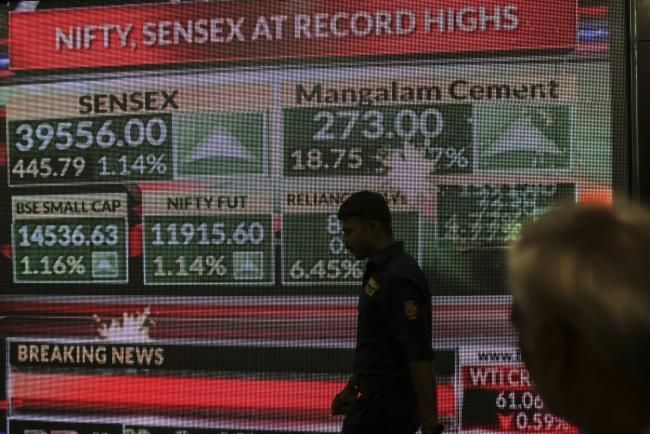

(Bloomberg) -- The first reaction of investors to Indian Prime Minister Narendra Modi’s landslide election win was to bid up local assets. The euphoria didn’t last long.

Stocks fell after rallying to records and the rupee slid as investors refocused on domestic realities, and posted modest gains Friday. While Modi’s sweeping victory allayed fears of a group of diverse parties forming the government, his return coincides with a slowing economy, wider budget deficit, volatile oil prices and global trade tensions.

“Slowing growth, tricky inflation dynamics and the fact that the external environment has worsened with escalation in trade tensions are all potentially negative factors” affecting India, said Anders Faergemann, a fund manager in London at PineBridge Investments.

Markets had partially priced in the election outcome after exit polls this week pointed to Modi’s return to power, which explains Thursday’s buy-the-rumor, sell-the-fact reaction. Also, this week’s rally has pushed up equity valuations to levels that are questionable in a country struggling to deal with a deteriorating macro environment.

“Forward multiples are demanding and when viewed against the backdrop of a slowing economy and earnings undershoot, they limit upside,” said Sriyan Pietersz, an investment strategist at Matthews Asia in Singapore. A strong mandate from the rural sector may prompt Modi to deliver on promises of cash income transfers to poor, which may widen the fiscal deficit, he said.

The government is already borrowing a record $100 billion, a key reason behind why a big rally has eluded local bonds despite two rate cuts in 2019. The yield on benchmark 10-year debt declined two basis points to 7.22% at 9:22 a.m. in Mumbai.

Read: Modi Exit Poll Euphoria Fades for Rupee as Challenges Loom Large

India’s rupee rallied 1.6% in the past three months, the most in Asia, amid wagers of Modi returning to power. Further appreciation may trigger purchases by the central bank, according to Amundi SA.

“The rupee has significantly outperformed its peers and further relative appreciation would act as a drag on India’s trade competitiveness,” said Abbas Ameli-Renani, a London-based portfolio manager at Amundi. “Whilst we have a positive bias on the rupee, we are not inclined to add to exposure at these levels.”

While Modi’s party in its second term is expected to wield more political strength, the stock market’s elevation will depend on the measures he takes to hasten growth, said Nilesh Shah, chief executive at Kotak Asset Management Co. in Mumbai.

“Markets are pricing in double-digit earnings growth over next few years. From a risk reward point of view, it is delicately balanced,” Shah said.

Here are views from other investors and analysts:

Morgan Stanley (NYSE:MS) (Ridham Desai)

- Sees the S&P BSE Sensex touching 45,000 and the NSE Nifty 50 Index reaching 13,500 by June 2020; it previously had a target of 42,000 for Sensex by end of 2019

- NOTE: Sensex closed at 38,811.39 on Thursday after briefly rising above 40,000.

Nikko Asset (Edward Ng)

- Indian bonds are set to outperform their Asian emerging-market peers due to their attractive yields

Aberdeen Standard Investments (Lin Jing Leong)

- Likes the highly rated corporate papers, and is overweight rupee sovereign and company bonds in India, especially in the short end of the curve

(Updates with Friday’s trading in sixth paragraph.)