- High-quality dividend-paying stocks provide income stability during times of economic distress

- Utilities have the potential to generate solid income for investors over the long run

- Makers of fighter jets, missiles, and radar systems are among the best defensive investments for income seekers

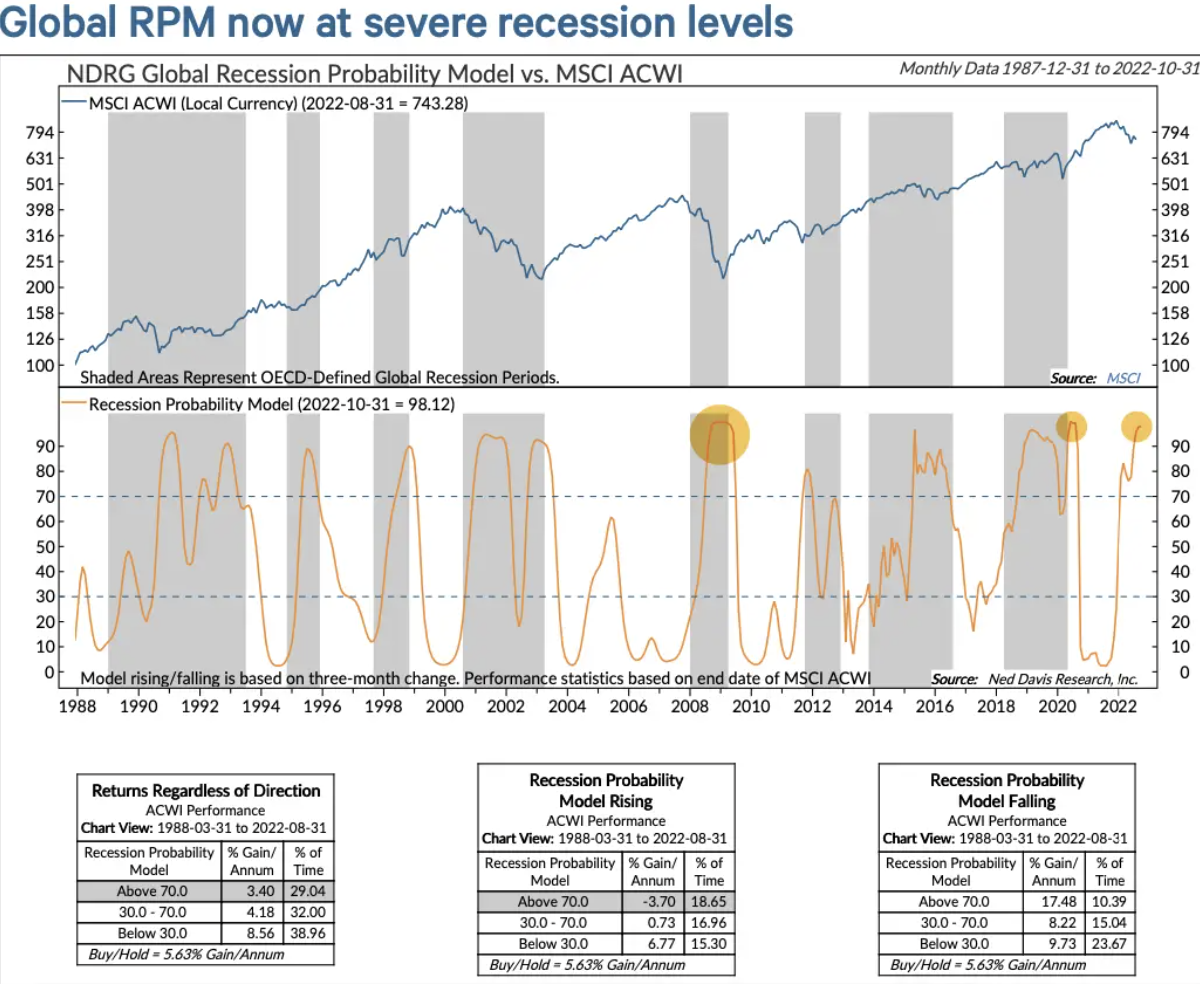

With central banks in aggressive tightening mode, fears over a broad-based global economic downturn are growing by the day. According to Ned Davis Research, the probability of a global recession has recently risen above 98%, triggering a “severe” signal. The last two times the model reached a similar level were during the acute downturns of 2020 and 2008-2009.

Source: Ned Davis Research

Likewise, in the U.S., on top of two quarters of negative GDP readings, developing weaknesses in the industrial cycle and the housing market indicate that things could be deteriorating quickly.

Against such a backdrop, it’s nearly impossible to remain unscathed as an equity investor. Still, you can minimize risk by diversifying your investments and adding high-quality dividend-paying stocks to your portfolio.

With this in mind, I have selected the following three stocks that should continue to produce income in a prolonged market downturn or even an economic recession.

1. Enbridge

Utilities are usually recession-proof for one simple reason: these companies invest billions of dollars to build assets that generate solid income for investors. Thus, the cash will keep rolling in as long as customers continue to pay their utility bills.

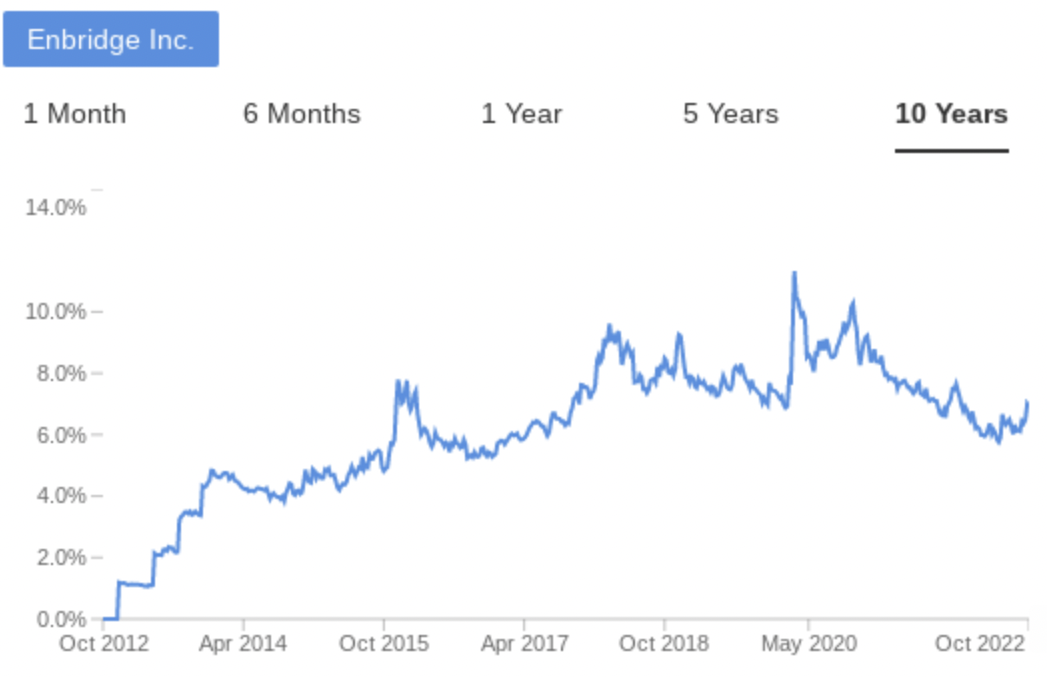

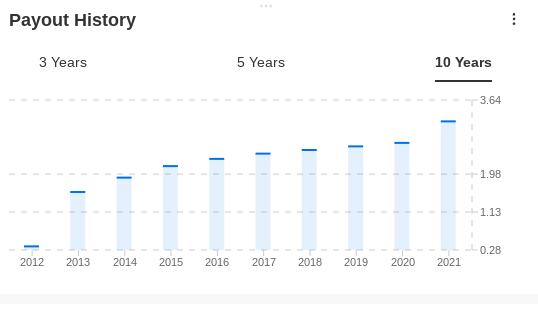

In this space, I particularly like the Calgary-based Enbridge Inc (NYSE:ENB), which runs the largest pipeline network in North America. With the dividend yield touching 6.9%, Enbridge is a reliable stock with more than 60 years of dividend payment history.

Enbridge’s operations are well diversified across many businesses and geographies, helping the utility to weather the economic downturn better than other companies.

Source: InvestingPro

While the pandemic hurt oil consumption across the board, Enbridge’s gas transmission, distribution, and storage businesses, which account for about 30% of cash flows, shielded the company and saved its payout.

According to Raymond James, the recent market pullback has made Enbridge an enticing investment opportunity. In a recent note, the research firms said:

“While the equity has been drifting lower, the fundamental outlook for ENB has only gotten better. Enbridge’s near and medium-term growth outlook has improved while also maintaining a balanced capital allocation strategy: self-funding and executing a modest NCIB, all while deleveraging. We recommend investors add to positions in Enbridge and are raising our rating.”

Furthermore, according to Raymond James:

“[Enbridge is] delivering on its two-pronged approach to fulfill its growth outlook – building project backlogs in both energy transition and conventional energy infrastructure.”

Enbridge’s New York-listed stock pays a $0.86 a share quarterly dividend, which has grown about 10% per annum over the past five years.

2. Target

When picking dividend-paying stocks, the biggest concern is whether the company can produce strong cash flows in both good and bad times. The big-box retailer Target Corporation (NYSE:TGT) has an excellent track record on this front.

The company has steadily increased its dividend every year for the last 50 years, covering crises such as the dot-com collapse of the early 2000s, the financial crash of 2008-2009, and the COVID-19 pandemic. While delivering cash to investors each quarter, the discount store has maintained a conservative payout ratio of about 30%, showing more cash-distribution runway.

Source: InvestingPro

In June last year, Target announced a whopping 32% hike in its payout, followed by another 20% raise this summer, taking its payout to $1.08 a share quarterly with an annual yield of 2.77%.

This year, however, has been quite challenging for the Minneapolis-based retailer as the company struggles to clear a large number of inventories it accumulated when consumers stopped spending on discretionary items, such as appliances and garden furniture, after the pandemic boom.

But the management is well on track to overcome this challenge and restore growth in its operating margins. Chief Executive Officer Brian Cornell said on a conference call with analysts last month:

“The vast majority of the financial impact of these inventory actions is now behind us. We’re positioned to deliver a great improvement in our profitability this fall.”

3. General Dynamics

Makers of fighter jets, missiles, and radar systems make one of the best defensive investments during economic downturns. This time around, their business outlook has further improved due to geopolitical conflicts and tensions between the world’s superpowers.

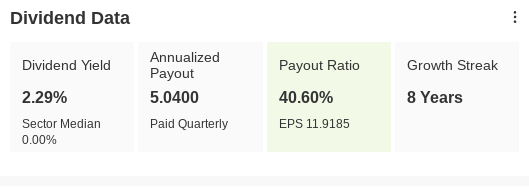

General Dynamics (NYSE:GD) is certainly one of those names that fit nicely in a defensive income portfolio. It pays a $1.26 a share quarterly dividend that translates into a 2.29% annual dividend yield, backed by the company’s strong cash flows and recession-proof business nature.

Source: InvestingPro

The Virginia-based GD is massively benefiting from elevated defense spending globally, especially after Russia’s war on Ukraine, bolstering demand for its products. In addition, the ongoing U.S.-China rivalry should continue to support long-term sentiment and funding upside.

General Dynamics is a global aerospace and defense company that offers a broad portfolio of products and services in business aviation, ship construction and repair, land combat vehicles, weapons systems and munitions, and technology products and services. General Dynamics employs more than 100,000 people worldwide and generated $38.5 billion in revenue in 2021.

With its diversified portfolio, G.D. also has an outstanding dividend growth track record, with 27 years of successive annual dividend hikes. General Dynamics has delivered about 10% dividend growth per year in the past ten years. With a manageable payout ratio of just around 41%, G.D. has the ability to continue with this impressive payout growth.

Disclosure: At the time of writing, the author owns ENB. The views expressed in this article are solely the opinion of the author and should not be taken as investment advice.