Utility dividends haven’t been this generous in years. Thank you, stock market selloff!

These yield machines have been expensive for a while. Today, utility stocks are finally cheap—and their dividends are finally high enough to get our attention!

That makes right now our time to buy. The Federal Reserve created this deal, and hey, the Fed could easily take it away with any hint of a policy pivot.

History tells us that cheap utility stocks don’t stay in the bargain bin for long. I’m staring at two in particular that are likely to bounce back next year. Both of these stocks are likely to deliver double-digit payout hikes, too.

(We’ll also talk about one utility to avoid. The company is carrying way too much debt as rates rise, and will likely be left out of the coming bounce.)

Fed, Bear-Market Rally Power Our Utility Upside

The case for utilities is all about timing, because these stocks tend to fall when interest rates rise.

Therein lies our opportunity, because Powell and the Fed will almost certainly move to the sidelines in early ’23, or they’ll really break something.

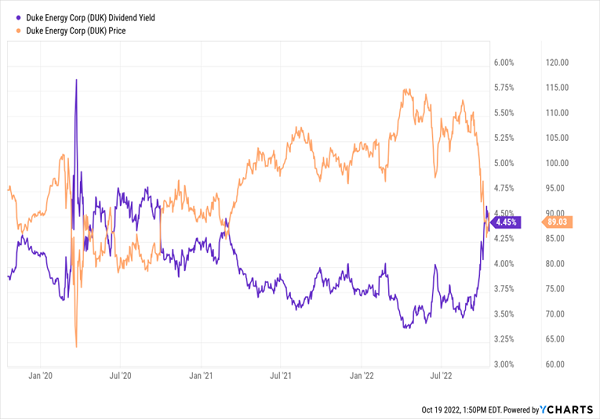

That, along with the bear-market bounce we’re seeing now, set up a nice entry point on utility stocks. Consider Duke Energy (NYSE:DUK), a good benchmark because it’s one of the biggest utilities out there. Duke yields 4.5% today, and the last time it yielded anywhere near that was two years ago—in late 2020.

What’s more, every time Duke’s yield has broken 4.5%, the stock has bounced. You can see it in the chart below, showing the yield in purple and the share price in orange (yields, of course, move in opposition to prices):

Duke Has Soared Every Time Its Yield Hits 4.5%

Note that I’m not recommending Duke here, just using it as a benchmark—fact is, its $70 billion in long-term debt is just too high—more than its $67-billion market cap (or its value as a public company)! With rising rates, this time really is different for Duke, so I expect its bounce to be more muted.

But that’s not the case for the two other utilities below. They’re nimble, carrying low debt and one, in particular, is riding a megatrend that’s locked in for decades.

Another bullish sign for utilities is the near certainty of a recession in ’23. If history is any guide, investors will pour into utilities beforehand, as they did in the six months leading to the 2007–2009 recession. Back then, safety-conscious income-seekers bid the benchmark Utilities Select Sector SPDR ETF (NYSE:XLU) up 38%, far past the S&P 500:

Utilities Soared as the “Great Recession” Set In

All of this leads to one takeaway: if we wait until the 2023 recession hits, we’ll be too late: utilities’ prices will be bid up (and their yields down). Now is the time to pounce.

1. A Mid-Sized Player With a Powerful “Dividend Magnet”

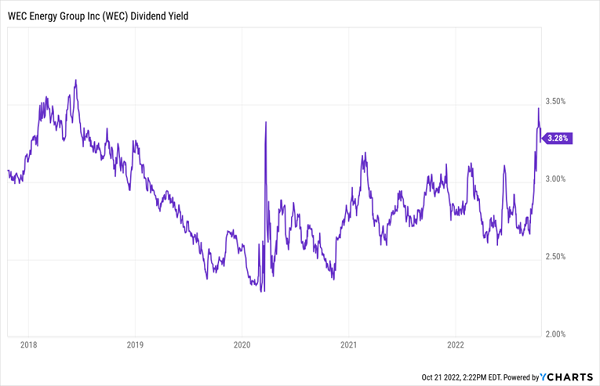

WEC Energy Group (NYSE:WEC) is a long-time favorite of mine: it has 4.6 million electricity and gas customers in Wisconsin, Illinois, Michigan and Minnesota. The stock yields 3.3% now—a level we haven’t seen since late 2018, when the Fed was also in the late stages of a rate-hike cycle.

WEC’s Yield Hits a 4-Year High

That 3.4% is a nice entry point for us, as WEC has a history of fast dividend increases that pull its stock up as the payout soars.

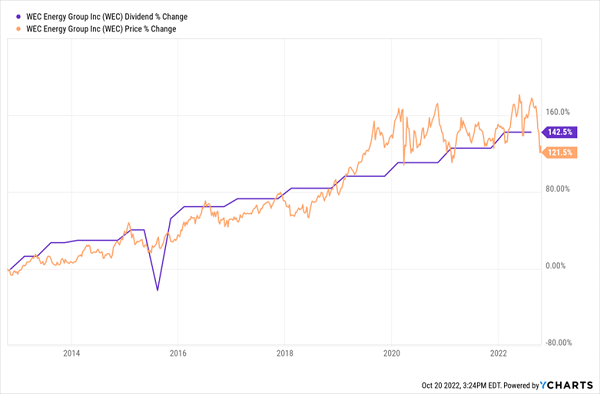

WEC’s “Dividend Magnet” Hits Full Power

(Don’t worry about that dip in 2015—the payout was pro-rated due to WEC’s acquisition of Integrys Energy; it wasn’t cut!) As you can see, the dividend has soared 143% in the last decade, and the price followed right along, a pattern I like to call the Dividend Magnet—we’ve seen it happen again and again (and again).

Thanks to that fast payout growth, folks who bought in 2012 are yielding a rich 7.7% on their original buy today. This is, hands down, the safest way to get a dividend that big.

WEC announced a hefty 7.4% dividend hike in the first quarter of 2022. I expect another nice increase in early 2023, with revenue up 27% in the second quarter from a year earlier and earnings per share (EPS) up 5%. As of June 30, payouts accounted for just 65% of earnings—at the low end of WEC’s target range of 65% to 70%, so there’s room to move there, too.

Finally, WEC’s debt is more reasonable than Duke’s bloated balance sheet, so it can easily handle rising rates: its long-term debt is $15 billion, or 56% of its market cap, which is just fine for a utility with steady revenue, which WEC gets from its 4.6 million customers.

2. A Renewable Leader Hiking Payouts Double Digits

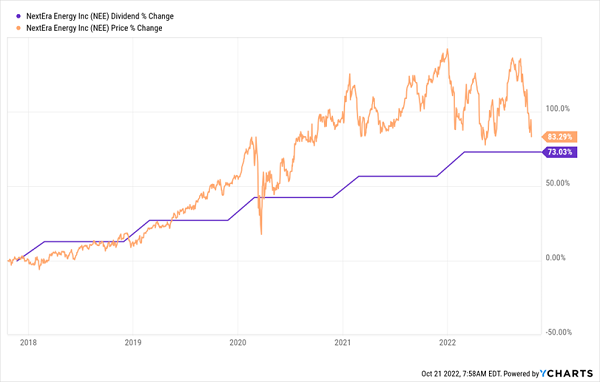

NextEra Energy (NYSE:NEE) is a megatrend stock if there ever was one: it’s the largest developer of renewable energy in North America. And it’s one of the fastest dividend growers in the utility space, boosting its payout 73% in the last five years—a string of hikes that has taken the price along for the ride:

Another Utility-Powered Dividend Magnet

NextEra is one of those utilities that is never cheap because everyone knows it’s a terrific stock. In its latest quarter, EPS jumped 14% and CEO John Ketchum said he expects the company to hit the top end of management’s earnings expectations for 2022, 2023, 2024 and 2025!

That’s largely on the back of NextEra’s renewables pipeline: just from April to late July, NEE, added 2 billion gigawatts to its backlog and is now sitting on nearly 20 billion worth.

As these projects roll out, its earnings are expected to soar, which is why Ketchum says he expects 10% dividend increases (at least!) through 2024. That has our attention, and its 2.4% yield (up from 1.7% at the start of the year) gives us a nice place to start.

Finally, NEE won’t break a sweat carrying its $63.5 billion of long-term debt, which is less than half its $139-billion market cap. So we don’t have to worry about Powell & Co. crashing our dividend party here, either.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement."