By Jennifer Hiller

HOUSTON (Reuters) - The former chief of Chevron (NYSE:CVX) Corp's Latin American operations is moving to raise $500 million from big financial firms to invest in Venezuela once U.S. sanctions are eventually lifted, confident that political change will come and that foreign investment will be needed to boost sagging oil output.

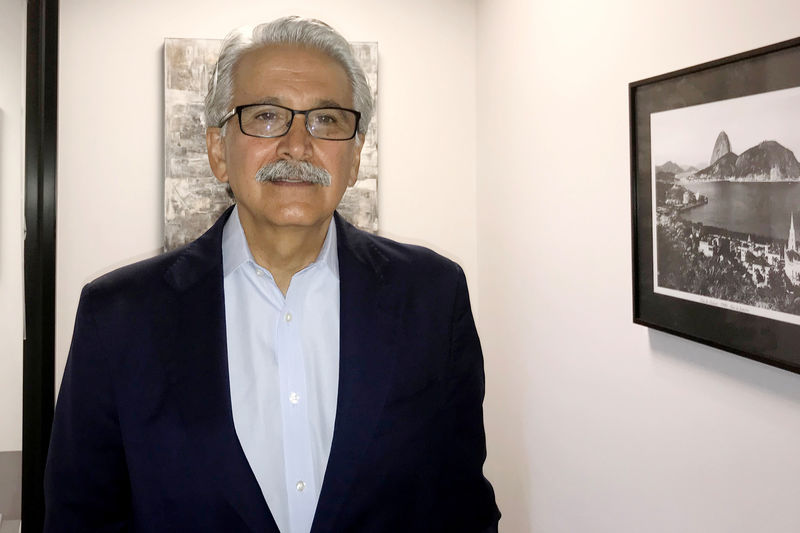

Amos Global Energy LLC, an oil and gas firm started by former Chevron executive Ali Moshiri, begins a road show to raise funding next month, seeking five big investors to put in $100 million each. Amos Global, which includes Moshiri and two co-founders, also is researching Venezuela public debt holders for another fund that would be even larger.

"We are trying to be the first to enter Venezuela when sanctions are lifted," he told Reuters in an interview on Monday. Amos Global's goal is to line up investors and manage the assets.

The United States imposed sanctions on Venezuela’s state-run oil firm, PDVSA, in January, seeking to starve the country of oil revenue and oust President Nicolas Maduro. Many Western nations regard last year's Venezuelan election as fraudulent, while Maduro has denounced opposition leader Juan Guaido as a U.S. puppet seeking to foment a coup.

Venezuela has the world's largest reserves of oil, which accounts for the bulk of the country's export revenue, but production has tumbled.

Moshiri said he understands the difficulty of raising funds when Venezuela's sovereign bonds are in default, but believes he will be able to win investors. The plan will combine a low management fee, input from investors through seats on the board, and allowing them to leave the fund after two years with a 2% penalty if sanctions remain.

Moshiri, who retired from Chevron in 2017 after nearly four decades with the oil major, oversaw exploration and production in Latin America and Africa. He launched Amos Global Energy soon afterward with Noel Avocato, a former Chevron executive, and Chris Hasty, a former banker with Citigroup (NYSE:C), Lloyds (LON:LLOY) Bank and Morgan Stanley (NYSE:MS).

The company also is hunting for assets in Mexico and Argentina, both places where energy investments have stalled this year. Moshiri insists opportunities exist there and in Colombia, but concedes they require patience given the hurdles to foreign investment.

He is looking to farm into an existing project or take over assets in Mexico’s Chicontepec Basin, an onshore field northeast of Mexico City that he compares to the U.S. Eagle Ford shale field. The company has a financial partner he will not name that he said is ready to put up $500 million if Amos Global finds the right projects.

"If there's no deal, good, we're going to continue to do our research and provide consulting," Moshiri said. "You learn about business by being patient."