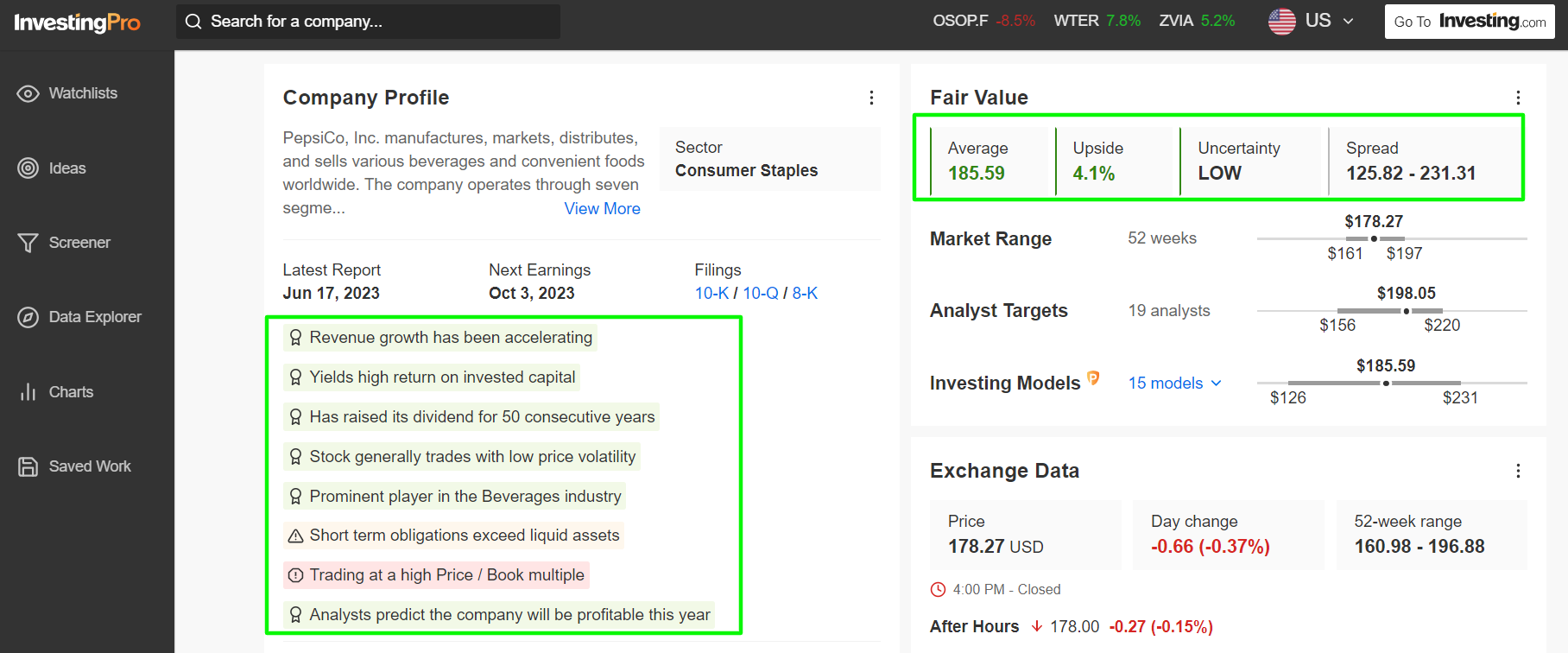

The New York-based company is also a reliable dividend payer with a history of consistent dividend growth. In fact, PepsiCo’s dividend payout has experienced 50 consecutive years of growth, earning it the status of ‘Dividend King.’ Source: InvestingPro

Source: InvestingPro

As per InvestingPro, investors have the chance to buy PepsiCo’s stock at a modest discount. The average ‘Fair Value’ price estimate for PEP stands at $185.59/share, implying a potential upside of 4.1%.

All things considered, PepsiCo’s strong global presence, diverse product portfolio, stable dividend history, and commitment to innovation make it a standout choice for investors looking to navigate the ongoing challenges of elevated inflationary pressures.

3. NextEra Energy

NextEra Energy (NYSE:NEE), which stands out in the utilities sector as a renewable energy leader, has the potential to deliver strong returns as inflation concerns resurface.

Stocks of defensive companies whose products and services are essential to people’s everyday lives, such as utility providers, tend to outperform in environments of accelerating inflation.

The Juno Beach, Florida-based utility giant, which is the world’s largest generator of wind and solar electricity, looks primed to continue to benefit from the ongoing shift to clean energy.

NextEra’s long-term contracts and regulated utilities business provide steady cash flows, making it a reliable choice for investors seeking insulation from inflation-related uncertainties.

In addition, the renewable energy company’s consistent dividend payouts and focus on shareholder value make it a solid choice for income-oriented investors.

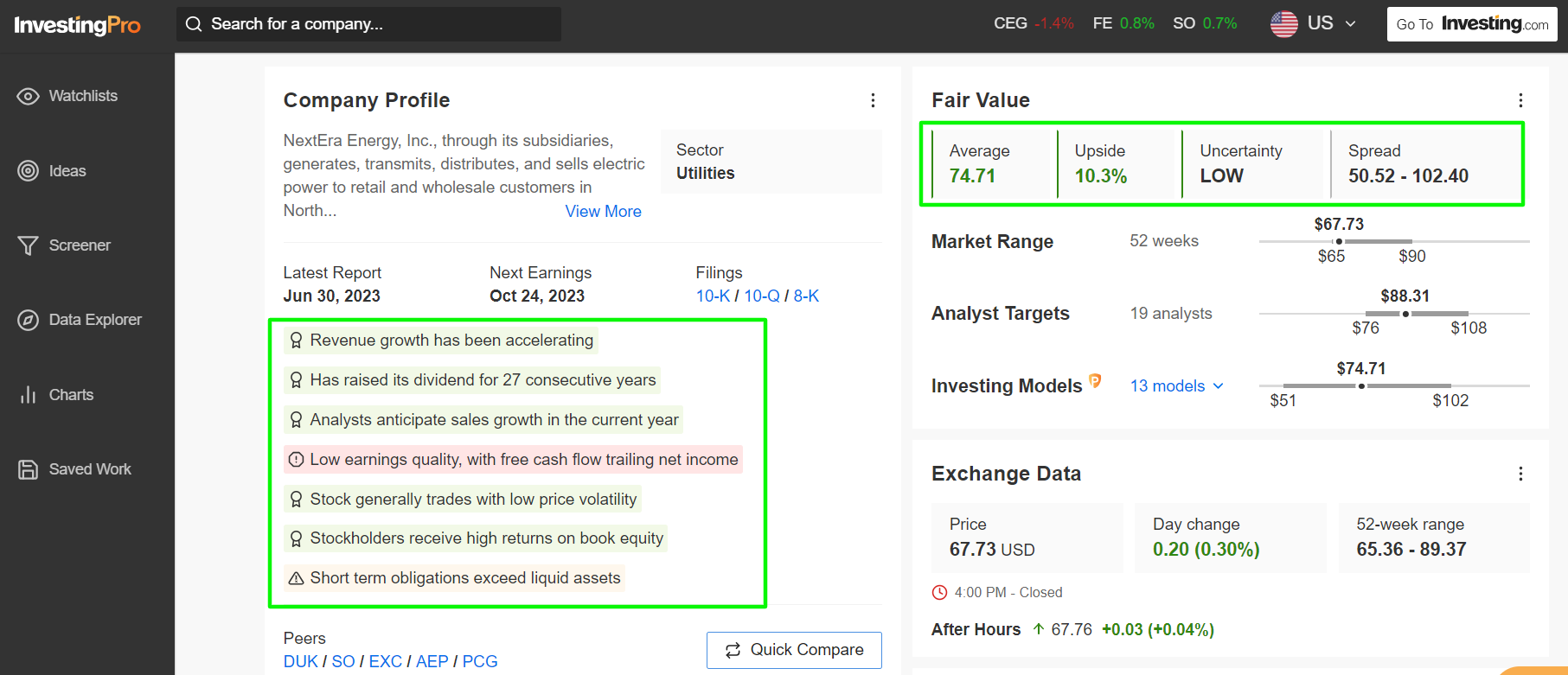

NextEra Energy has maintained a streak of 27 consecutive years in which it has raised its annual dividend. Source: InvestingPro

Source: InvestingPro

Indeed, shares could see an upside of 10.3% from Tuesday’s closing price according to the quantitative models in InvestingPro, bringing NEE stock closer to its ‘Fair Value’ price of around $75.

All in all, NextEra Energy’s strong financial position, diverse renewable energy portfolio, steady cash flows, and commitment to dividend growth make its shares a compelling option as inflation fears return.

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading decisions.

***

Disclosure: At the time of writing, I am long on the Dow Jones Industrial Average via the SPDR Dow ETF. I also have a long position on the Energy Select Sector SPDR ETF (NYSE:XLE) and the Health Care Select Sector SPDR ETF (NYSE:XLV). Additionally, I am short on the S&P 500, Nasdaq 100, and Russell 2000 via the ProShares Short S&P 500 ETF, ProShares Short QQQ ETF, and ProShares Short Russell 2000 ETF. I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies' financials. The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.