(Bloomberg) -- Sign up for the New Economy Daily newsletter, follow us @economics and subscribe to our podcast.

Economists at Goldman Sachs no longer predict a euro-zone recession after the economy proved more resilient at the end of 2022, natural gas prices fell sharply and China abandoned Covid-19 restrictions earlier than anticipated.

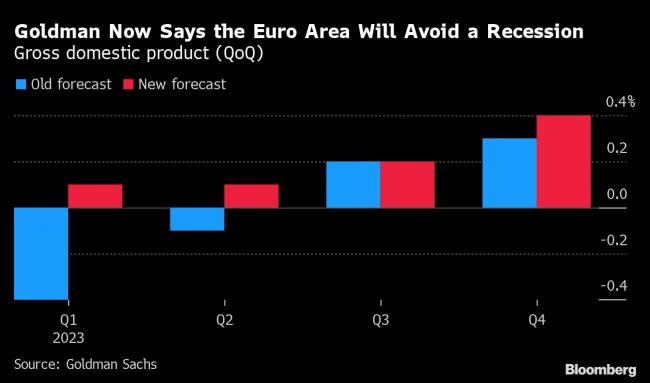

Gross domestic product is now expected to increase 0.6% this year, compared with an earlier forecast for a contraction of 0.1%. Economists led by Jari Stehn warn in a report to clients of weak growth during the winter given the energy crisis, and say headline inflation will ease faster than thought, to about 3.25% by end-2023.

“We also look for core inflation to slow due to cooling goods prices but see continued upward pressure on services inflation due to rising labor costs,” they said. “Given more resilient activity, sticky core inflation and hawkish commentary, we expect the European Central Bank to tighten significantly more in coming months.”

Goldman reiterated its call for half-point increases in interest rates at the ECB’s February and March meetings, followed by a final quarter-point step in May to take the deposit rate to 3.25%.