By Lisa Pauline Mattackal and Medha Singh

(Reuters) - A fledgling class of crypto that feasts on risk is outshining a wider market paralyzed by war and inflation.

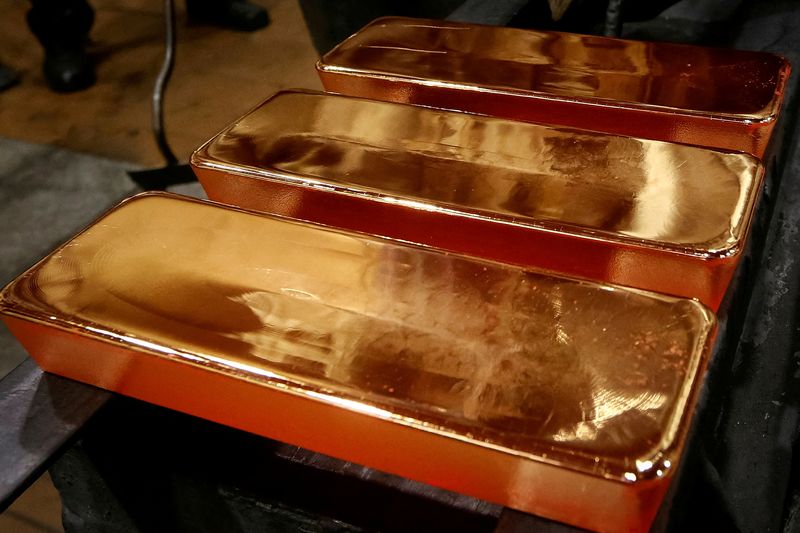

Coins backed by gold are newer variants of "stablecoins", which are typically pegged to the dollar to tame volatility. The largest, Pax Gold or PAXG, has jumped 7.4% in 2022, while main rival Tether Gold has leapt 8.5%.

By contrast, bitcoin has lost over 13% and ether is down 20%.

"One of the main concerns that a lot of people who are new to crypto have is that it's not backed by anything. It just gets on a screen," said Everett Millman, chief market analyst at Gainesville Coins. "So attaching them or linking them to a real-world commodity, it does make some sense."

The reach for gold, a traditional hedge against geopolitical upheaval and inflation, is unsurprising. The demand for gold-backed cryptocurrencies, though, is new.

Stablecoins, a fast-growing breed of crypto, have emerged as a common medium of exchange, often used by traders seeking to move funds around. It is easier to swap major stablecoins for bitcoin or other crypto, for example, than it is to swap traditional money like U.S. dollars for bitcoin.

Tether Gold has been buoyed by bigger investors, including "whales" with $1 million or more of cryptocurrency, using the token to change a portion of their holdings into gold, according to Paolo Ardoino, Tether's chief technology officer.

"Many of our investors were already involved in crypto, but were interested in not having their entire wealth in cryptos or in dollars, and were seeking more inflation-resistant assets like gold," he said.

Yet gold-backed coins are still a niche novelty in the crypto market at present - PAXG and Tether Gold are barely over two years old - with thin liquidity and little certainty about their long-term fortunes.

PAXG has seen its market value almost double to $627 million this year, while Tether Gold has risen 9% to above $209 million. By comparison the latter's eight-year-old sibling, dollar-pegged Tether - the world's largest stablecoin - has a market cap of over $83 billion.

According to data from CoinMarketCap, daily PAX gold trading volumes ranged between $10 million to $520 million over the past month, compared to ether volumes which fluctuated between $8.7 billion and $25 billion in April. Dollar-pegged tether's 24-hour volumes ranged between $35 billion and $92 billion.

ALL THAT GLITTERS?

Sceptics argue that PAXG, developed by the company Paxos, and Tether Gold have merely risen on the coat-tails of a broad rush for gold; indeed they have tracked the price of physical gold, which is up about 8.5% this year. PAXG is up 4.5% since Feb. 23, the day before Russia invaded Ukraine, versus gold's 4%.

The SPDR Gold Shares (NYSE:GLD) exchange-traded fund, which is managed by State Street (NYSE:STT) Global Advisors, is up 7.6% in 2022.

"The (crypto gold) tokens themselves aren't immutable. They're literally just IOUs that happen to be using blockchain infrastructure," said Alex Thorn, head of firmwide research for Galaxy Digital in New York.

He said investors would have to determine whether they should have the same level of confidence in the companies behind PAXG and the gold ETF.

"They're both basically synthetic gold exposure backed by gold holdings. Perhaps trust is part of the thing that people would consider when deciding whether we can trust Paxos the same way we trust State Street."

Nonetheless, advocates of such coins say they offer the ease of owning gold without having to worry about storing a physical coin or bar, while eliminating the minimum margin requirements often required to trade gold on traditional markets.

PAXG, for instance, requires a minimum investment of the equivalent of 0.01 ounce of gold, roughly $20, versus the $184 an investor would pay for each share of the SPDR Gold ETF.

Millman at Gainesville Coins also argued that gold-backed stablecoins bolstered the credibility of cryptocurrencies.

"One of the main criticisms of cryptos is that they have been so extremely volatile. Hence, the idea to back a token with a stable commodity," he said. "The marriage between those two things could actually also bolster confidence in cryptos."